You might even see media protection speaking a couple of drop in home-owner fairness. What’s essential to know is that fairness is tied carefully to house values. So, when house costs respect, you possibly can count on fairness to develop. And when house costs decline, fairness does too. Right here’s how this has performed out not too long ago.

Residence costs rose quickly throughout the ‘unicorn’ years. That gave owners a substantial fairness increase. However these ‘unicorn’ years couldn’t final perpetually. The market needed to average sooner or later, and that’s what we noticed final fall and winter.

As house costs dropped barely within the again half of 2022, fairness was impacted. Based mostly on the newest report from CoreLogic, there was a 0.7% dip in home-owner fairness during the last 12 months. Nonetheless, the headlines reporting on that change aren’t portray the entire image. The truth is, whereas home price depreciation throughout the second half of final 12 months brought on fairness to drop, the info reveals owners nonetheless have close to document quantities of fairness.

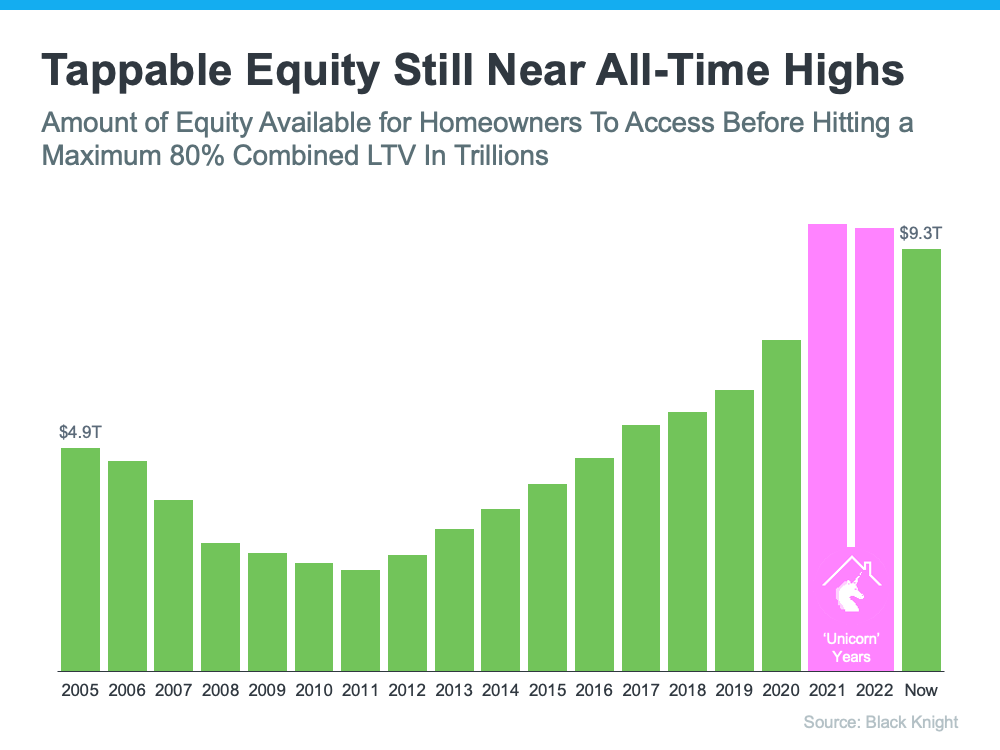

The graph beneath helps illustrate this level by wanting on the complete quantity of tappable fairness on this nation going all the way in which again to 2005. Tappable fairness is the quantity of fairness obtainable for owners to entry earlier than hitting a most 80% loan-to-value ratio (LTV). As the info reveals, there was a big fairness increase throughout the ‘unicorn’ years as house costs quickly appreciated (see the pink within the graph beneath).

However right here’s what’s key to appreciate – although there’s been a small dip, complete home-owner fairness continues to be a lot larger than it was earlier than the ‘unicorn’ years.

And there’s extra excellent news. Current house value reviews present the worst home price declines are behind us, and costs have began to go up once more. As Selma Hepp, Chief Economist at CoreLogic, explains:

“Residence fairness developments carefully observe house value modifications. Because of this, whereas the typical quantity of fairness declined from a 12 months in the past, it elevated from the fourth quarter of 2022, as month-to-month house costs progress accelerated in early 2023.”

The final a part of that quote is especially essential and is the piece of the puzzle the information is leaving out. To additional emphasize the constructive flip we’re already seeing, specialists say house costs are forecast to understand at a extra regular price over the following 12 months. In the identical report, Hepp places it this manner:

“The common U.S. home-owner now has greater than $274,000 in fairness – up considerably from $182,000 earlier than the pandemic. Additionally, whereas owners in some areas of the nation who purchased a property final spring haven’t any fairness on account of value losses, forecasted house value appreciation over the following 12 months ought to assist many debtors regain a few of that misplaced fairness.”

And although Odeta Kushi, Deputy Chief Economist at First American, references a barely totally different quantity, Kushi additional validates the truth that owners have loads of fairness proper now:

“Householders in the present day have a median of $302,000 in fairness of their properties.”

Which means when you’ve owned your property for just a few years, you seemingly nonetheless have far more equity than you probably did earlier than the ‘unicorn’ years. And when you’ve owned your property for a 12 months or much less, the forecast for extra typical value appreciation over the following 12 months ought to imply your fairness is already on the way in which again up.

Backside Line

Context is all the pieces when taking a look at headlines. Whereas home-owner fairness dropped some from final 12 months, it’s nonetheless close to all-time highs. Attain out to a trusted actual property professional so you may get the solutions you deserve from an professional who’s there to assist as you intend your move this 12 months.

GIVE ME A CALL AND LETS TALK ABOUT YOUR REAL ESTATE NEEDS – JAMES JESTES 386-315-4744

Most Current MLS Listings Right now

Take a look at a few of these hottest house searches right here at Daytona Seashore Property Search

- Homes for sale on the Intercoastal waterway

- Homes and Condos for sale with Seller Financing Available

- Homes for sale in Port Orange along Spruce Creek Rd

- Port Orange Homes for sale with Boat Docks

- New Construction Town Homes in Plantation Bay

- Homes For Sale in LPGA

- Homes For Sale in the Spruce Creek High School District ( TOP RATED SCHOOLS)

Whats Going On @ My YouTube Channel

DOWNLOAD MY LATEST REAL ESTATE GUIDES