Earlier than you resolve to sell your house, it’s essential to know what you may anticipate within the present housing market. One optimistic development proper now’s homebuyers are adapting to right this moment’s mortgage charges and getting used to them as the brand new regular.

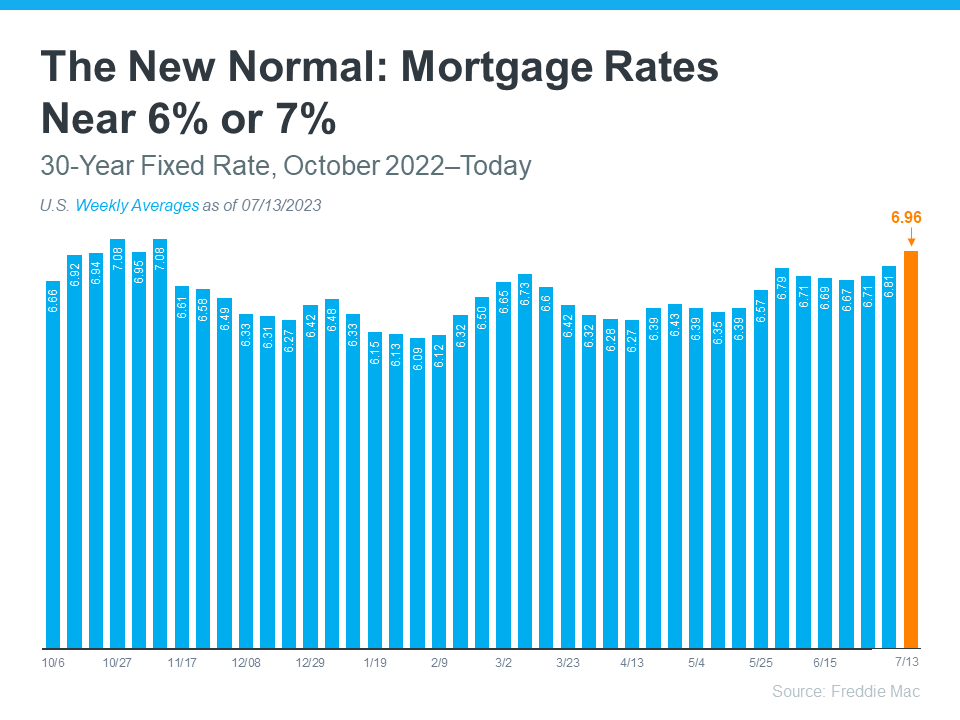

To raised perceive what’s been occurring with mortgage charges recently, the graph under exhibits the development for the 30-year mounted mortgage fee from Freddie Mac since final October. As you may see, rates have been between 6% and seven% fairly persistently for the previous 9 months:

According to Lawrence Yun, Chief Economist on the Nationwide Affiliation of Realtors (NAR), mortgage charges play a major function in purchaser demand and, by extension, dwelling gross sales. Yun highlights the optimistic affect of steady charges:

“Mortgage charges closely affect the route of dwelling gross sales. Comparatively regular charges have led to a number of consecutive months of constant dwelling gross sales.”

As a vendor, listening to that dwelling gross sales are constant proper now’s excellent news. It means consumers are on the market and actively buying houses. Right here’s a bit extra context on how mortgage charges have impacted demand not too long ago.

When mortgage charges surged dramatically last year, escalating from roughly 3% to 7%, many potential consumers felt a little bit of sticker shock and determined to carry off on their plans to buy a house. Nevertheless, as time has handed, that preliminary shock has worn off. Patrons have grown extra accustomed to present mortgage charges and have accepted that the record-low charges of the previous few years are behind us. As Doug Duncan, SVP and Chief Economist at Fannie Mae, says:

“. . . customers are adapting to the concept larger mortgage charges will possible stick round for the foreseeable future.”

In truth, a current survey by Freddie Mac reveals 18% of respondents say they’re more likely to purchase a house within the subsequent six months. Meaning almost one out of each 5 individuals surveyed plan to purchase within the close to future. And that goes to indicate consumers are planning to be lively within the months forward.

After all, mortgage charges aren’t the only real issue affecting purchaser demand. Regardless of the place mortgage charges stand, individuals will at all times have causes to maneuver, whether or not it’s for job relocation, altering households, or some other private motivation. As a seller, you may really feel assured there’s a marketplace for your own home right this moment. And that demand is fairly robust as consumers settle into the place charges are proper now.

Backside Line

The best way consumers understand right this moment’s mortgage charges is shifting – they’re getting used to the brand new regular. Regular charges are contributing to robust purchaser demand and constant dwelling gross sales. Connect with a neighborhood actual property agent to get your own home available on the market and in entrance of these consumers.

GIVE ME A CALL AND LETS TALK ABOUT YOUR REAL ESTATE NEEDS – JAMES JESTES 386-315-4744

Most Current MLS Listings Right this moment

Try a few of these hottest dwelling searches right here at Daytona Seashore Property Search

- Homes for sale on the Intercoastal waterway

- Homes and Condos for sale with Seller Financing Available

- Homes for sale in Port Orange along Spruce Creek Rd

- Port Orange Homes for sale with Boat Docks

- New Construction Town Homes in Plantation Bay

- Homes For Sale in LPGA

- Homes For Sale in the Spruce Creek High School District ( TOP RATED SCHOOLS)

Whats Going On @ My YouTube Channel

DOWNLOAD MY LATEST REAL ESTATE GUIDES