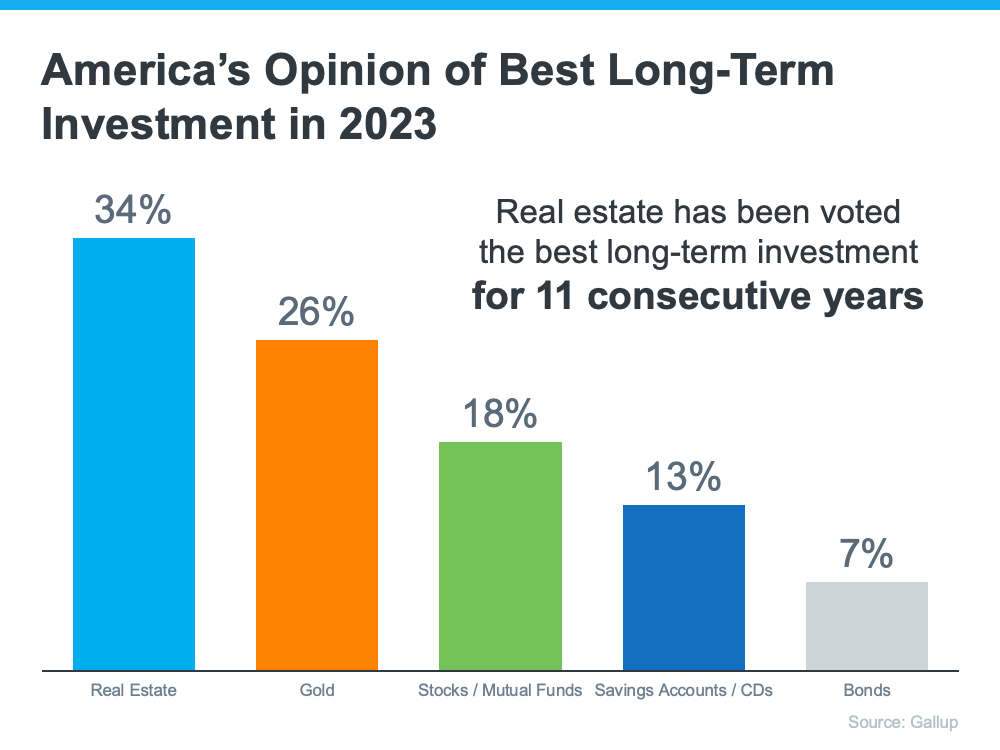

With all of the headlines circulating about home prices and rising mortgage rates, it’s possible you’ll marvel if it nonetheless is smart to put money into homeownership proper now. A recent poll from Gallup reveals the reply is sure. The truth is, actual property was voted the perfect long-term funding for the 11th consecutive yr, persistently beating different funding sorts like gold, shares, and bonds (see graph beneath):

If you happen to’re fascinated about purchasing a home, let this ballot reassure you. Even with all the things taking place at this time, Individuals acknowledge proudly owning a house is a robust monetary choice.

Why Do Individuals Nonetheless Really feel So Constructive Concerning the Worth of Investing in a House?

Buying actual property has usually been a strong long-term technique for constructing wealth in America. As Lawrence Yun, Chief Economist on the Nationwide Affiliation of Realtors (NAR), notes:

“. . . homeownership is a catalyst for constructing wealth for folks from all walks of life. A month-to-month mortgage cost is commonly thought of a compelled financial savings account that helps householders construct a internet price about 40 occasions larger than that of a renter.”

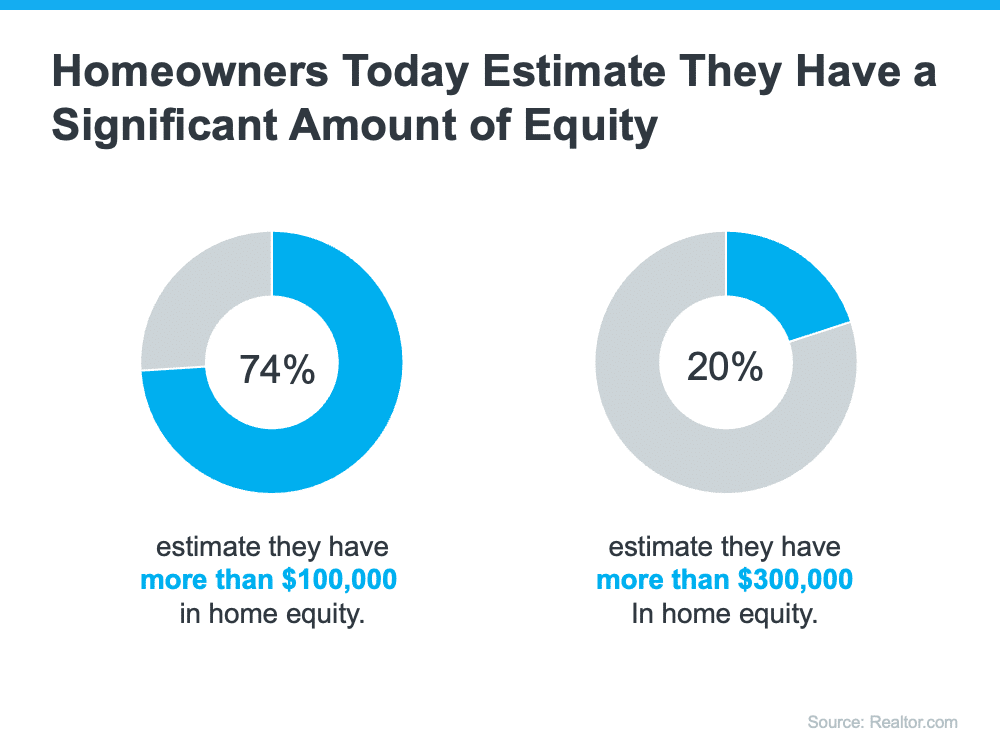

That’s as a result of proudly owning a house grows your net worth over time as your private home appreciates in worth and as you pay down your mortgage. And, since constructing that wealth takes time, it could make sense to start out as quickly as you may. If you happen to wait to purchase and hold renting, you’ll miss out on these month-to-month housing funds going towards your private home fairness.

Backside Line

Shopping for a house is a robust choice. So, it’s no marvel so many individuals view actual property as the perfect long-term funding. If you happen to’re prepared to start out by yourself journey towards homeownership, join with an area actual property advisor at this time.

![The Worst Home Price Declines Are Behind Us [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/05/The-Worst-of-Home-Price-Declines-Are-Behind-Us-KCM-Share.png)

If you’re thinking about

If you’re thinking about