Research the Market and Identify Opportunities

Condotels For Sale Dayton Beach Flordia

Analyze Financials and Return on Investment (ROI)

Work With A Knowledgeable Real Estate Agent When It Comes To Condotels

Understand the Condotel Rental Program

Assess Maintenance and Management Fees

![Reasons To Own Your Home [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/06/Reasons-To-Own-Your-Home-KCM-Share.jpg)

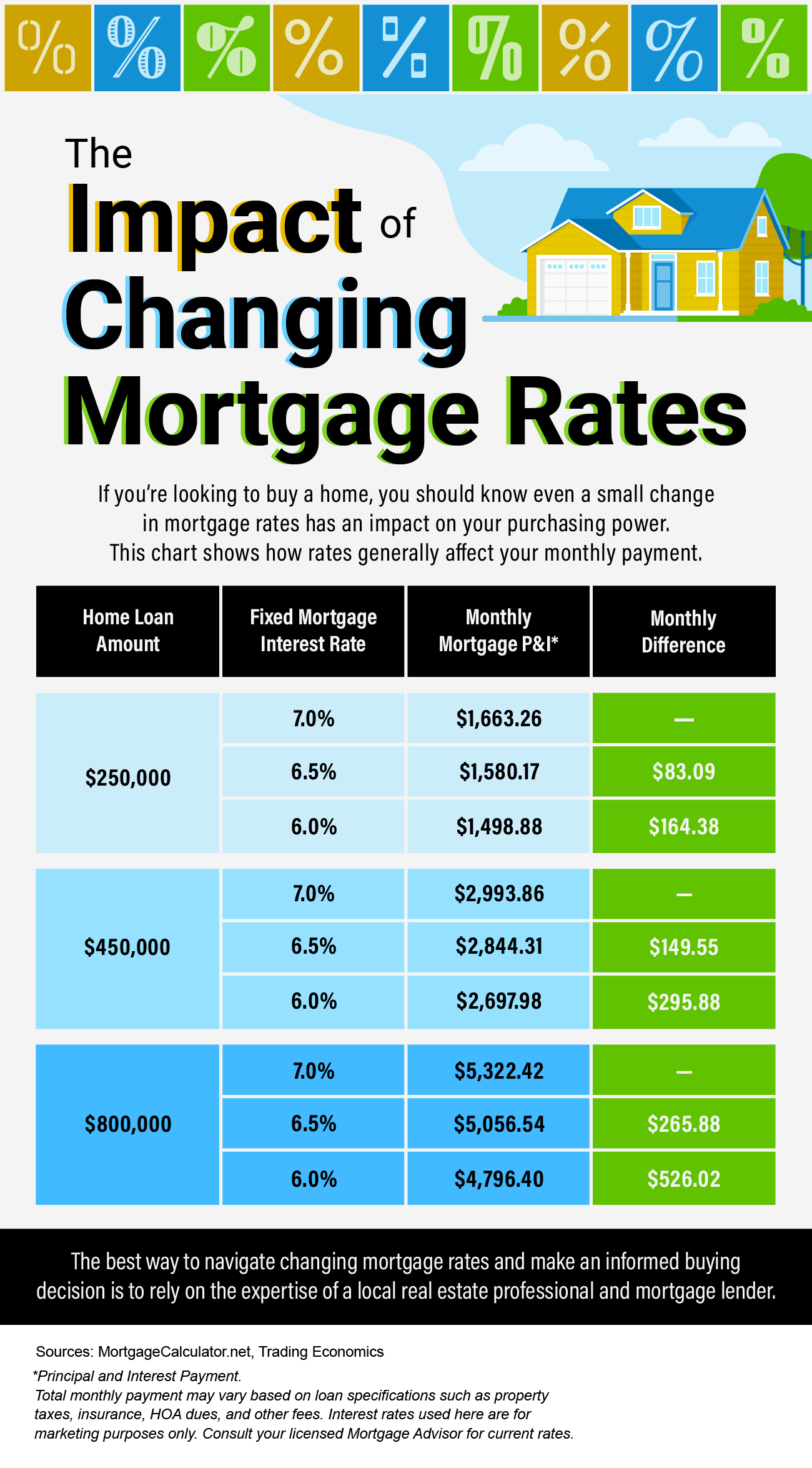

![The Impact of Changing Mortgage Rates [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/05/The-Impact-of-Changing-Mortgage-Rates-KCM-Share.png)