In the event you’re considering of buying a home, chances are high you’re listening to nearly every thing you hear concerning the housing market. And also you’re getting your data from a wide range of channels: the information, social media, your actual property agent, conversations with buddies and family members, overhearing somebody chatting on the native grocery store, the record goes on and on. Most certainly, house costs and mortgage charges are developing so much.

To assist minimize via the noise and provide the data you want most, check out what the info says. Listed here are the highest two questions you’ll want to ask your self about house costs and mortgage charges as you make your determination:

1. The place Do I Assume Residence Costs Are Heading?

One dependable place you may flip to for that data is the Home Price Expectation Survey from Pulsenomics – a survey of a nationwide panel of over 100 economists, actual property consultants, and funding and market strategists.

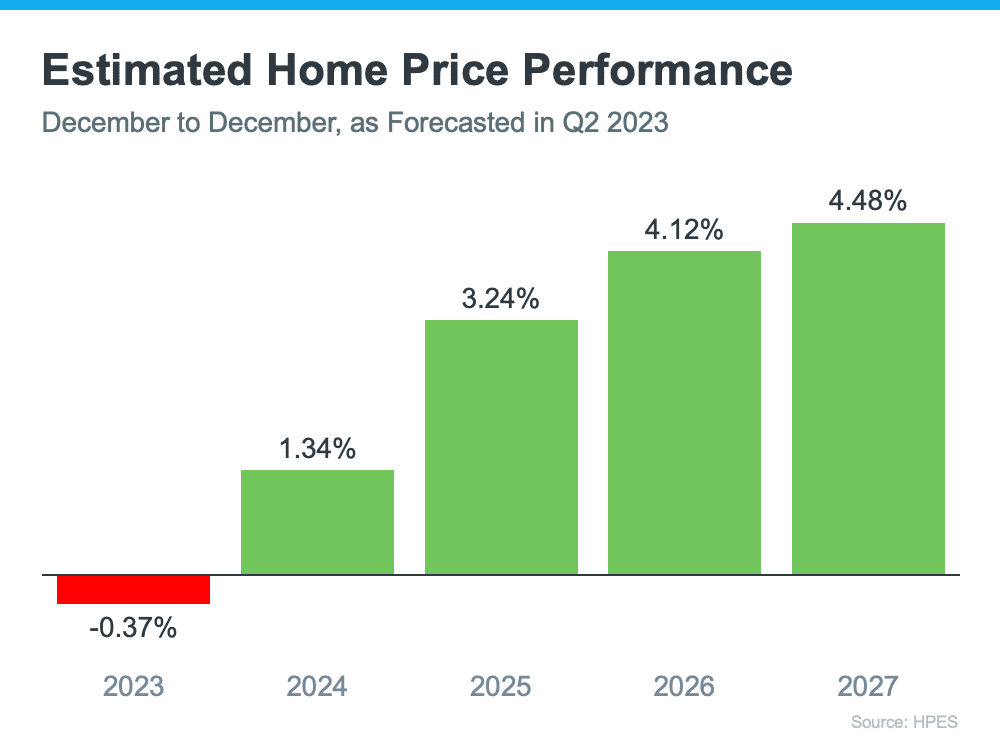

In line with the newest launch, the consultants surveyed are projecting slight depreciation this 12 months (see the purple within the graph under). However right here’s the context you want most. The worst house worth declines are already behind us, and costs are literally appreciating again in lots of markets. To not point out, the small 0.37% depreciation HPES is exhibiting for 2023 is much from the crash some individuals initially stated would occur.

Now, let’s look to the longer term. The inexperienced within the graph under reveals costs have turned a nook and are anticipated to understand in 2024 and past. After this 12 months, the HPES is forecasting house worth appreciation returning to extra regular ranges for the following a number of years.

So, why does this matter to you? It means your house will probably grow in value and you need to achieve home equity within the years forward, however provided that you purchase now. In the event you wait, primarily based on these forecasts, the house will solely price you extra afterward.

2. The place Do I Assume Mortgage Charges Are Heading?

Over the previous 12 months, mortgage rates have risen in response to financial uncertainty, inflation, and extra. We all know primarily based on the newest studies that inflation, whereas nonetheless excessive, has moderated from its peak. That is an encouraging signal for the market and for mortgage charges. Right here’s why.

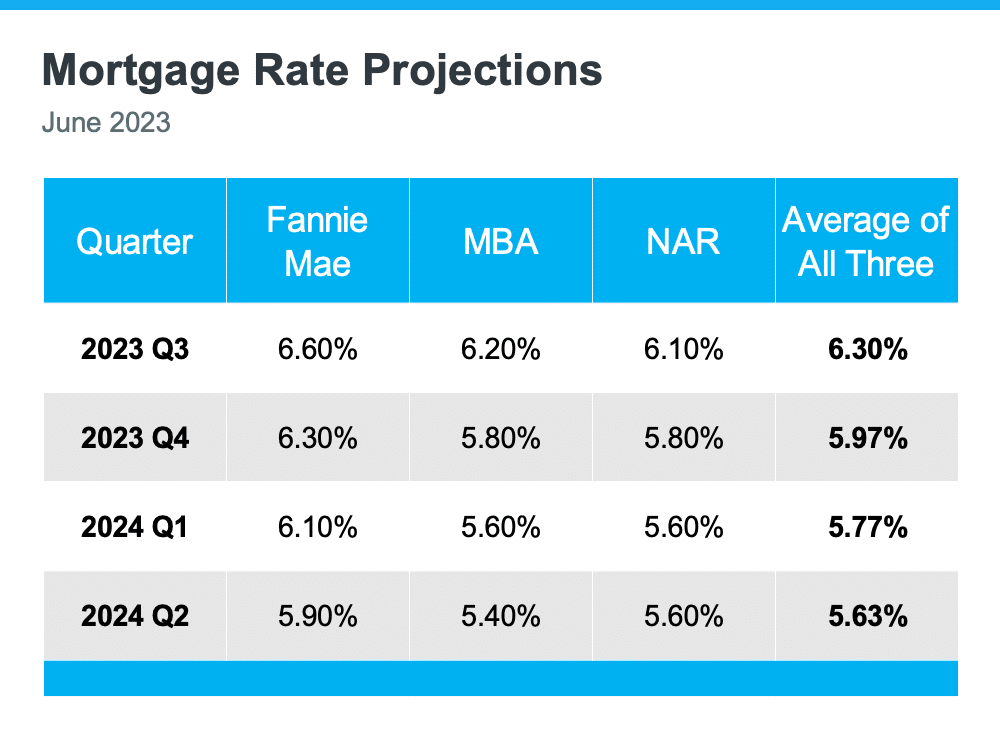

When inflation cools, mortgage charges usually fall in response. This can be why some experts are saying mortgage rates will pull again barely over the next few quarters and settle someplace round roughly 5.5 and 6% on common.

However, not even the consultants can say with absolute certainty the place mortgage rates might be subsequent 12 months, and even subsequent month. That’s as a result of there are such a lot of components that may impression what occurs. So, to present you a lens into the assorted doable outcomes, right here’s what you need to contemplate:

- In the event you purchase now and mortgage charges don’t change: You made transfer since house costs are projected to develop with time, so no less than you beat rising costs.

- In the event you purchase now and mortgage charges fall (as projected): You in all probability nonetheless made determination since you acquired the home earlier than house costs appreciated extra. And, you may at all times refinance your house afterward if charges are decrease.

- In the event you purchase now and mortgage charges rise: If this occurs, you made an ideal determination since you purchased earlier than each the worth of the house and the mortgage charge went up.

Backside Line

In the event you’re serious about shopping for a house, you’ll want to know what’s anticipated with house costs and mortgage charges. Whereas nobody can say for sure the place they’ll go, skilled projections can provide you highly effective data to maintain you knowledgeable. Lean on a trusted actual property skilled who can add in an skilled opinion in your native market.

GIVE ME A CALL AND LETS TALK ABOUT YOUR REAL ESTATE NEEDS – JAMES JESTES 386-315-4744

Most Latest MLS Listings At this time

Try a few of these hottest house searches right here at Daytona Seashore Property Search

- Homes for sale on the Intercoastal waterway

- Homes and Condos for sale with Seller Financing Available

- Homes for sale in Port Orange along Spruce Creek Rd

- Port Orange Homes for sale with Boat Docks

- New Construction Town Homes in Plantation Bay

- Homes For Sale in LPGA

- Homes For Sale in the Spruce Creek High School District ( TOP RATED SCHOOLS)

Whats Going On @ My YouTube Channel

DOWNLOAD MY LATEST REAL ESTATE GUIDES