Right this moment’s larger mortgage rates, inflationary pressures, and considerations a couple of potential recession have some individuals questioning: ought to I nonetheless purchase a house this 12 months? Whereas it’s true this 12 months has distinctive challenges for homebuyers, it’s vital to consider the long-term advantages of homeownership when making your determination.

Think about this: if individuals who purchased a house 5, 10, and even 30 years in the past, you’re most likely going to have a tough time discovering somebody who regrets their determination. Why is that? The reason being tied to how dwelling values develop with time and the way, by extension, that grows your individual wealth. That could be why, in a current Fannie Mae survey, 70% of respondents say they imagine shopping for a house is a protected investment.

Right here’s a have a look at how simply the house value appreciation piece can actually add up over time.

House Value Development over Time

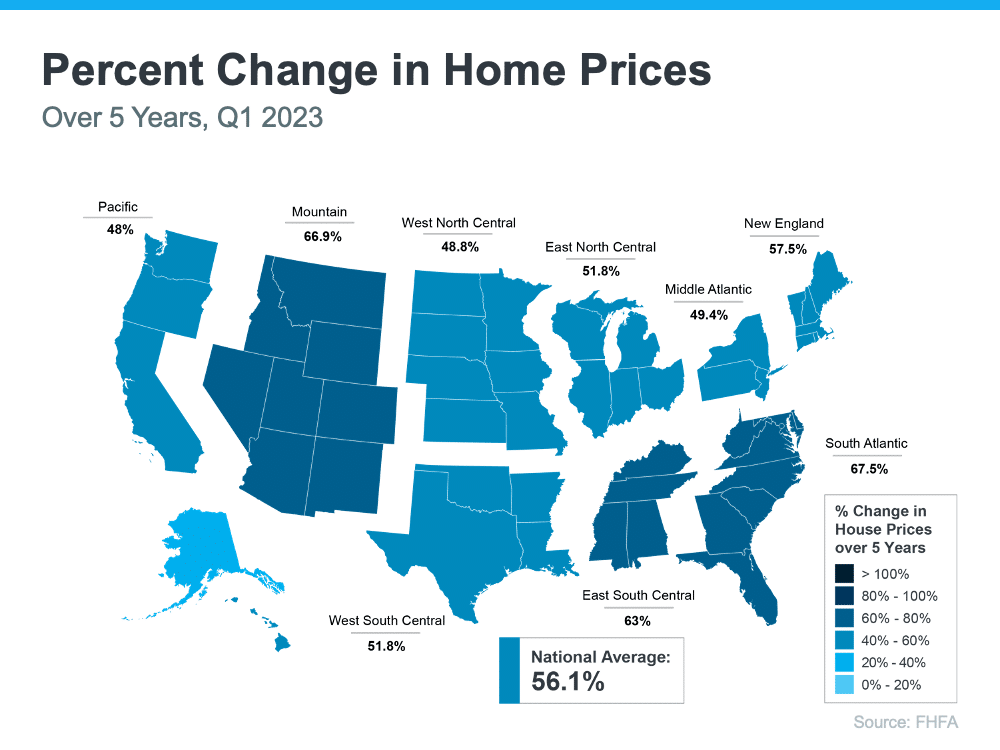

The map beneath makes use of data from the Federal Housing Finance Company (FHFA) to point out simply how noteworthy value positive factors have been during the last 5 years. And, since dwelling costs fluctuate by space, the map is damaged out regionally to assist convey bigger market tendencies.

If you happen to have a look at the p.c change in dwelling costs, you possibly can see dwelling costs grew on common by simply over 56% nationwide over a five-year interval.

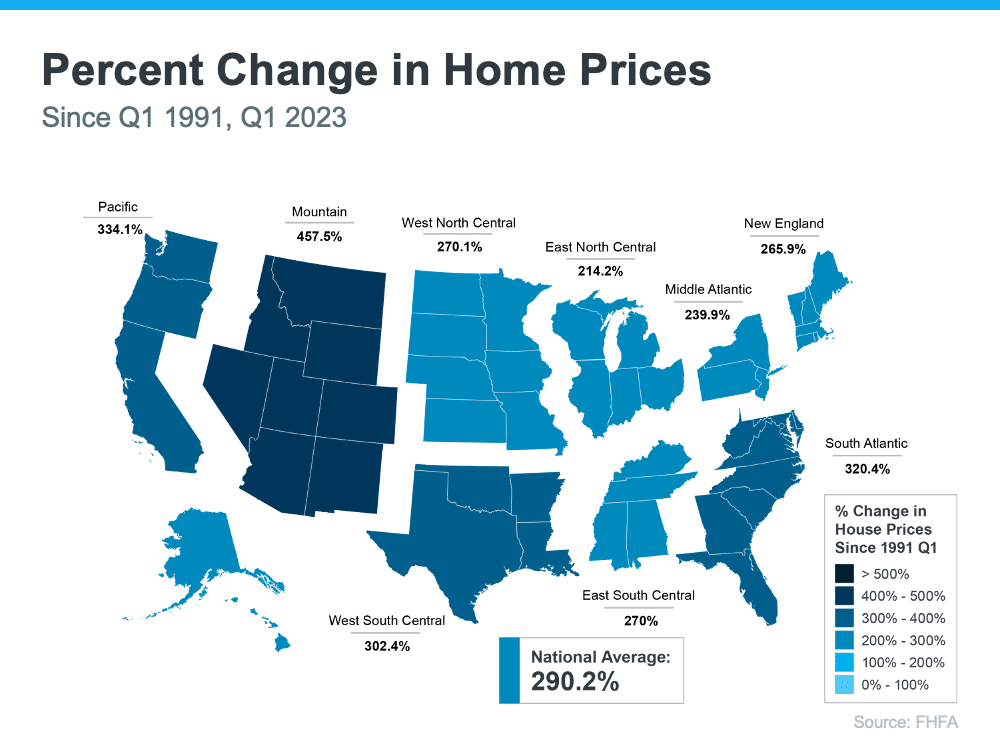

Some areas are barely above or beneath that common, however total, dwelling costs gained strong floor in a short while. And in case you broaden that time-frame much more, the advantage of homeownership and the drastic positive factors householders made over time turn out to be even clearer (see map beneath):

The second map reveals, nationwide, dwelling costs appreciated by a mean of over 290% over a roughly 30-year span.

This nationwide common tells you the standard home-owner who purchased a home 30 years in the past noticed their dwelling virtually triple in worth over that point. That’s a key consider why so many householders who purchased their houses years in the past are nonetheless proud of their determination.

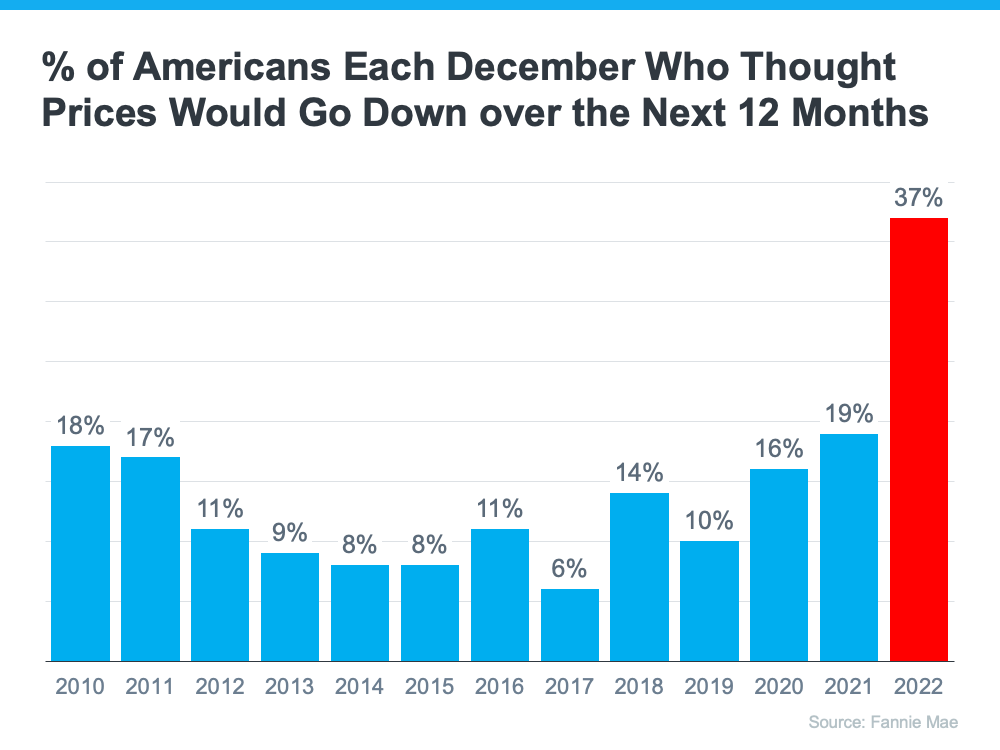

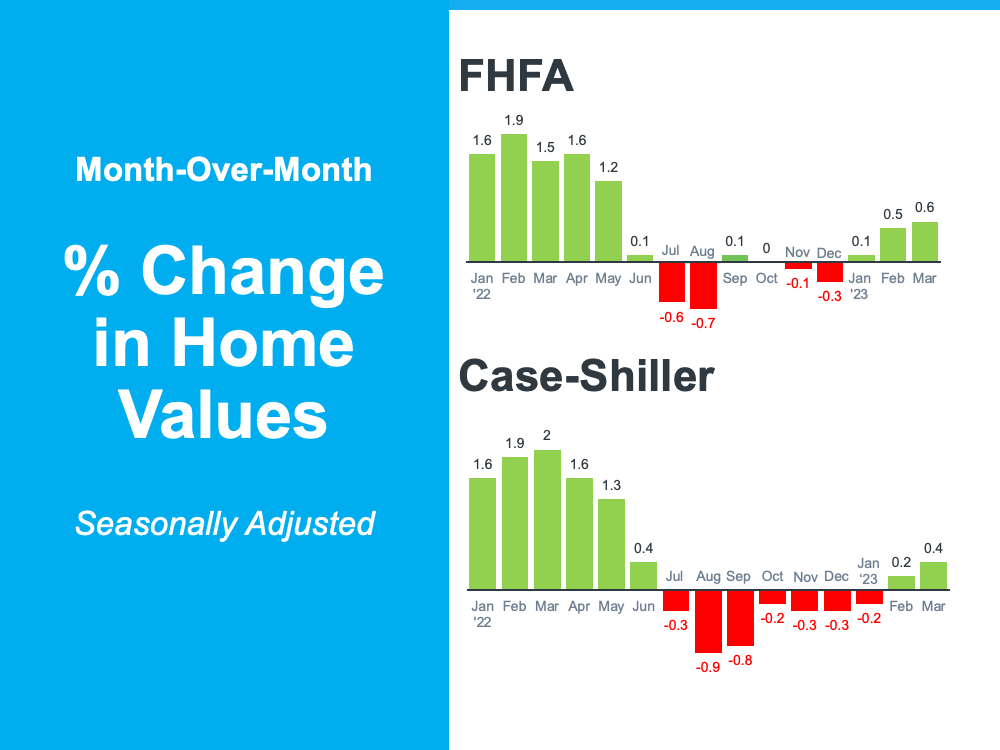

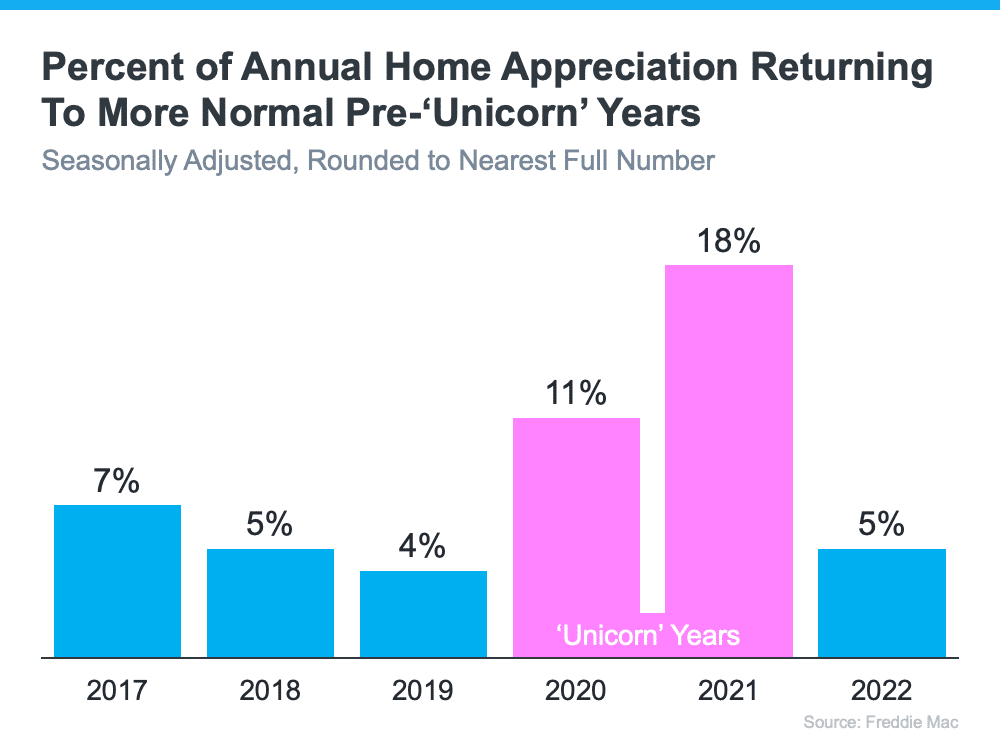

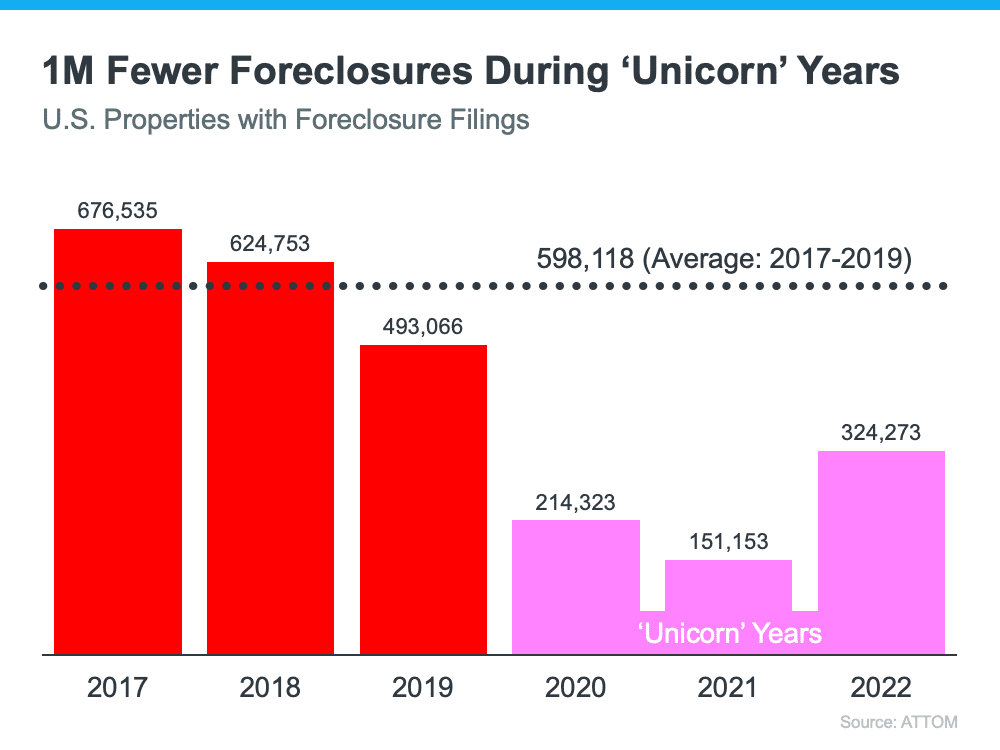

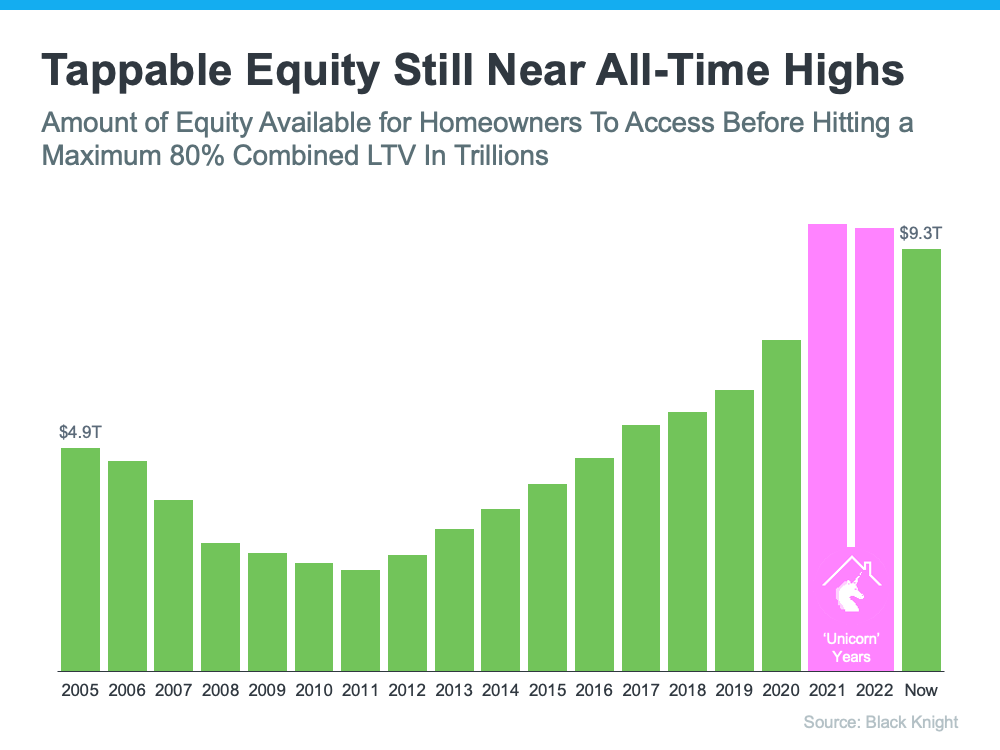

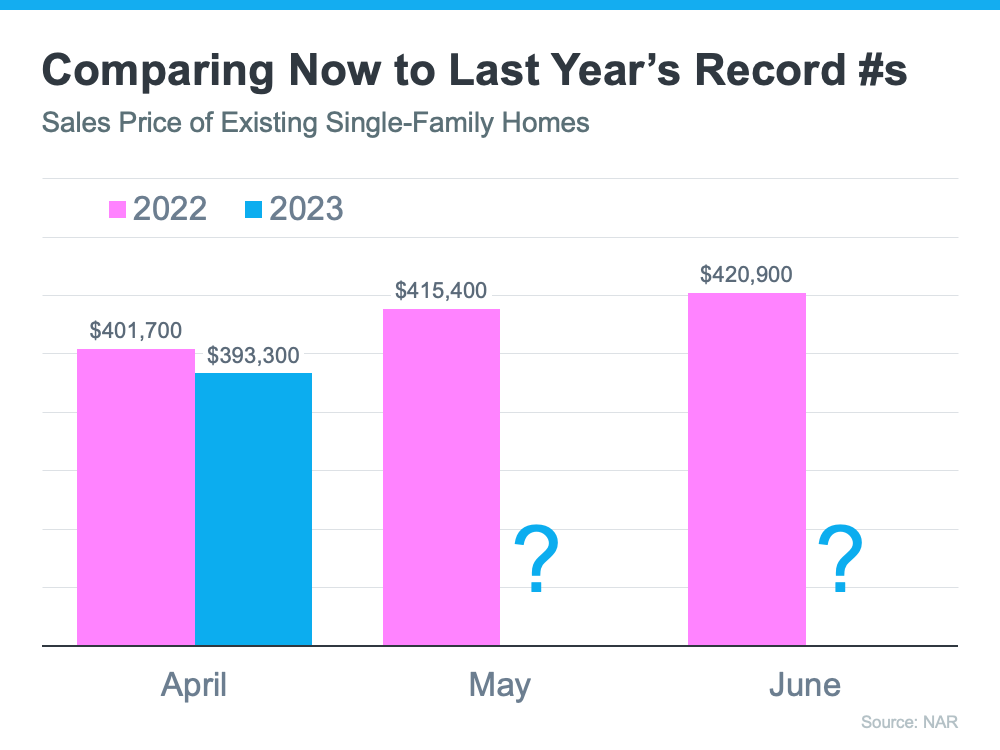

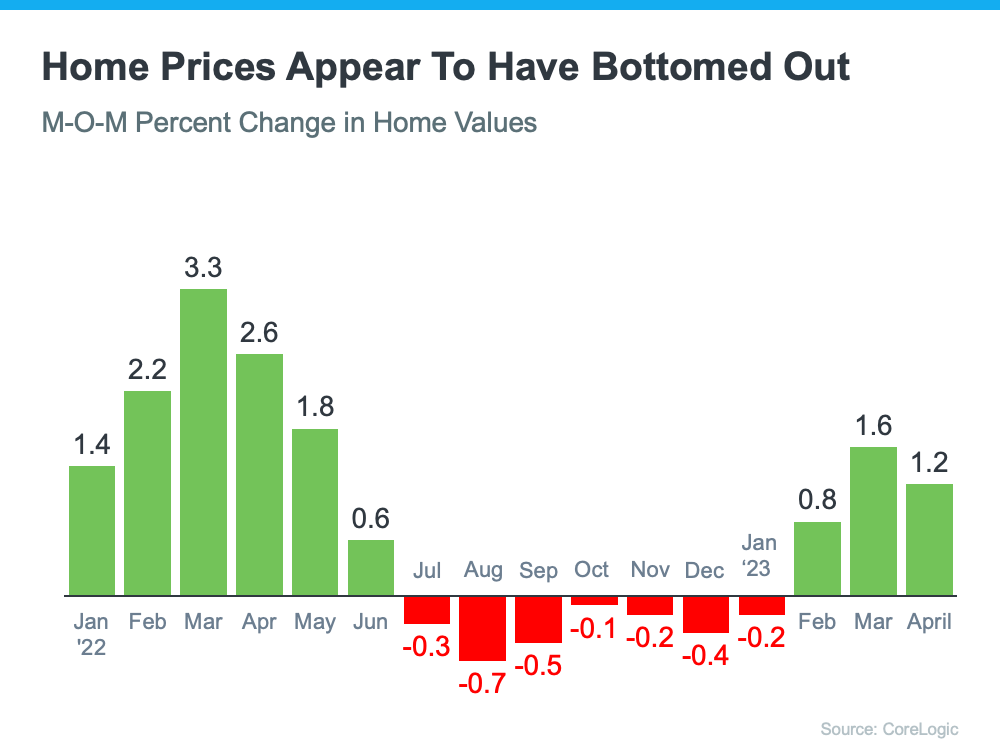

And whereas you’ll have heard discuss in late 2022 that home prices would crash, it didn’t occur. Although dwelling costs have moderated from the file peak we noticed through the ‘unicorn’ years, costs are already rebounding in lots of areas in the present day. Which means, in most markets, your property ought to develop in worth over the subsequent 12 months.

The choice to purchasing a house is renting, and rental costs have been climbing for many years. So why lease and take care of annual lease hikes for no long-term monetary profit? As an alternative, think about shopping for a house.

Backside Line

If you happen to’re questioning if it nonetheless is sensible to purchase a house in the present day, bear in mind the unbelievable long-term advantages of homeownership. If you happen to’re prepared to start out the dialog, attain out to an actual property skilled in the present day.

![How Owning a Home Grows Your Wealth with Time [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/06/How-Owning-a-Home-Grows-Your-Wealth-with-Time-KCM-Share.png)

![Why You Can’t Compare Now to the ‘Unicorn’ Years of the Housing Market [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/06/Why-You-Cant-Compare-Now-to-the-Unicorn-Years-of-the-Housing-Market-KCM-Share.png)