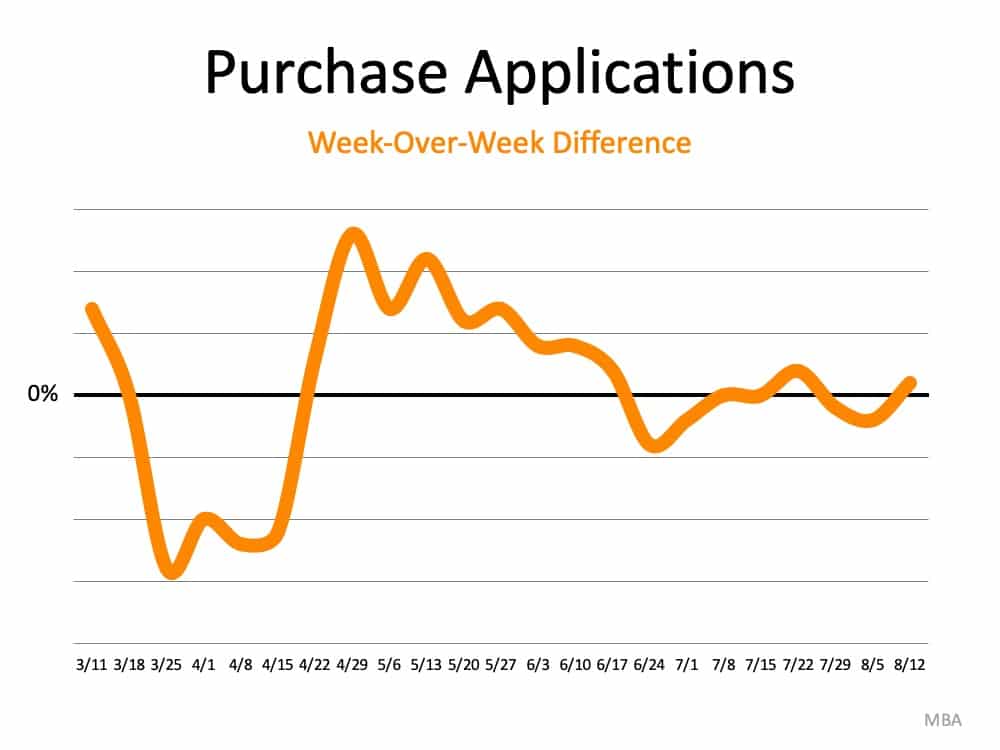

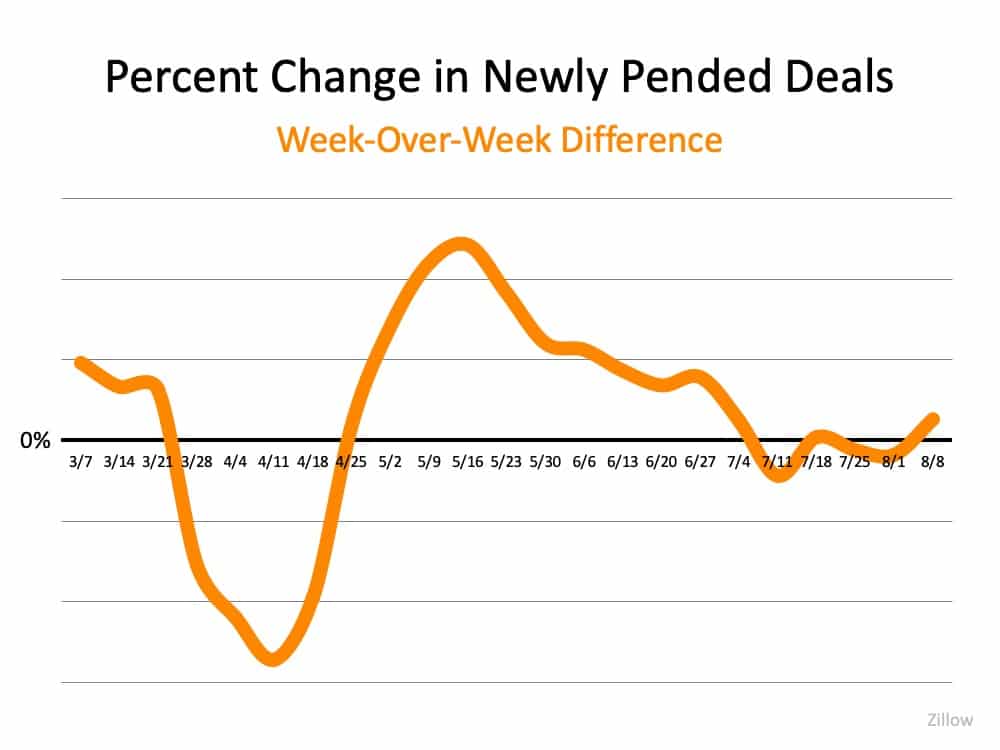

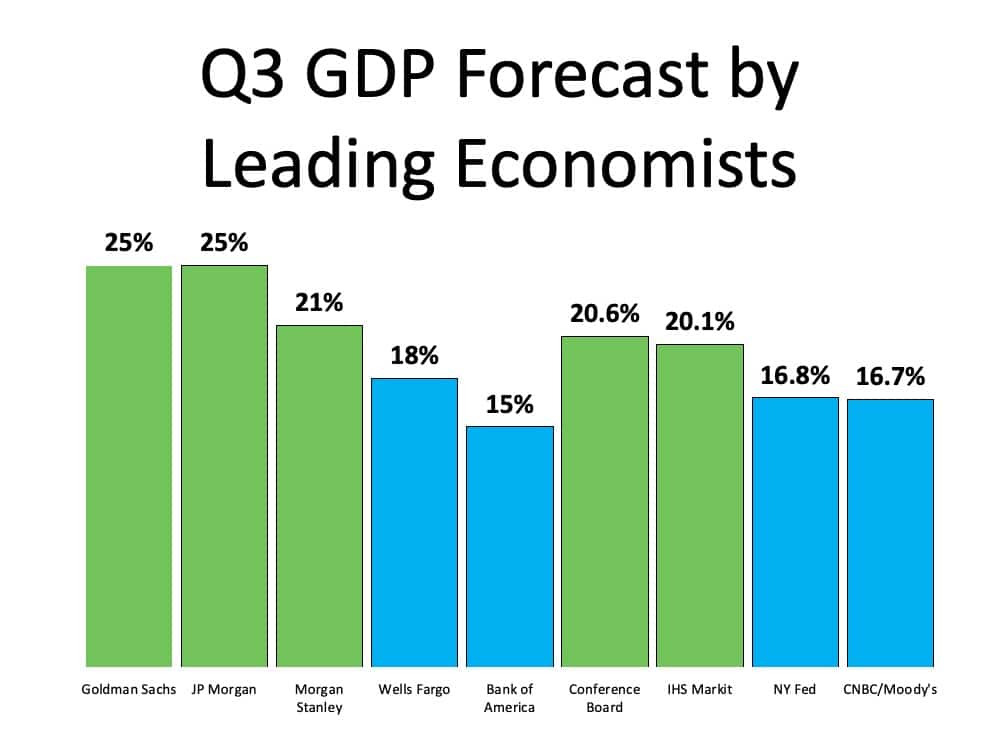

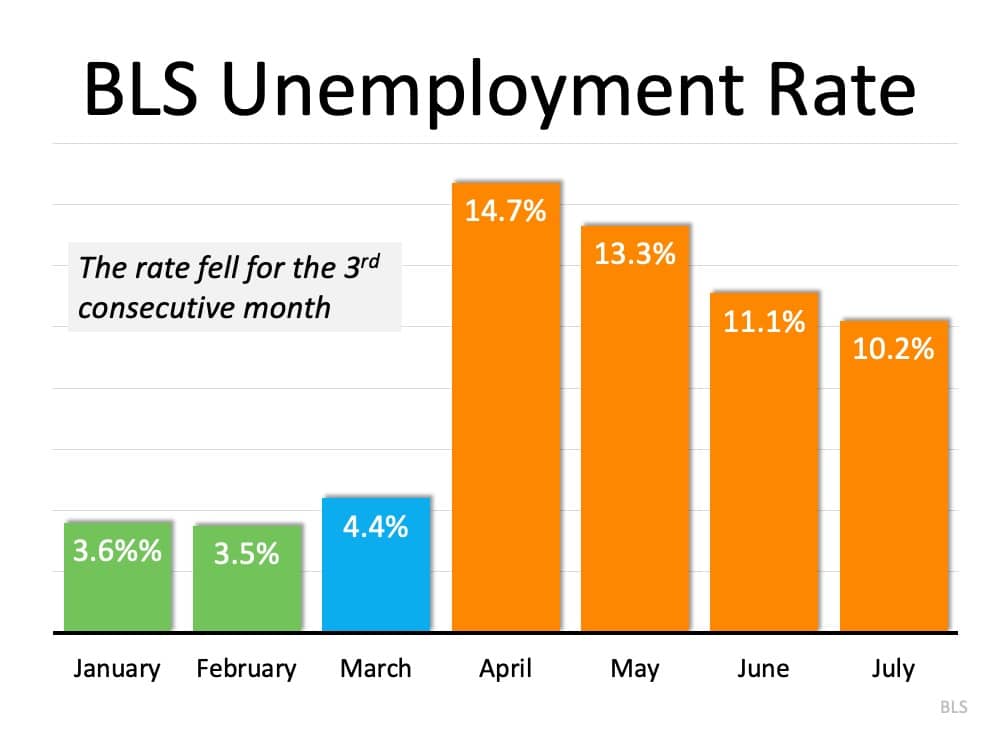

Originally, some housing industry analysts were concerned that the mortgage forbearance program (which allows families to delay payments to a later date) could lead to an increase in foreclosures when forbearances end. Some even worried that we might relive the 2006-2008 housing crash all over again. Once you examine the data, however, that seems unlikely.

As reported by Odeta Kushi, Deputy Chief Economist for First American:

“Despite the federal foreclosure moratorium, there were fears that up to 30% of homeowners would require forbearance, ultimately leading to a foreclosure tsunami. Forbearance did not hit 30%, but rather peaked at 8.6% and has been steadily falling since.” Continue reading…

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] | Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2020/08/20200814-KCM-Share-549x300-1.jpg)

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] | Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2020/08/20200814-MEM-1-scaled-1.jpg)

![2020 Homebuyer Preferences [INFOGRAPHIC] | Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2020/08/20200807-MEM.jpg)