While you learn concerning the housing market within the information, you may see one thing a few latest choice made by the Federal Reserve (the Fed). However how does this choice have an effect on you and your plans to purchase a house? Here is what you might want to know.

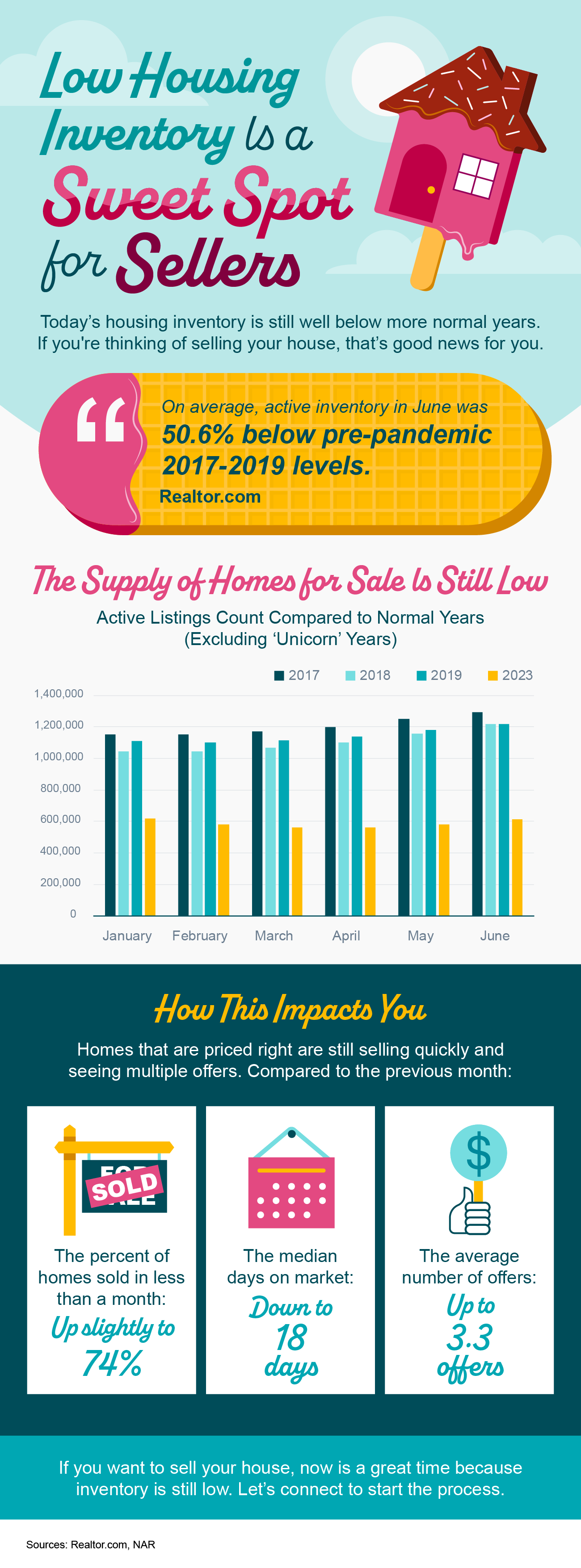

The Fed is making an attempt exhausting to scale back inflation. And although there’s been 12 straight months the place inflation has cooled (see graph beneath), the latest data exhibits it’s nonetheless larger than the Fed’s goal of two%:

Whereas you might have been hoping the Fed would cease their hikes since they’re making progress on their purpose of bringing down inflation, they don’t need to cease too quickly, and danger inflation climbing again up consequently. Due to this, the Fed determined to extend the Federal Funds Charge once more final week. As Jerome Powell, Chairman of the Fed, says:

“We stay dedicated to bringing inflation again to our 2 % purpose and to holding longer-term inflation expectations nicely anchored.”

Greg McBride, Senior VP, and Chief Monetary Analyst at Bankrate, explains how excessive inflation and a powerful financial system play into the Fed’s latest choice:

“Inflation stays stubbornly excessive. The financial system has been remarkably resilient, the labor market remains to be strong, however which may be contributing to the stubbornly excessive inflation. So, Fed has to pump the brakes a bit extra.”

Though a Federal Fund Charge hike by the Fed doesn’t straight dictate what occurs with mortgage charges, it does have an effect. As a latest article from Fortune says:

“The federal funds price is an rate of interest that banks cost different banks after they lend each other cash . . . When inflation is working excessive, the Fed will enhance charges to extend the price of borrowing and decelerate the financial system. When it’s too low, they’ll decrease charges to stimulate the financial system and get issues transferring once more.”

How All of This Impacts You

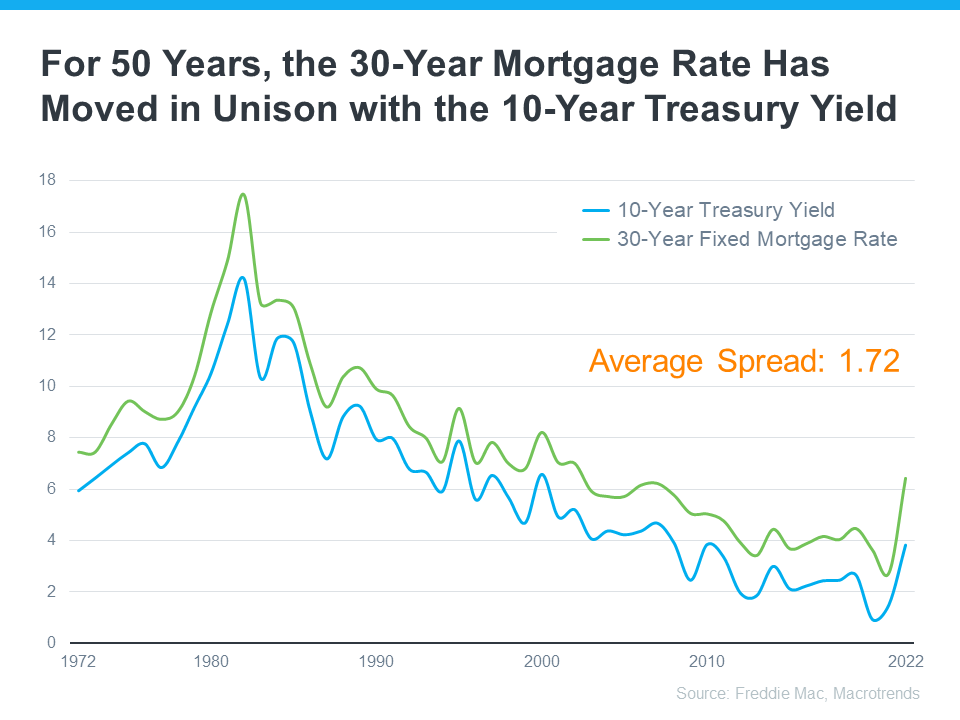

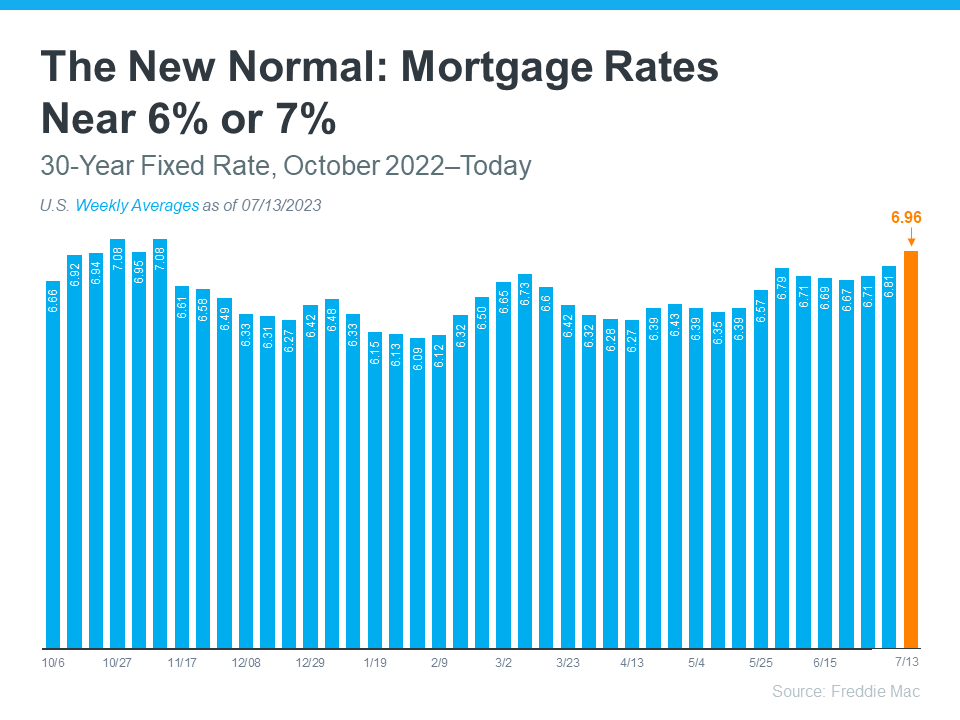

Within the easiest sense, when inflation is excessive, mortgage rates are additionally excessive. However, if the Fed succeeds in bringing down inflation, it may in the end result in decrease mortgage charges, making it extra inexpensive so that you can purchase a house.

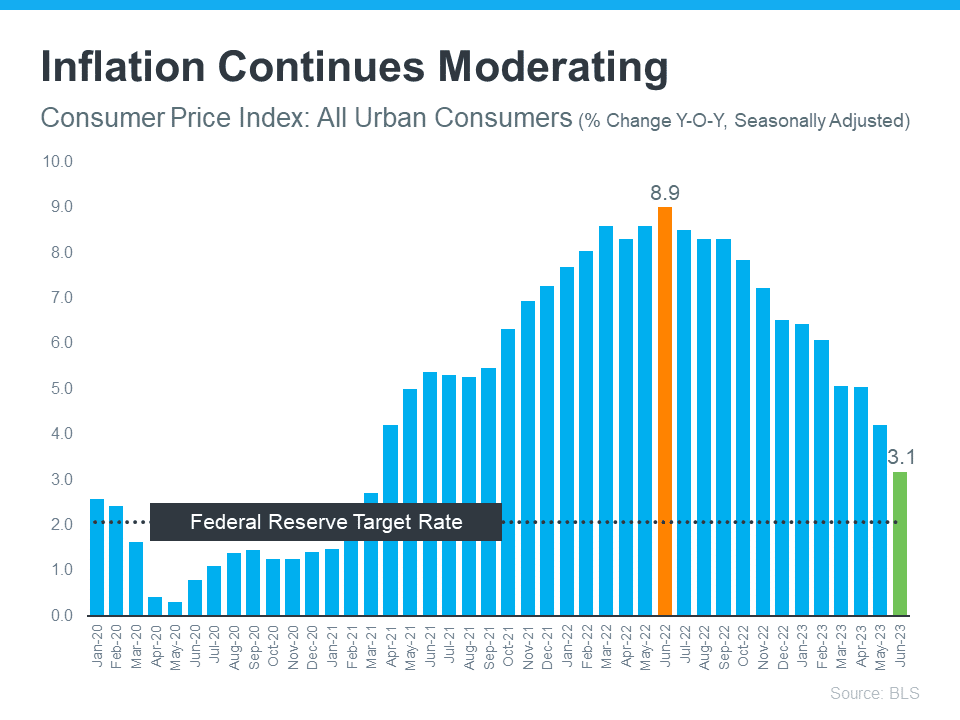

This graph helps illustrate that time by displaying that when inflation decreases, mortgage rates usually go down, too (see graph beneath):

As the information above exhibits, inflation (proven in the blue pattern line) is slowly coming down and, based mostly on historic traits, mortgage charges (proven in the inexperienced pattern line) are likely to follow. McBride says this about the way forward for mortgage charges:

“With the backdrop of easing inflation pressures, we should always see extra constant declines in mortgage charges because the yr progresses, notably if the financial system and labor market gradual noticeably.”

Backside Line

What occurs to mortgage charges will depend on inflation. If inflation cools down, mortgage charges ought to go down too. Depend on an actual property skilled you may belief for knowledgeable recommendation on housing market modifications and what they imply for you.

![Key Housing Market Trends [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/07/Key-Housing-Market-Trends-KCM-Share.png)

![Real Estate Continues To Be the Best Investment [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/07/Real-Estate-Continues-To-Be-the-Best-Investment-KCM-Share.png)

![Low Housing Inventory Is a Sweet Spot for Sellers [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/07/Low-Housing-Inventory-Is-a-Sweet-Spot-for-Sellers-KCM-Share.png)