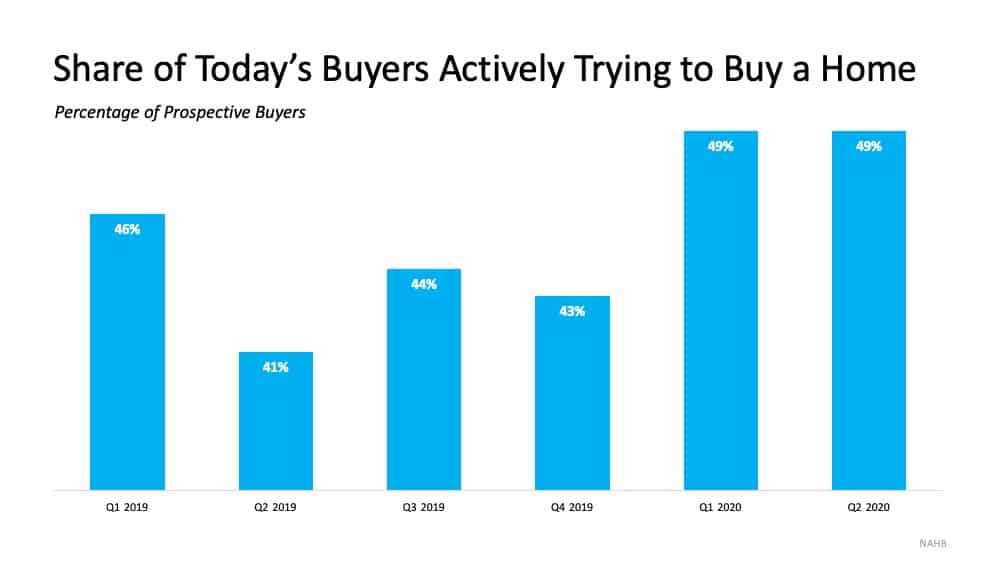

The demand for homes this year is extraordinary as record-breaking numbers of hopeful buyers continue to shop for homes. In a normal year, the peak homebuying season comes to a close by early fall. However, 2020 is anything but a normal year, and the housing market is no exception. Lawrence Yun, Chief Economist for the National Association of Realtors (NAR), explains:

“Home sales traditionally taper off toward the end of the year, but in September they surged beyond what we normally see during this season…I would attribute this jump to record-low interest rates and an abundance of buyers in the marketplace, including buyers of vacation homes given the greater flexibility to work from home.”

What’s drawing so many buyers to the market?

As Yun mentioned, record-low interest rates are key. Today’s rates are strengthening purchasing power for buyers, too. Sam Khater, Chief Economist at Freddie Mac, emphasizes: Continue reading…

![Where Homebuyers Are Heading By Generation [INFOGRAPHIC] | Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2020/01/20200117-KCM-Share-549x300-1.jpg)

![Where Homebuyers Are Heading By Generation [INFOGRAPHIC] | Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2020/01/20200117-MEM-1-scaled-1.jpg)