Countless people have set out on the exciting journey of homeownership. Ask around and you’ll find the vast majority are thankful they took the leap and bought a home. But why? It’s because of the many emotional and lifestyle benefits that come with being a homeowner.

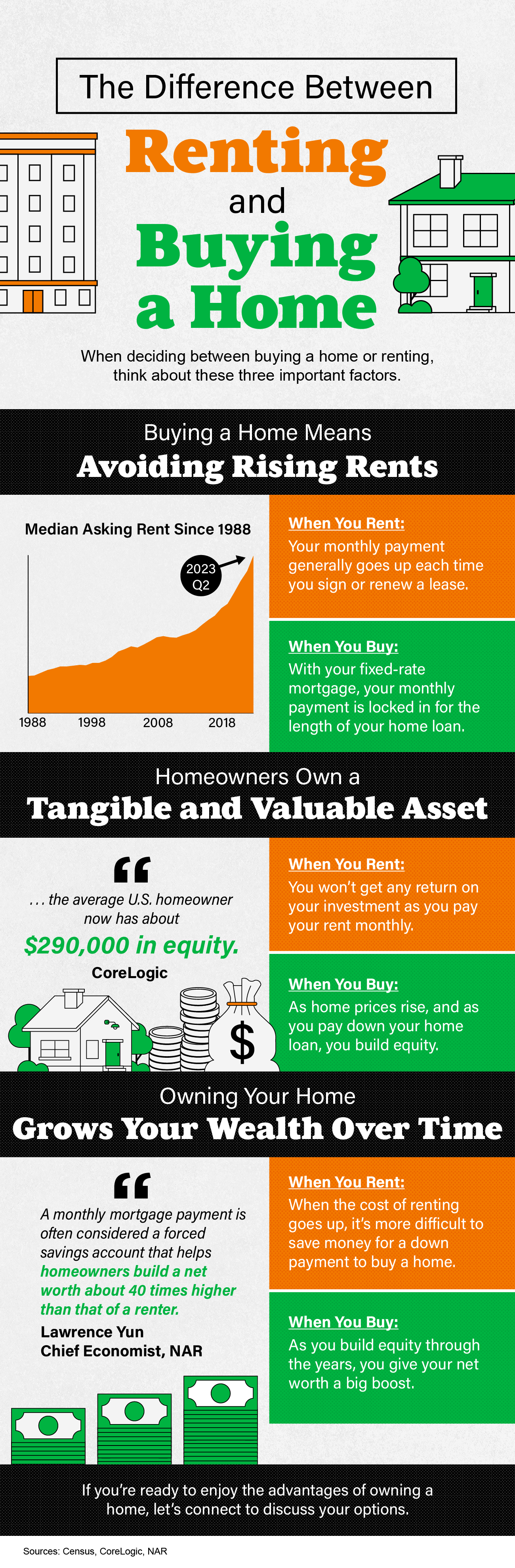

So, if you’re trying to decide if you want to rent or buy a home, here are just a few of the many benefits you could look forward to if you buy.

It’s a Safe Haven

Owning a home goes beyond just having a roof over your head. It provides a sense of security and safety. In fact, in a survey from Fannie Mae, respondents say “having a sense of privacy and security” is one of the top reasons homeownership is preferred to renting. And in a different Fannie Mae survey, “living in a place where you and your family feels safe” is another one of the top benefits of homeownership.

Your home is a place where you can truly relax and unwind. Knowing that you have a sanctuary to return to at the end of the day is a great source of comfort.

It’s a Canvas for Self-Expression

For many homeowners, their home is a reflection of who they are. The National Association of Realtors (NAR), says:

“The home is yours. You can decorate any way you want and choose the types of upgrades and new amenities that appeal to your lifestyle.”

From the color of the front door to the art hanging on the walls, every detail contributes to a unique expression of personal style. Put simply, owning a home gives you the freedom to make changes and improvements that resonate with your personality.

It Helps You Feel More Connected to the Community

Stability is another cornerstone of homeownership. The longer you stay put, the more emotionally connected you are to your community. For example, if your neighborhood does cook-outs, block parties, or other events, you’ll feel more engaged and probably build meaningful relationships with those around you. As NAR states:

“Remaining in one neighborhood for several years allows you and your family time to build long-lasting relationships within the community.”

The sense of community where you can make life-long friends helps give you more stability and predictability than you’d have if you move each time a rental lease renews.

Its Where Lifelong Memories Are Made

Not to mention, your home is where you’ll make many memories. It’s a backdrop for the stories of your life. Celebrating milestones, hosting gatherings, and building a treasure trove of special moments within the walls of your home is a heartwarming experience to be thankful for.

Bottom Line

As you start thinking about buying a home, remember why so many people are glad they did. Homeownership isn’t just a financial decision. It’s about having a stable place where you can make lasting memories. If you’re thinking of buying a home and want advice, talk with a trusted real estate agent.

![The Difference Between Renting and Buying a Home [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/10/The-Difference-Between-Renting-And-Buying-A-Home-KCM-Share.png)

![Homeownership Helps Protect You from Inflation [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/06/Homeownership-Helps-Protect-You-From-Inflation-KCM-Share.png)