If you’re thinking about buying a home soon, higher mortgage rates, rising home prices, and ongoing affordability concerns may make you wonder if it still makes sense to buy a home right now. While those market factors are important, there’s more to consider. You should think about the long-term benefits of homeownership too.

Think about this: if you know people who bought a home 5, 10, or even 30 years ago, you’re probably going to have a hard time finding someone who regrets their decision. Why is that? The reason is tied to how home values grow with time and how, by extension, that grows your own wealth. That may be why, in a recent Fannie Mae survey, 76% of respondents say they believe buying a home is a safe investment.

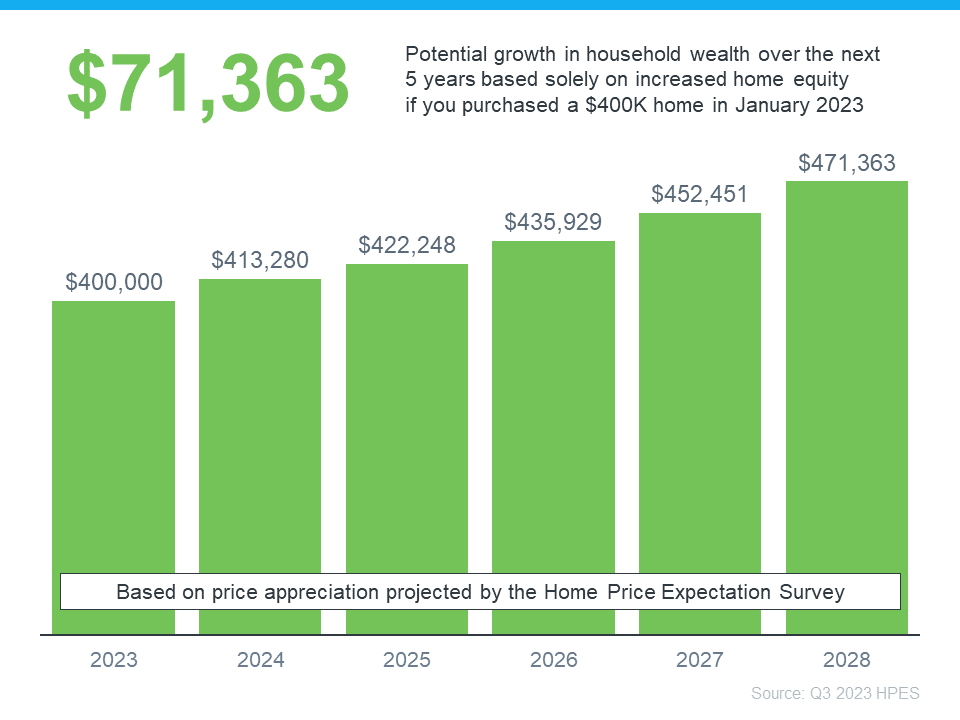

Here’s a look at how just the home price appreciation piece can really add up over the years.

Home Price Growth over Time

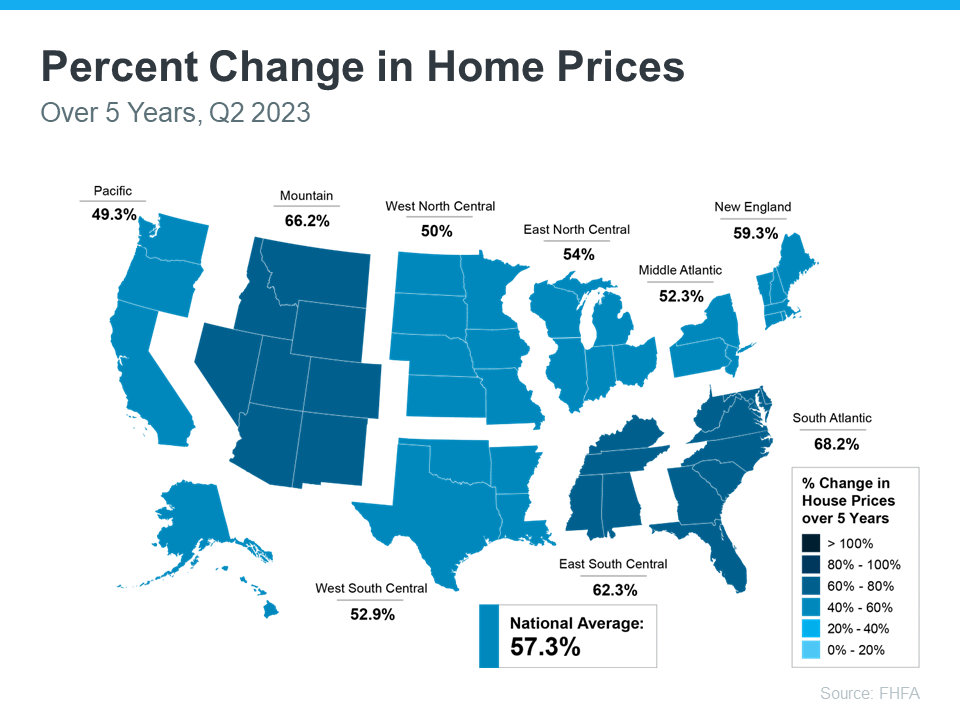

The map below uses data from the Federal Housing Finance Agency (FHFA) to show just how noteworthy price gains have been over the last five years. And, since home prices vary by area, the map is broken out regionally to help convey larger market trends:

If you look at the percent change in home prices, you can see home prices grew on average by just over 57% nationwide over a five-year period.

Some regions are slightly above or below that average, but overall, home prices gained solid ground in a short time. And if you expand that time frame even more, the benefit of homeownership and the drastic gains homeowners made over the years become even clearer (see map below):

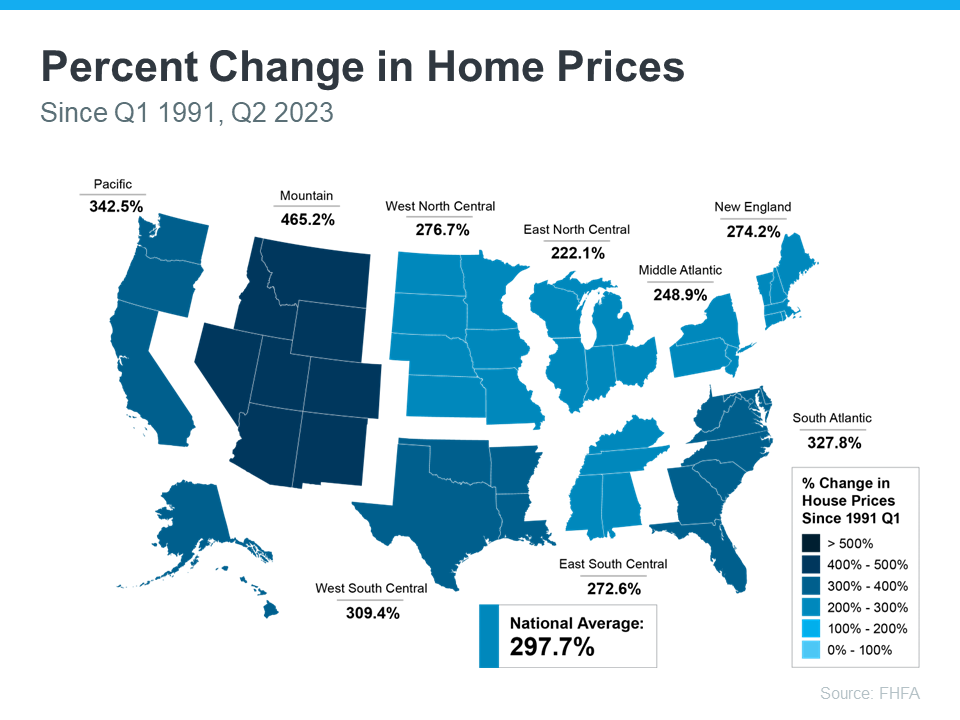

The second map shows, nationwide, home prices appreciated by an average of over 297% over a roughly 30-year span.

This nationwide average tells you the typical homeowner who bought a house 30 years ago saw their home almost triple in value over that time. That’s a key factor in why so many homeowners who bought their homes years ago are still happy with their decision.

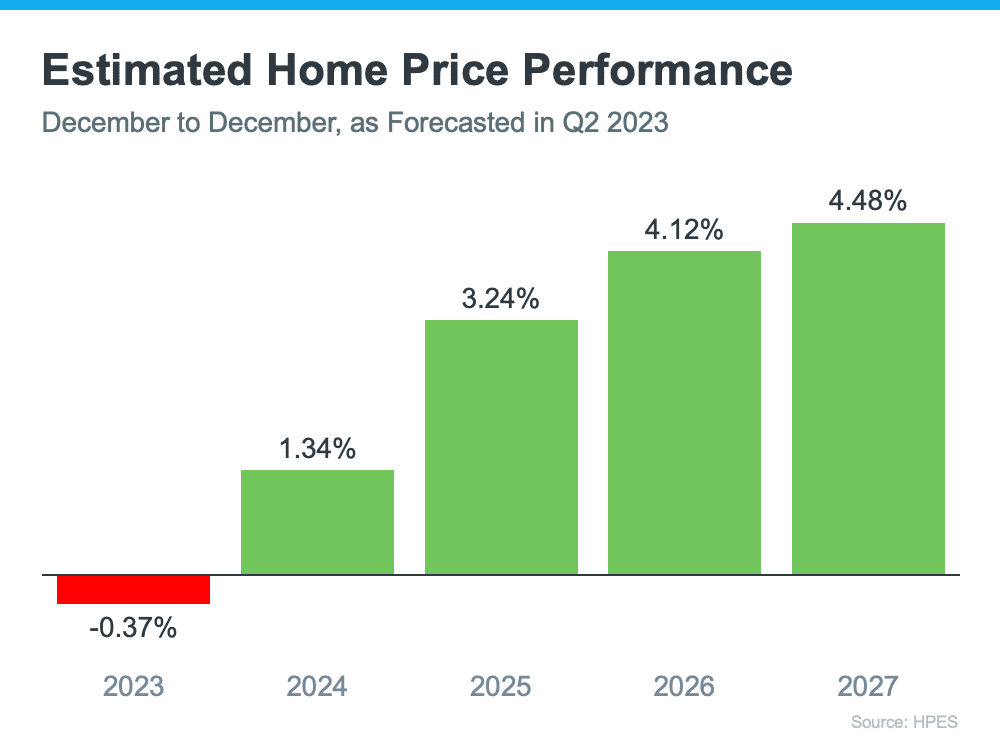

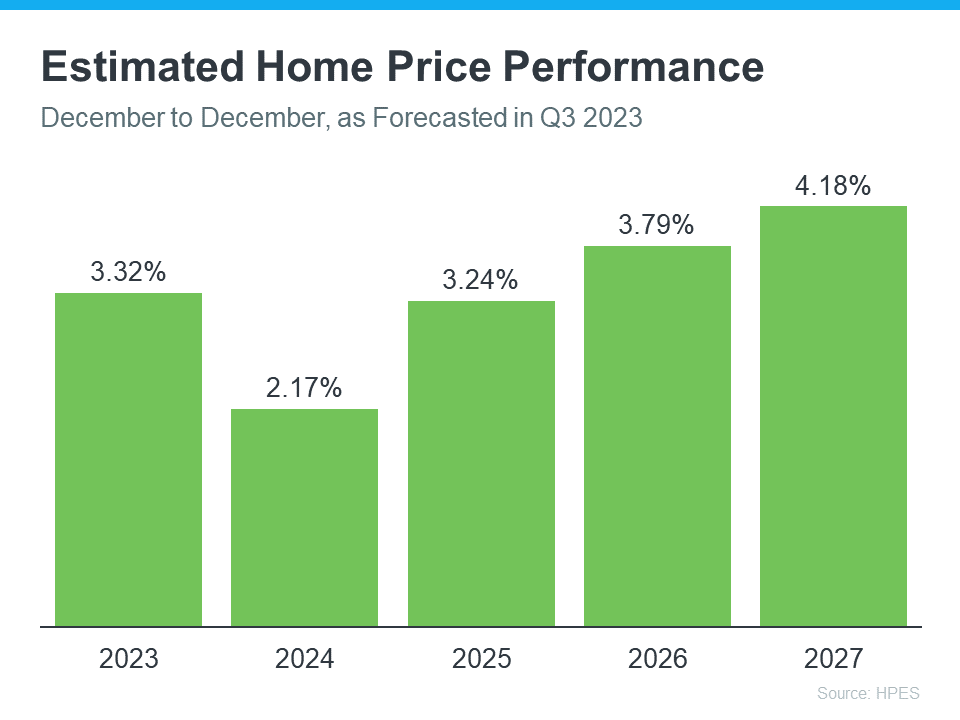

And while you may have heard talk throughout the year that home prices would crash, it hasn’t happened. In fact, experts project home prices will continue to rise for years to come.

Bottom Line

If you’re wondering if it still makes sense to buy a home today, it’s important to focus on the long-term advantages that come with homeownership. When you’re ready to start your homebuying journey, reach out to a local real estate professional.

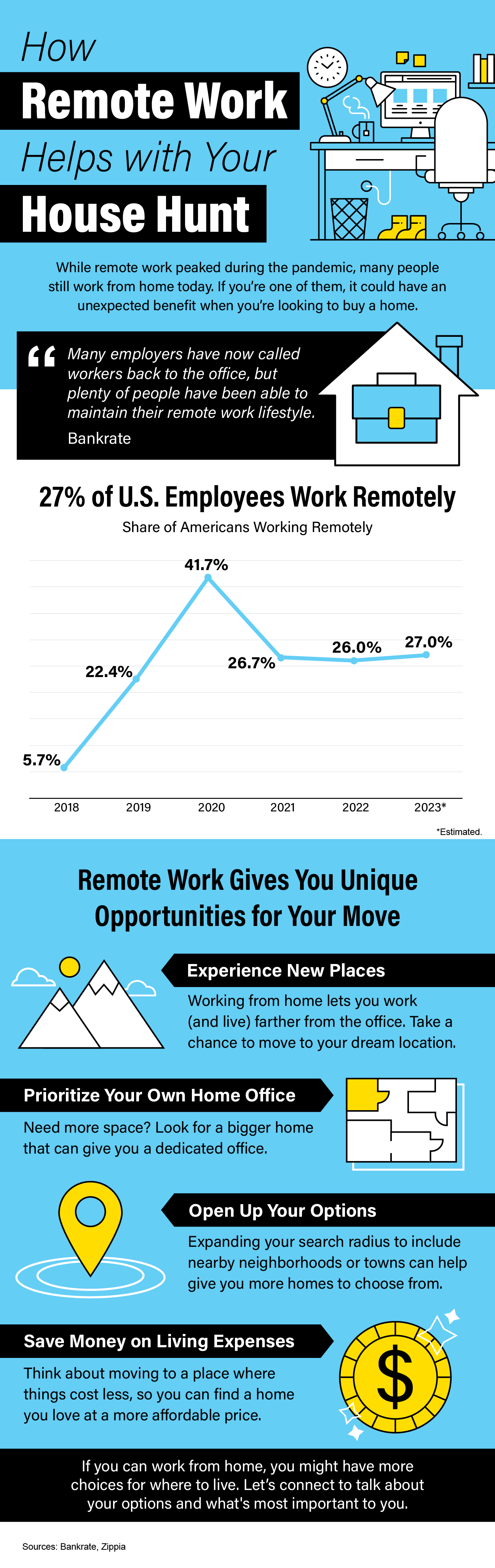

![How Remote Work Helps with Your House Hunt [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/09/How-Remote-Work-Helps-with-Your-House-Hunt-KCM-Share.png)

If you’re a homeowner, you might be torn on whether or not to

If you’re a homeowner, you might be torn on whether or not to

![Real Estate Continues To Be the Best Investment [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/07/Real-Estate-Continues-To-Be-the-Best-Investment-KCM-Share.png)