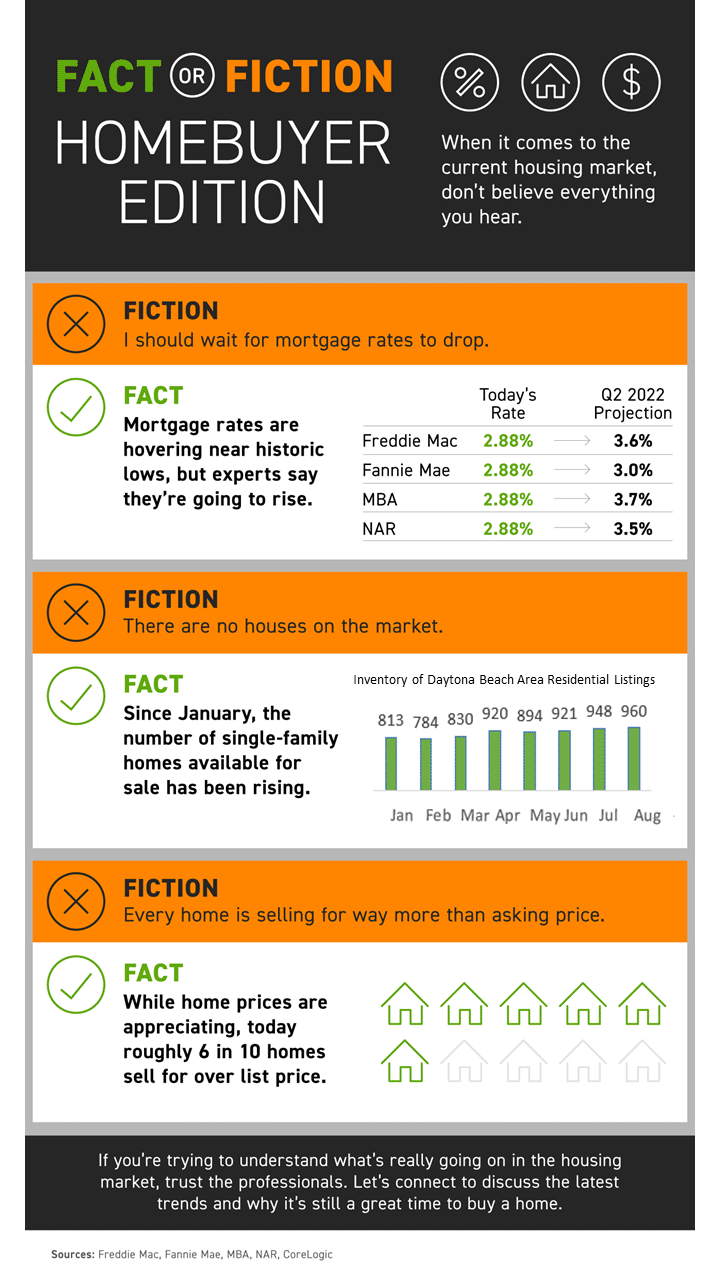

In today’s sellers’ market, standing out as a buyer is critical. Multi-offer scenarios and bidding wars are the norm due to the low supply of houses for sale and high buyer demand. If you’re buying this fall, you’ll want every advantage, especially when you’ve found the home of your dreams.

Below are five things to keep in mind when it’s time to make an offer.

1. Know Your Budget

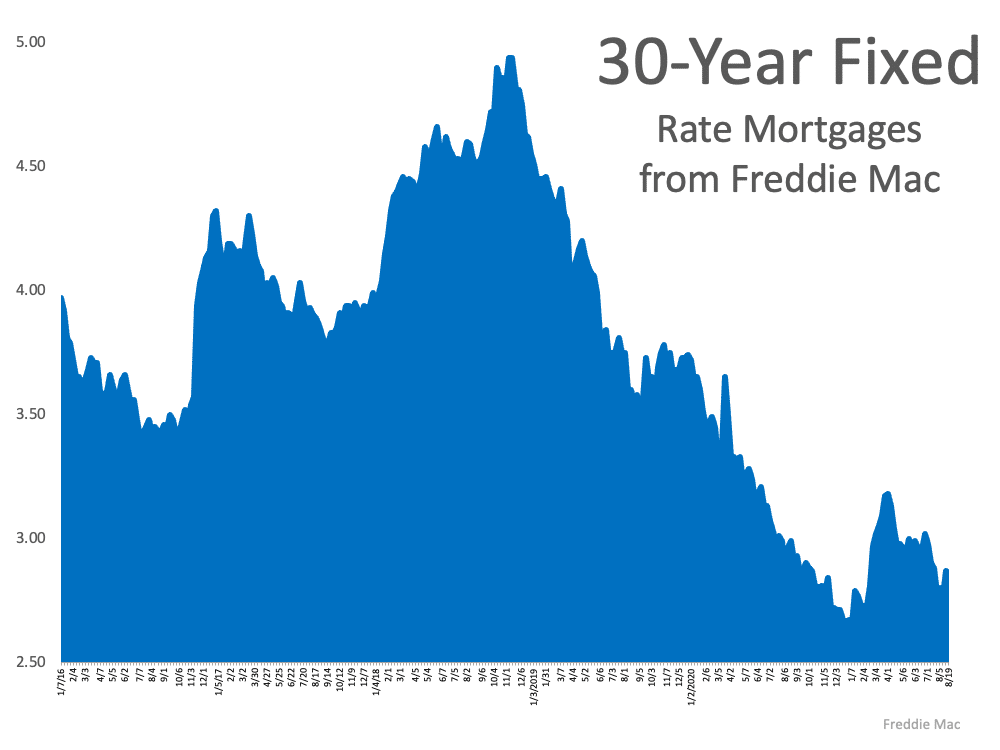

Knowing your budget and what you can afford is critical to your success as a homebuyer. The best way to understand your numbers is to work with a lender so you can get pre-approved for a loan. As Freddie Mac puts it:

“This pre-approval allows you to look for a home with greater confidence and demonstrates to the seller that you are a serious buyer.”

Showing sellers you’re serious can give you a competitive edge. It enables you to act quickly when you’ve found your perfect home.

2. Be Prepared To Move Fast

Speed and the pace of sales are contributing factors to today’s competitive housing market. According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), the average home is on the market for just 17 days. As the report notes:

“Eighty-nine percent of homes sold in July 2021 were on the market for less than a month.” Continue reading…

![Options for First-Time Homebuyers [INFOGRAPHIC] | Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2021/08/20210820-KCM-Share-549x300-1.png)

![Options for First-Time Homebuyers [INFOGRAPHIC] | Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2021/08/20210820-MEM.png)