![Don’t Expect a Wave of Foreclosures [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/08/Dont-Expect-A-Wave-Of-Foreclosures-KCM-Share.png)

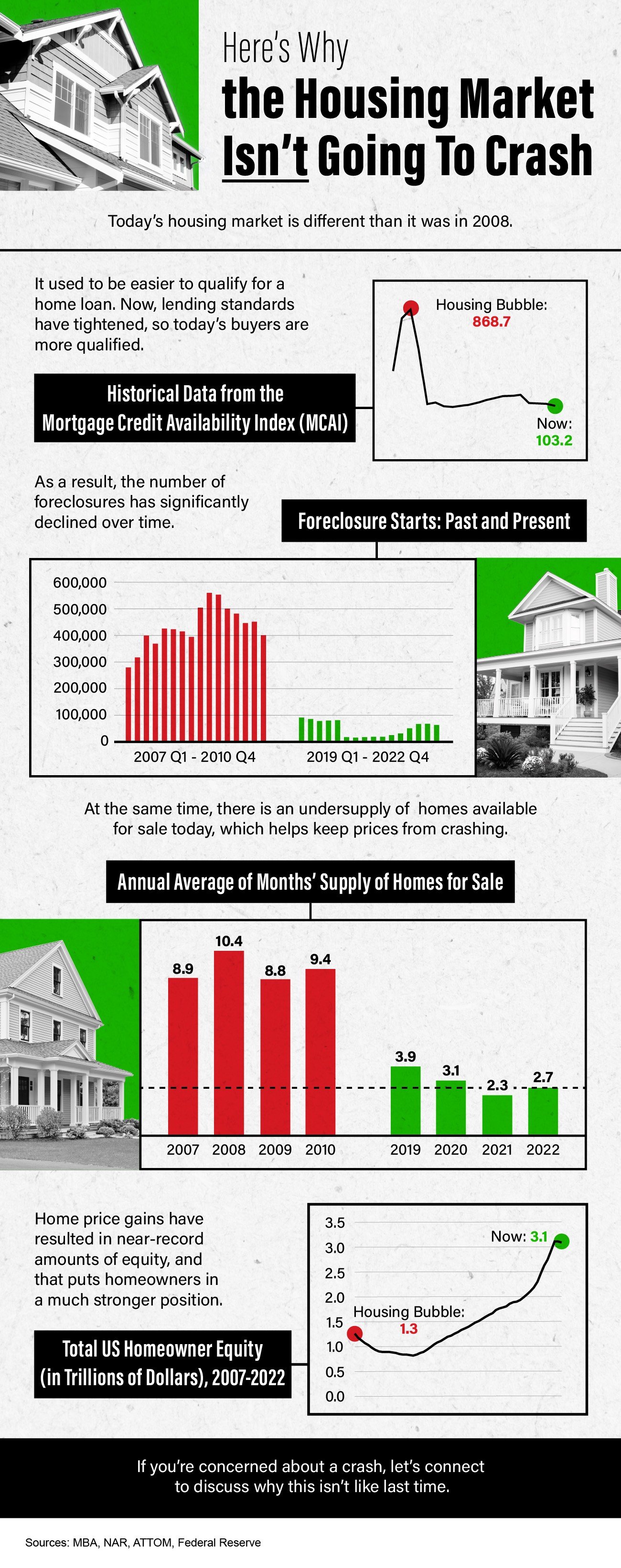

Some Highlights

- With ongoing high inflation pushing up everyday costs, some people are worried that’ll create a flood of foreclosures. Here’s why that’s unlikely.

- Fewer people are seriously behind on mortgage payments right now. If foreclosures were going to rise a lot, more people would need to be late on their payments.

- Since most are paying on time, a wave isn’t coming. If you’re concerned about a flood of foreclosures, the data shows that’s not likely.

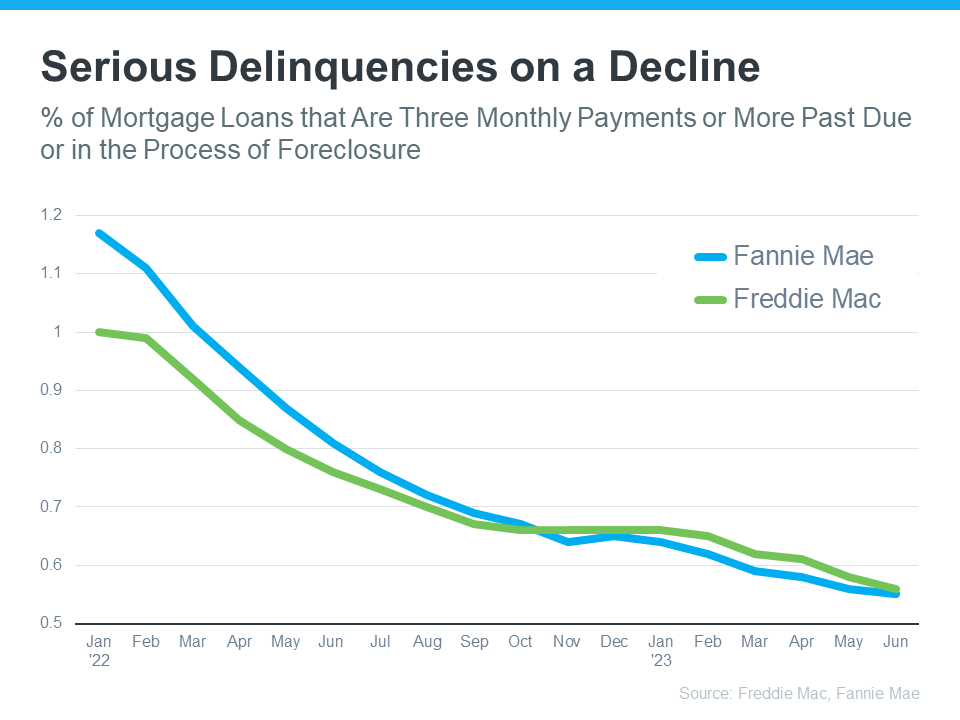

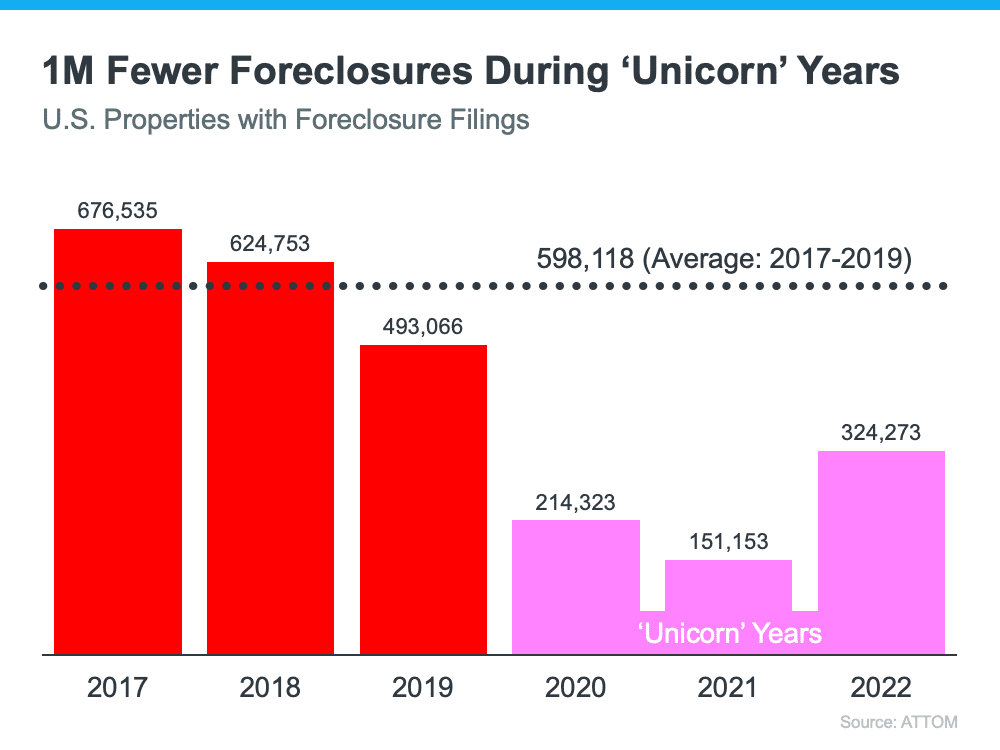

![Why You Can’t Compare Now to the ‘Unicorn’ Years of the Housing Market [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/06/Why-You-Cant-Compare-Now-to-the-Unicorn-Years-of-the-Housing-Market-KCM-Share.png)

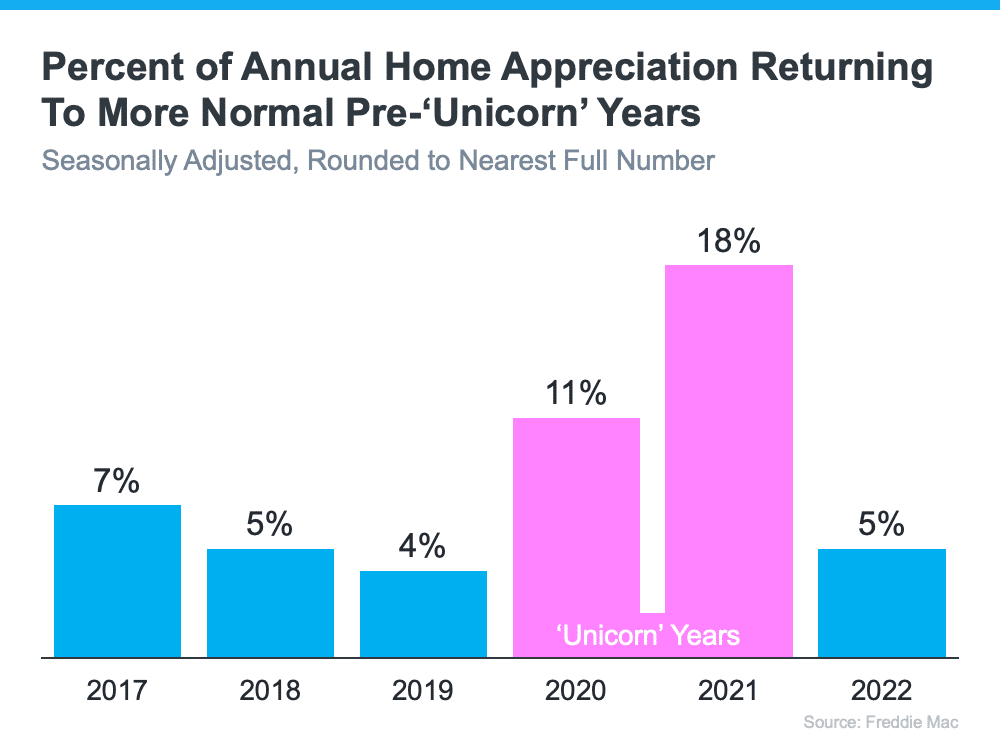

![Here’s Why the Housing Market Isn’t Going To Crash [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/03/20230317_Heres-Why-The-Housing-Market-Isnt-Going-To-Crash-KCM-Share.png)