![Housing Market Forecast for the Rest of 2023 [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/08/Housing-Market-Forecast-For-The-Rest-Of-2023-KCM-Share.png)

Some Highlights

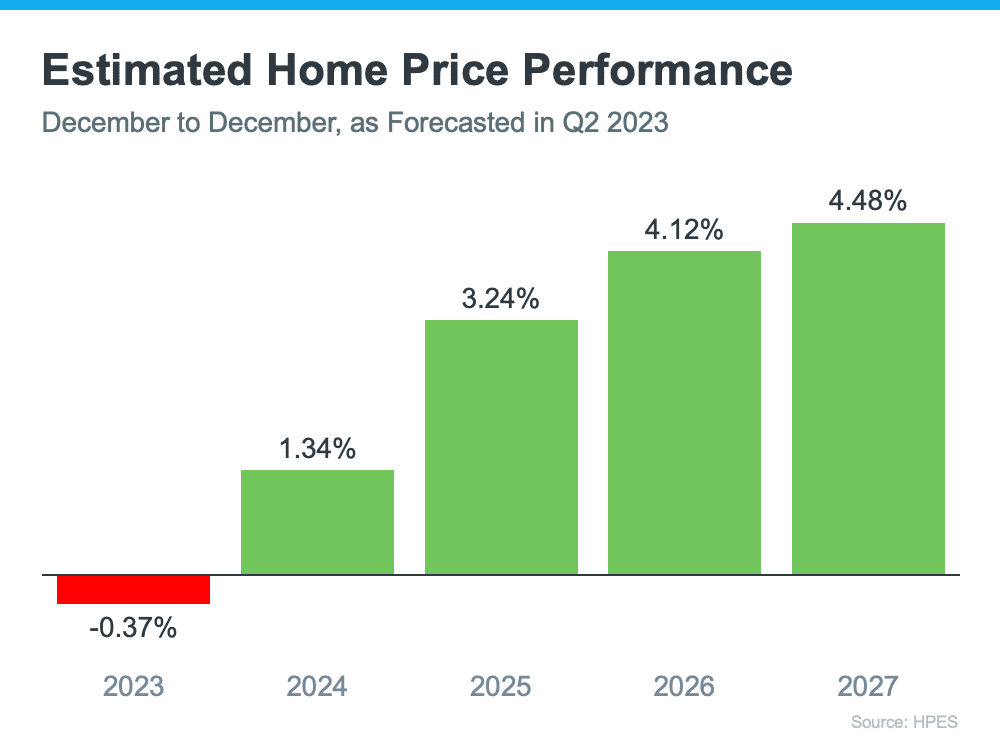

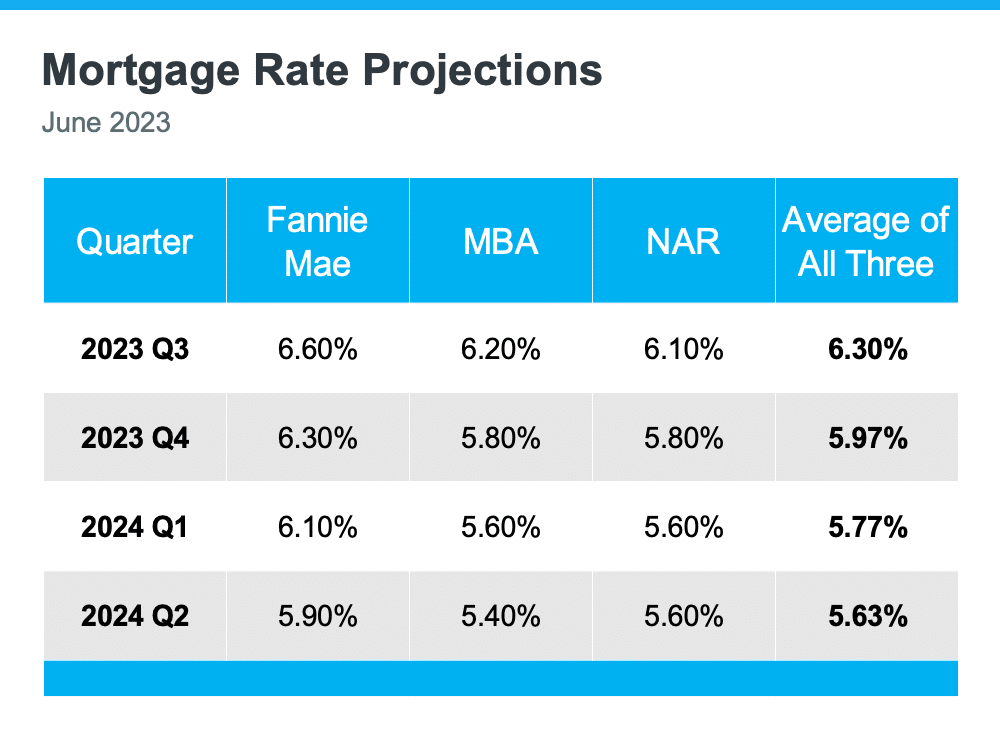

- Need to know what specialists say will occur in the remainder of 2023? Residence prices are already appreciating once more in lots of areas. The common of the professional forecasts exhibits constructive price development.

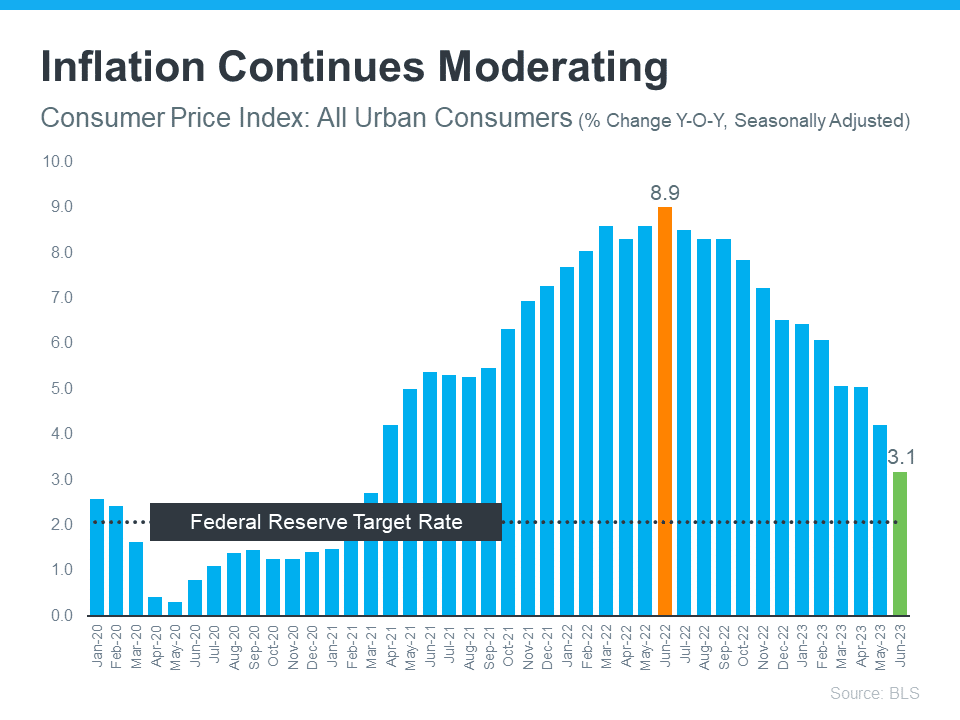

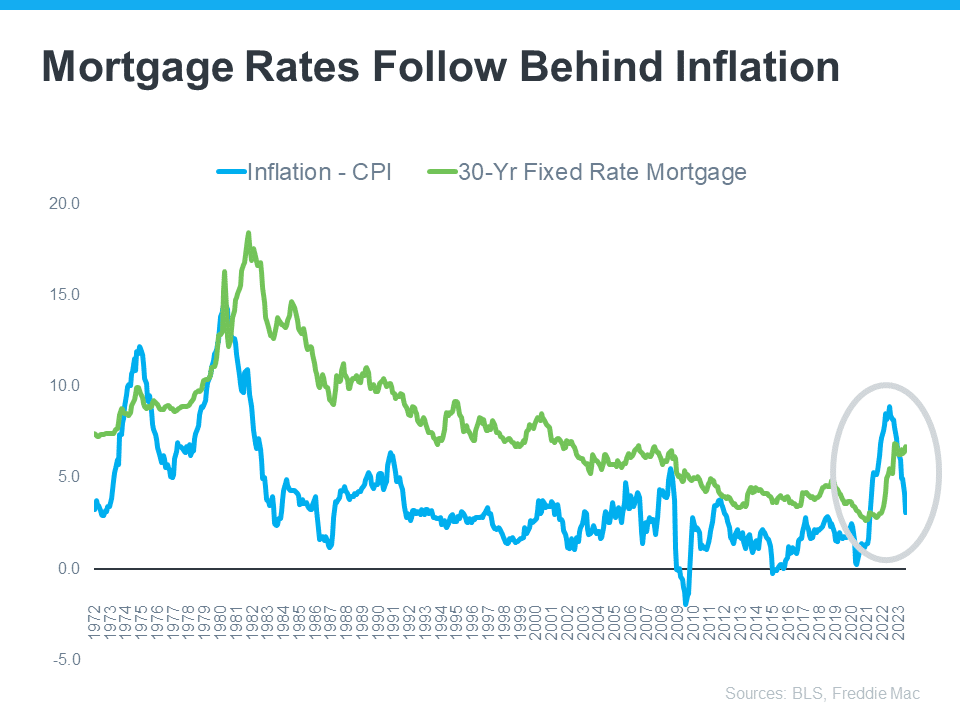

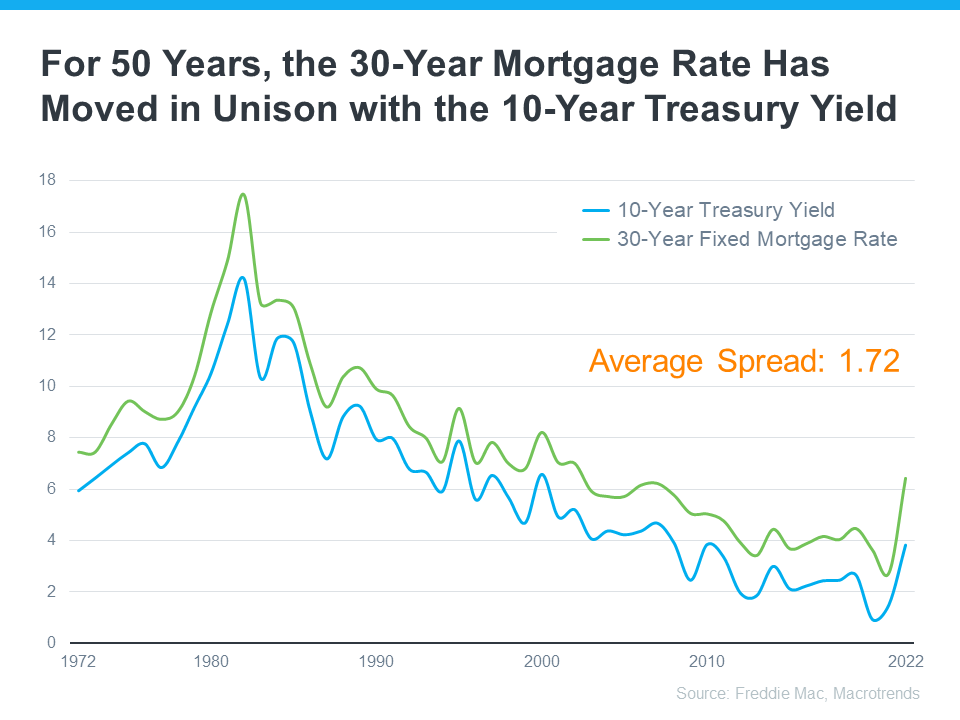

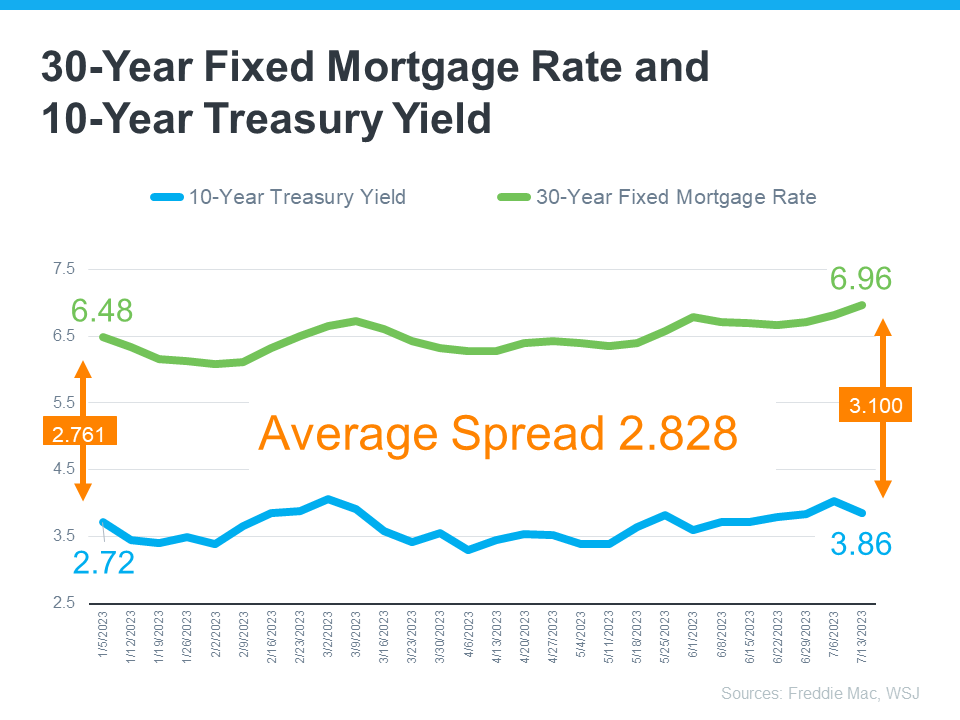

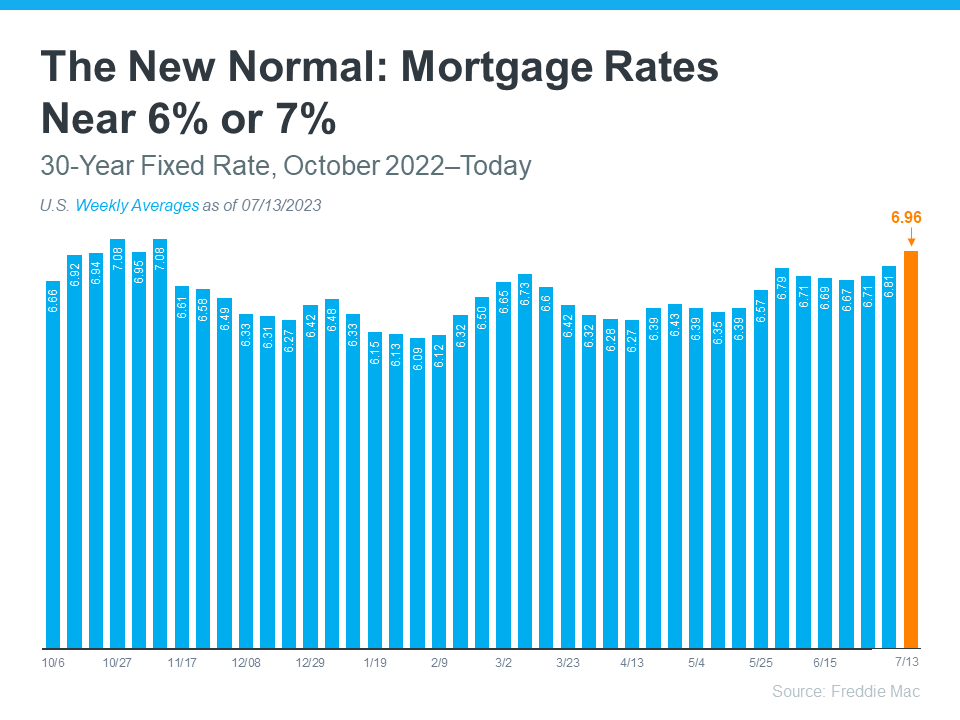

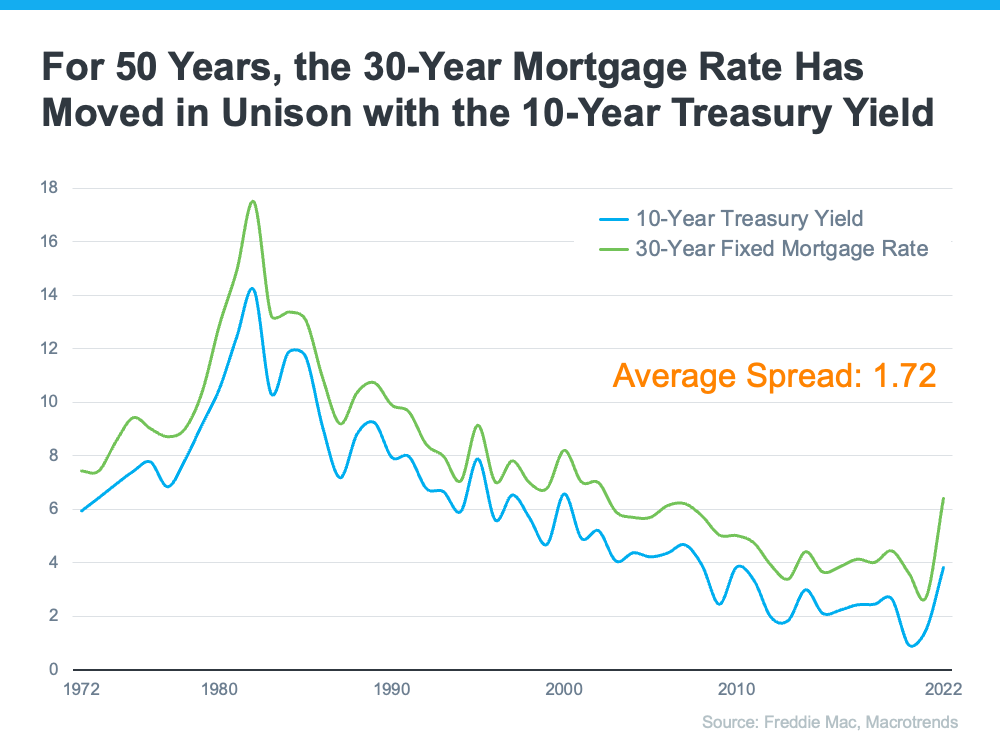

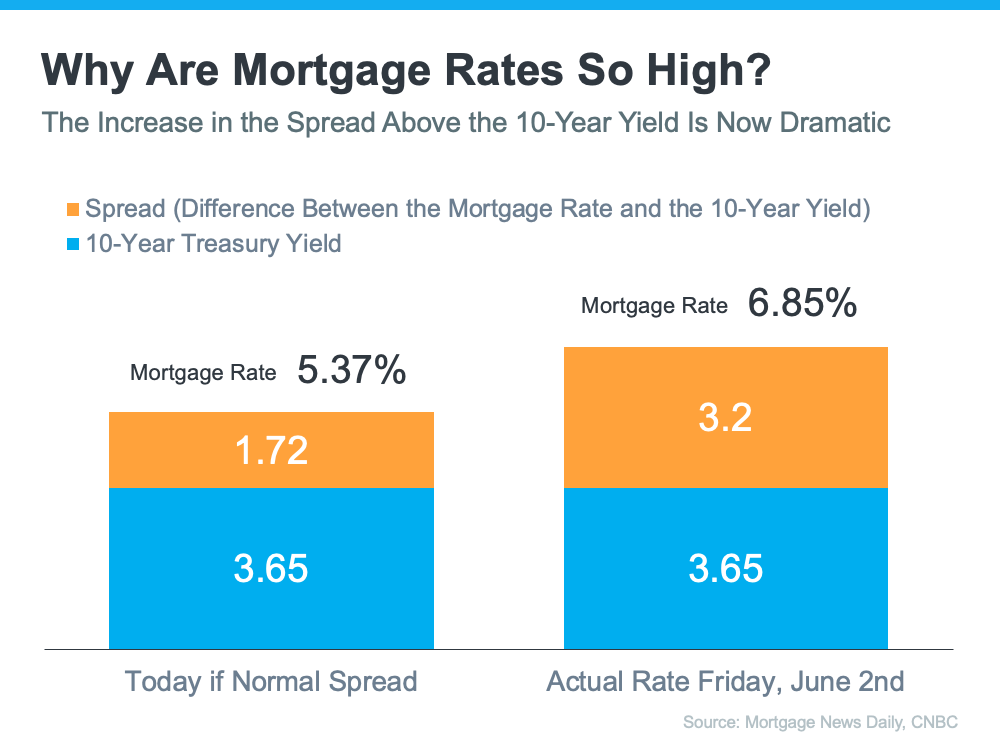

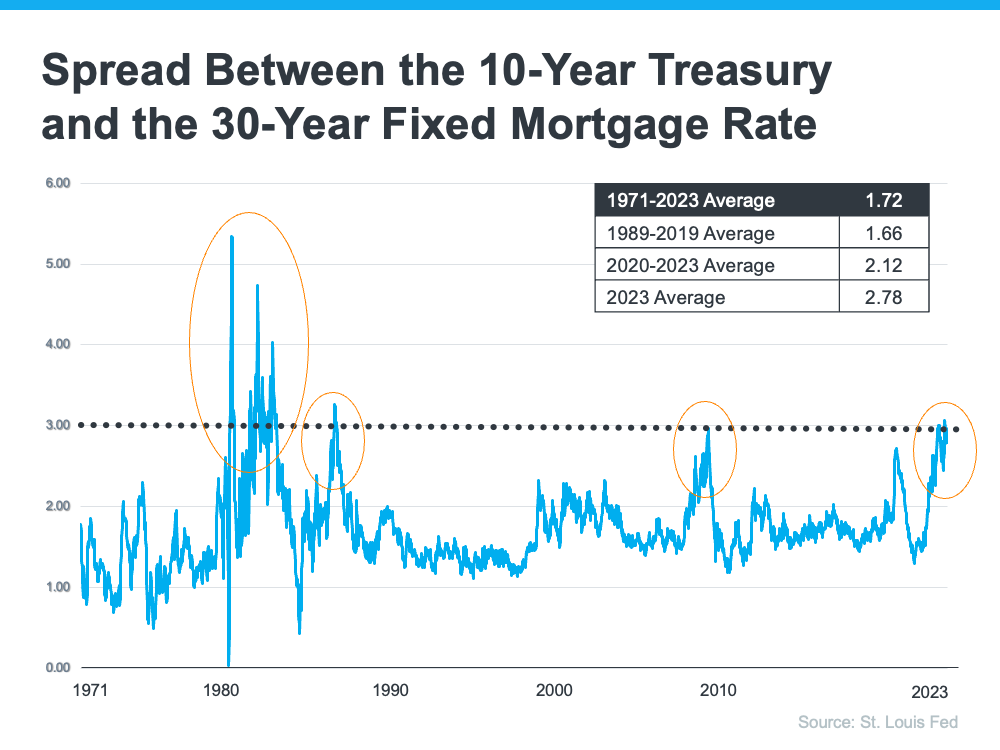

- The place mortgage rates go for the remainder of the year will rely upon inflation. Primarily based on historic developments, rates are more likely to ease as inflation continues to chill.

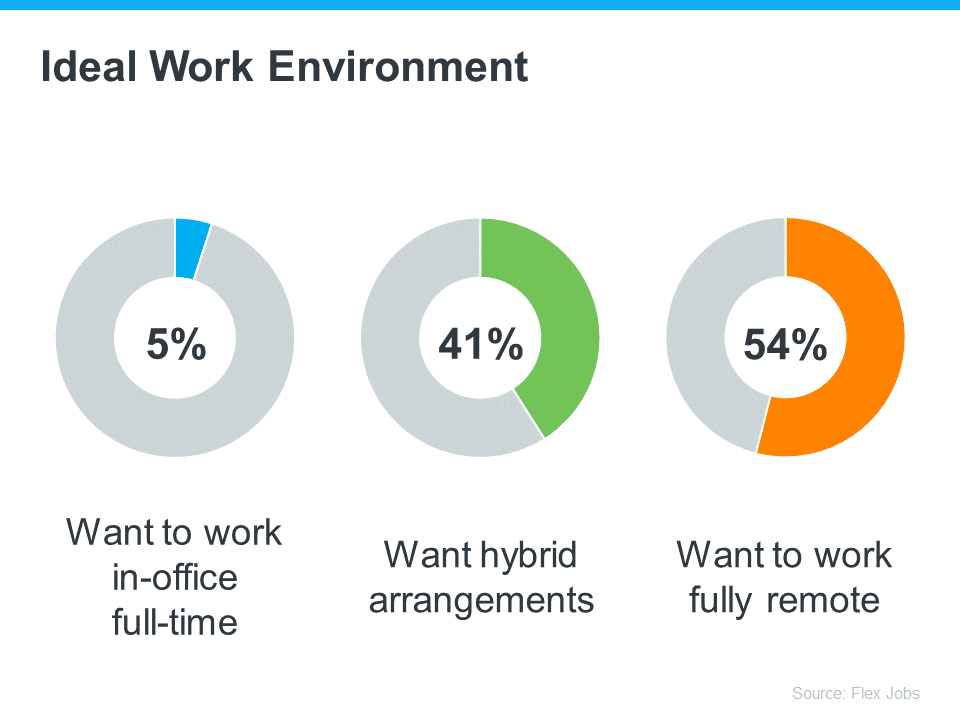

- Regardless that low inventory continues to be a problem, specialists venture 5 million properties will nonetheless sell this 12 months. That pace ought to choose up if rates come down.

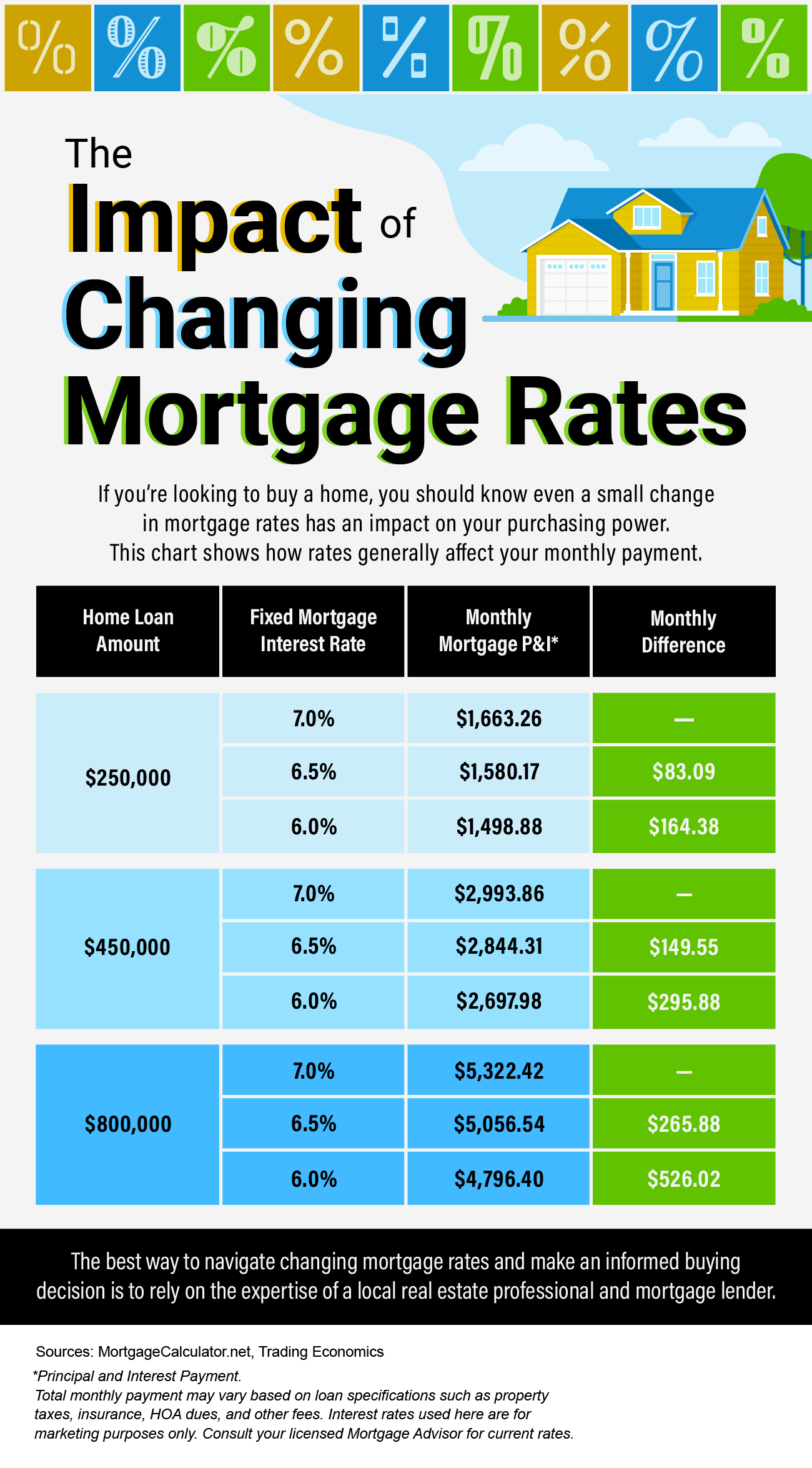

![The Impact of Changing Mortgage Rates [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/05/The-Impact-of-Changing-Mortgage-Rates-KCM-Share.png)