![The Difference Between Renting and Buying a Home [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/10/The-Difference-Between-Renting-And-Buying-A-Home-KCM-Share.png)

Deciding to own a home or rent one is still a big choice for many people. The decision depends on personal circumstances and financial goals. Both options have advantages. This article will discuss the advantages of owning a home versus renting one. It will help you make a smart choice that fits your needs and dreams.

-

Building Equity

One of the primary advantages of owning a home is the opportunity to build equity. When you make your mortgage payment, some of it goes towards the loan’s principal, increasing your home’s equity. Over time, your home typically appreciates in value, allowing you to build wealth and financial stability. When you rent a property, you don’t have the chance to build equity. Your monthly payments benefit the landlord’s equity.

-

Investment Potential

Real estate has been a sound investment. Homeowners may see their property value increase if they buy in a popular area. Additionally, homeowners can leverage their property as collateral for loans or even generate income by renting out a portion of the property. These investment opportunities are generally not available to renters.

-

Stability and Control

Owning a home provides stability and control over your living space. You can renovate, paint, and decorate as much as you want without asking the landlord. This control extends to decisions about landscaping, security measures, and energy-efficient upgrades. Renters, however, must typically adhere to restrictions set by the landlord or property management.

-

Predictable Monthly Payments

With a fixed-rate mortgage, homeowners enjoy predictability in their monthly housing expenses. Your mortgage payment stays the same throughout the loan, making it easier to plan for future goals. Rent costs can increase yearly because of market conditions or landlord choices. This can make it difficult to budget for future expenses.

-

Tax Benefits

Homeownership offers several tax advantages. You can deduct mortgage interest and property taxes on your federal income tax return. This might lower your tax liability. Additionally, if you sell your primary residence, you can benefit from a capital gains tax exclusion on profits (up to a certain threshold), which can result in substantial savings.

-

Sense of Community

Owning a home often fosters a stronger sense of community and belonging. You’re more likely to establish long-term relationships with neighbors and engage in local activities when you plan to stay in an area for an extended period. Renters may not have the same level of commitment to a community, as their tenure can be more transient.

-

Retirement Planning

Homeownership can be an integral part of retirement planning. Paying off your mortgage before retirement can significantly reduce your monthly expenses, allowing you to live comfortably on a fixed income. Moreover, if you decide to downsize or sell your home upon retirement, you can use the proceeds to fund your retirement lifestyle or pass down wealth to your heirs.

Conclusion

The decision to own or rent a home is a personal one that depends on individual circumstances, financial goals, and lifestyle preferences. Owning a home offers numerous benefits, including building equity, investment potential, stability, and tax advantages. However, renting can be flexible for those who prioritize mobility and lower upfront costs. Ultimately, the right choice is the one that aligns with your long-term objectives and provides you with the security and satisfaction you seek in your liv

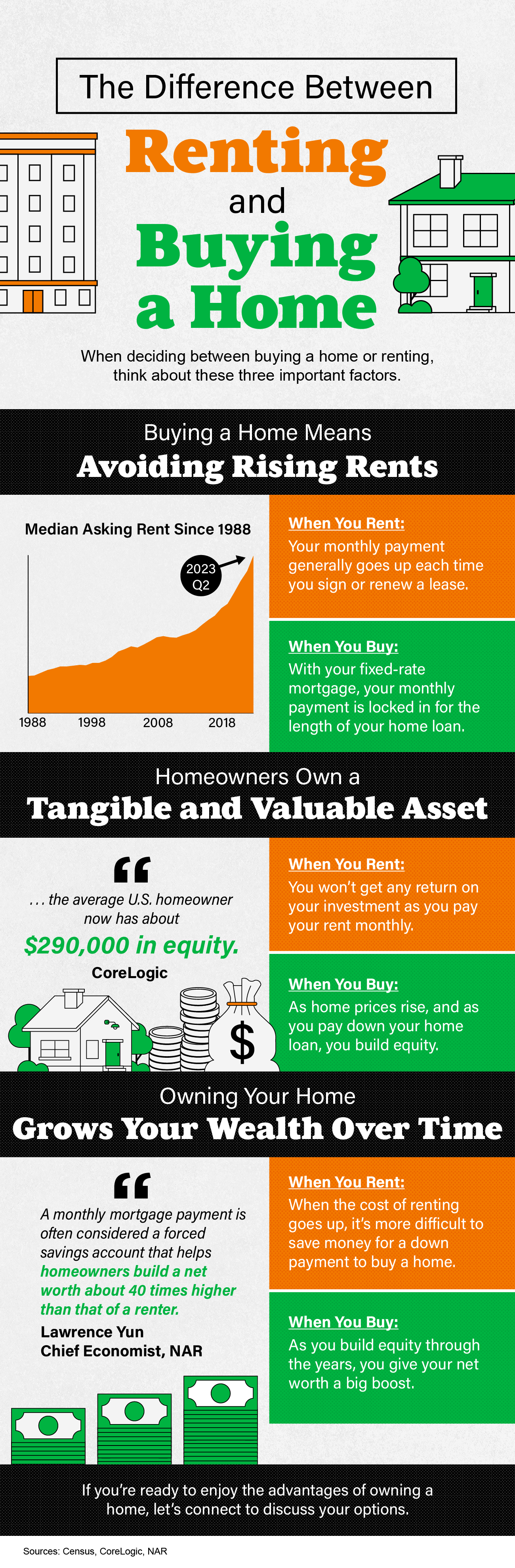

Some Highlights

- Consider these three important factors when deciding between buying a home or renting.

- Buying a home means avoiding rising rents, owning a tangible and valuable asset, and growing wealth over time.

- If you’re ready to enjoy the advantages of owning a home, connect with a local real estate expert to discuss your options.