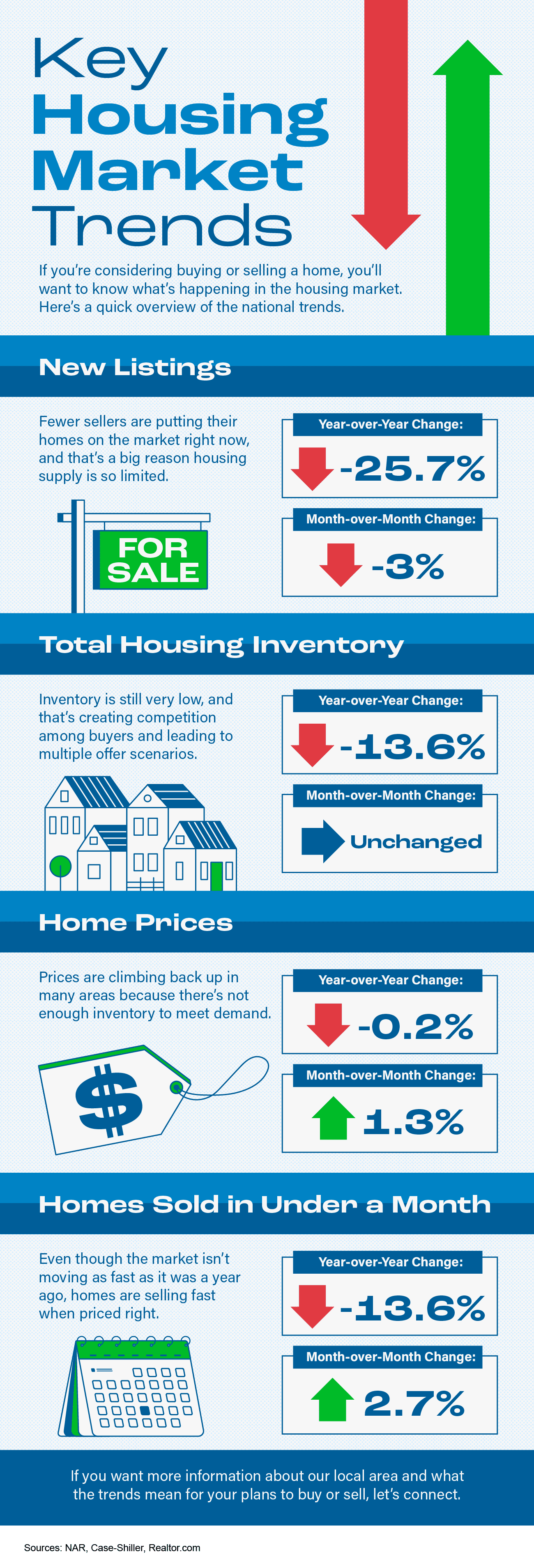

Whereas this isn’t the frenzied market we noticed through the ‘unicorn’ years, properties which can be priced proper are nonetheless promoting shortly and seeing a number of affords proper now. That’s as a result of the variety of homes for sale continues to be so low. Data from the Nationwide Affiliation of Realtors (NAR) reveals 76% of properties bought inside a month and the typical noticed 3.5 affords in June.

To set your self as much as see benefits like these, you’ll want to depend on an agent. Solely an agent has the experience wanted to search out the correct asking value for your home. Right here’s what’s at stake if that value isn’t correct for at this time’s market worth.

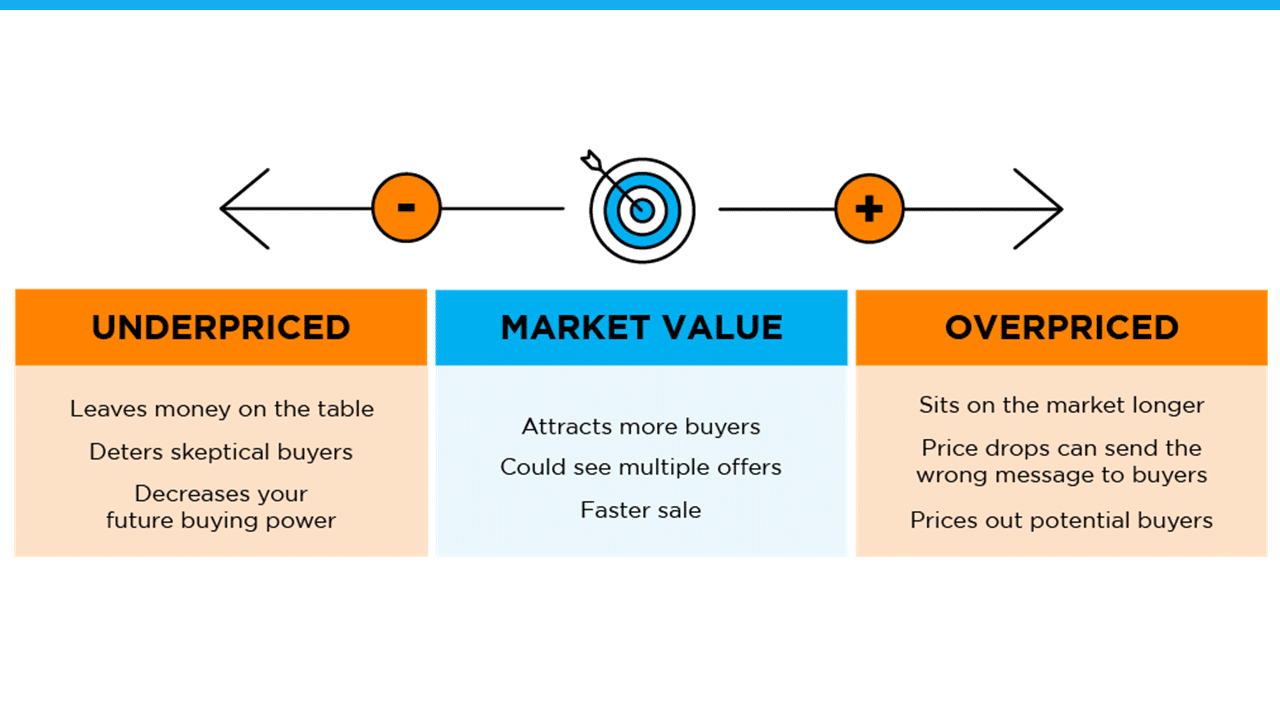

The value you set for your home sends a message to potential patrons.

Value it too low and also you may increase questions on your private home’s situation or lead patrons to imagine one thing is flawed with it. To not point out, if you happen to undervalue your home, you would go away cash on the desk, which decreases your future shopping for energy.

However, value it too excessive and also you run the danger of deterring patrons from ever touring it within the first place. When that occurs, you might have to do a value drop to attempt to re-ignite curiosity in your home when it sits on the market for some time. However remember {that a} value drop will be seen as a crimson flag for some patrons who will surprise why the value was diminished and what which means concerning the dwelling.

A recent article from NerdWallet sums it up like this:

“Your own home’s market debut is your first likelihood to draw a purchaser and it’s vital to get the pricing proper. If your private home is overpriced, you run the danger of patrons not seeing the itemizing . . . However value your home too low and you would find yourself leaving some severe cash on the desk. A bargain-basement value might additionally flip some patrons away, as they could surprise if there are any underlying issues with the home.”

Consider pricing your private home as a goal. Your aim is to purpose immediately for the middle – not too excessive, not too low, however proper at market worth.

Pricing your home pretty primarily based on market circumstances will increase the possibility you’ll have extra patrons who’re interested by buying it. That makes it extra possible you’ll see a number of affords too. Plus, when properties are priced proper, they nonetheless are inclined to promote shortly.

To get a high-level look into the potential downsides of over or underpricing your home and the perks that include pricing it at market worth, see the chart under:

Lean on a Skilled’s Experience to Value Your Home Proper

So why is an agent important find the correct value? Your native agent has the ability and the perception mandatory to search out the market worth of your private home. They’ll use their experience to find out a sensible itemizing value by assessing:

- The costs of just lately bought properties

- The present market circumstances

- The dimensions and situation of your home

- The situation of your home

Backside Line

Pricing your home at market worth is crucial, so don’t depend on guesswork. Work with a trusted actual property agent to ensure your home is priced proper for at this time’s market.

![Key Housing Market Trends [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/07/Key-Housing-Market-Trends-KCM-Share.png)

![Real Estate Continues To Be the Best Investment [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/07/Real-Estate-Continues-To-Be-the-Best-Investment-KCM-Share.png)