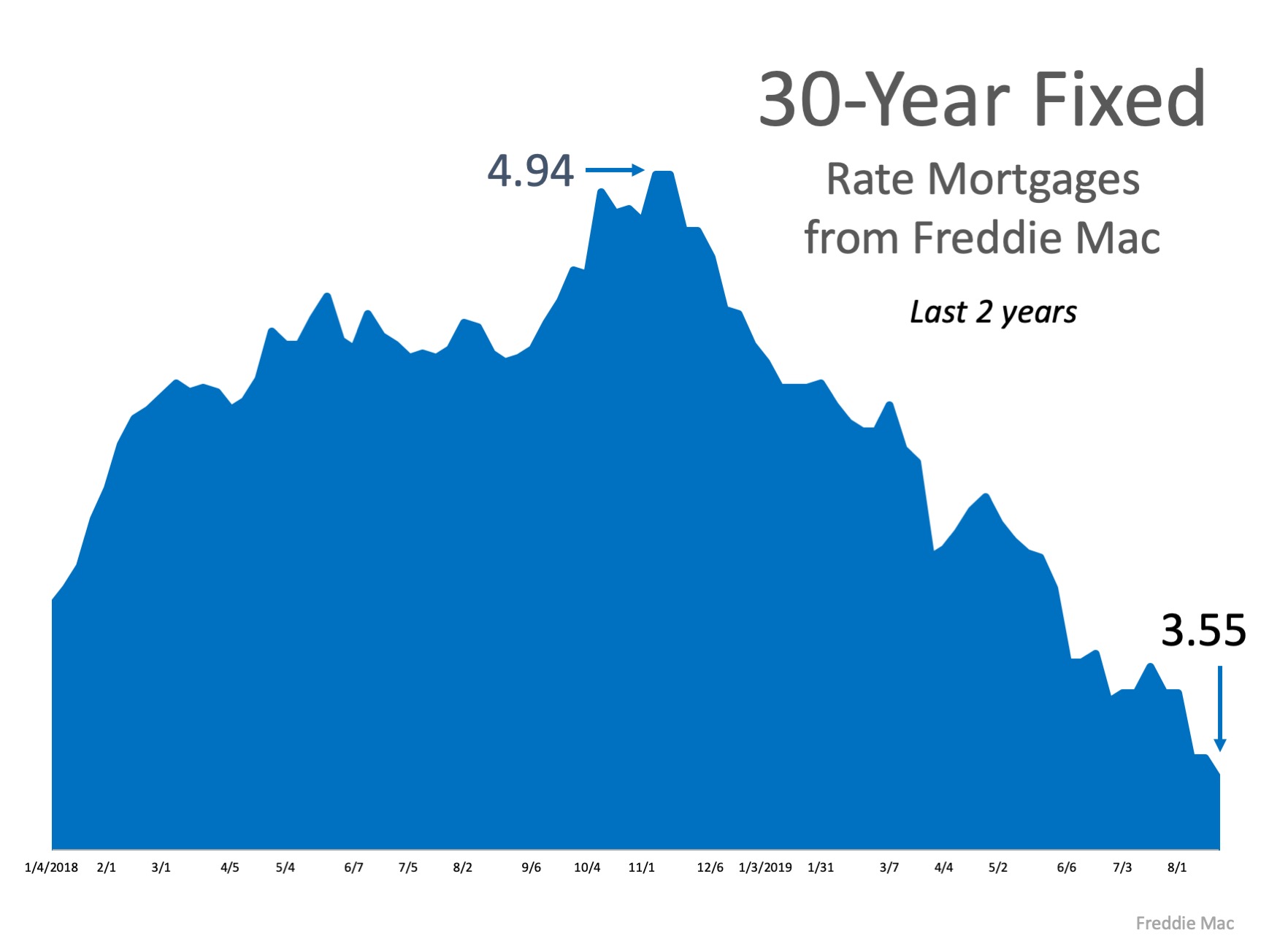

Mortgage rates have fallen by over a full percentage point since Q4 of 2018, settling at near-historic lows. This is big news for buyers looking to get more for their money in the current housing market.

“the 30-year fixed-rate mortgage (FRM) rate averaged 3.60 percent, the lowest it has been since November 2016.”

Sam Khater, Chief Economist at Freddie Mac, notes how this is great news for Continue reading…