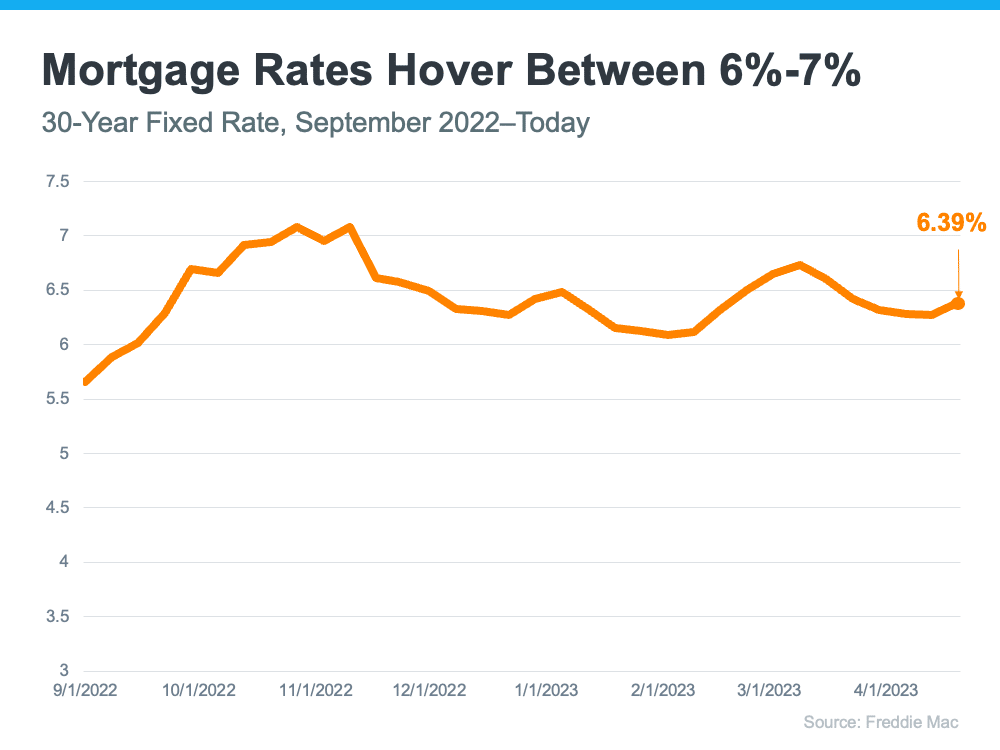

The Federal Reserve’s (the Fed) decision to raise the Federal Funds Rate last week had an impact on the housing market. During high inflation, expenses such as gas and groceries start increasing and in this case, raising the Federal Funds Rate is an effort to lower inflation. The Fed’s decision doesn’t directly determine what will happen with mortgage rates; however, it is expected that lower inflation rates will also cause mortgage rates to fall. Experts believe that mortgage rates will descend later in the year as the consumer price inflation calms down. If you are unclear on these projected changes and how they may impact your homeownership plans, it’s best to contact a trusted real estate professional who stays up to date on market changes. Finally, at Daytona Beach Property Search, you can find many popular home searches.

![Reasons To Sell Your House Today [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/05/Reasons-To-Sell-Your-House-in-Todays-Market-KCM-Share.png)