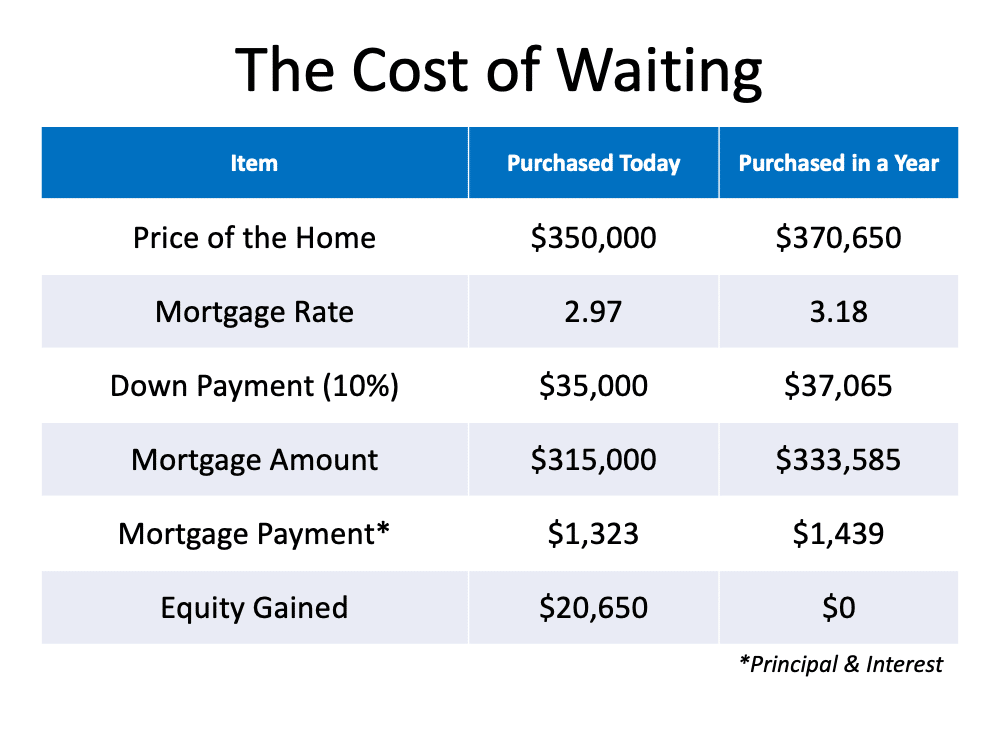

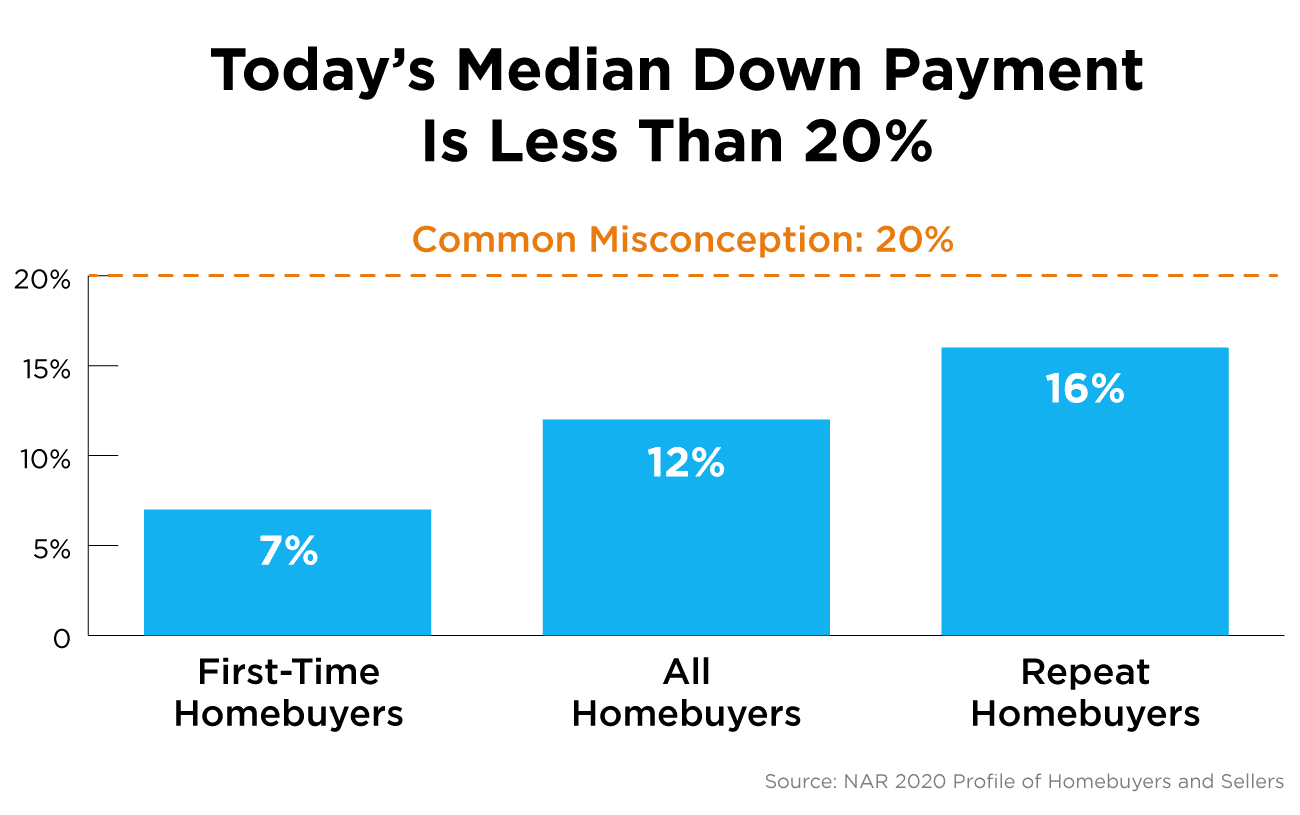

When buying a home, it’s important to have a budget and make sure you plan ahead for certain homebuying expenses. Saving for a down payment is the main cost that comes to mind for many, but budgeting for the closing costs required to get a mortgage is just as important.

What Are Closing Costs?

According to Trulia:

“When you close on a home, a number of fees are due. They typically range from 2% to 5% of the total cost of the home, and can include title insurance, origination fees, underwriting fees, document preparation fees, and more.” Continue reading…

![Financial Fundamentals for Homebuyers [INFOGRAPHIC] | Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2021/01/20210122-KCM-Share-549x300-1.png)

![Financial Fundamentals for Homebuyers [INFOGRAPHIC] | Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2021/01/20210122-MEM.png)