Introduce the concept of condotels and their appeal as vacation investments.

Many owners rent through websites like Airbnb or VRBO. They manage the property themselves or hire a property management company. Give me a call, and I can discuss these options with you. 386-315-4744

Condotels For Sale Daytona Beach, Florida

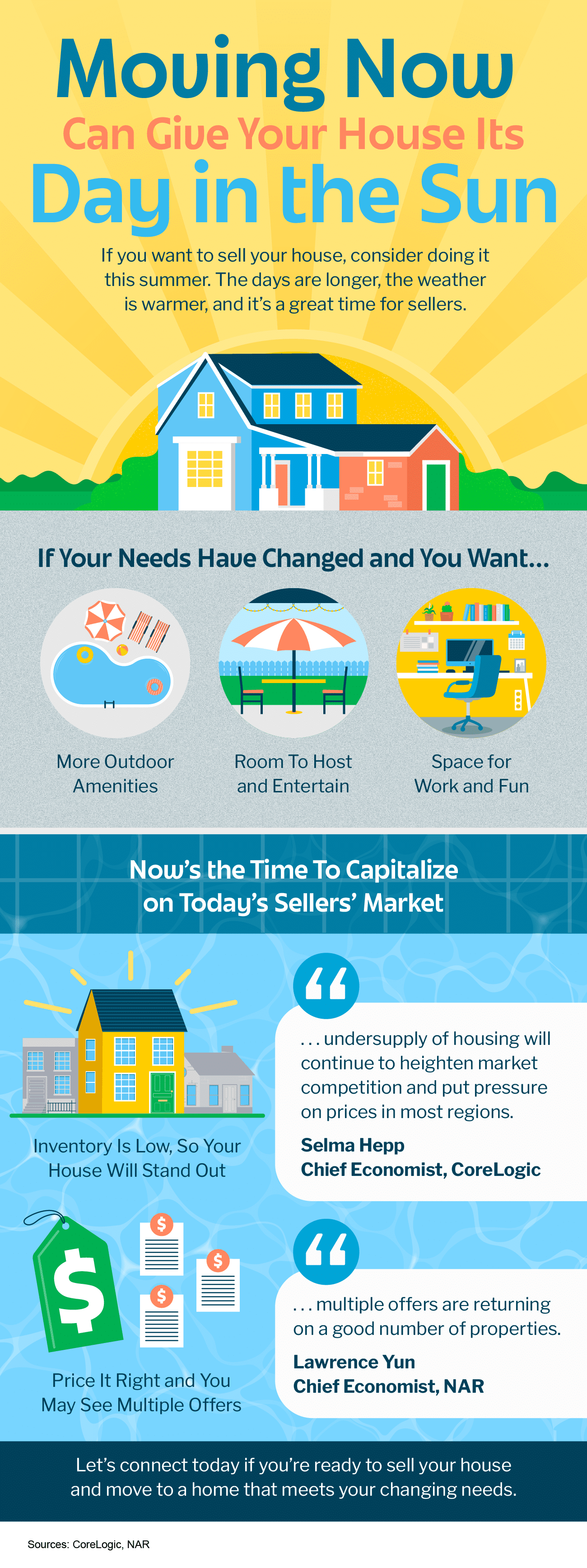

![Moving Now Can Give Your House Its Day in the Sun [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/05/Moving-Now-Can-Give-Your-House-Its-Day-In-The-Sun-KCM-Share.png)

![The Worst Home Price Declines Are Behind Us [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/05/The-Worst-of-Home-Price-Declines-Are-Behind-Us-KCM-Share.png)