You is perhaps frightened we’re heading for a housing crash, however there are various the explanation why this housing market isn’t just like the one we noticed in 2008. One in all which is how lending requirements are completely different in the present day. Right here’s a take a look at the information to assist show it.

Each month, the Mortgage Bankers Affiliation (MBA) releases the Mortgage Credit Availability Index (MCAI). In line with their web site:

“The MCAI supplies the one standardized quantitative index that’s solely centered on mortgage credit score. The MCAI is . . . a abstract measure which signifies the supply of mortgage credit score at a time limit.”

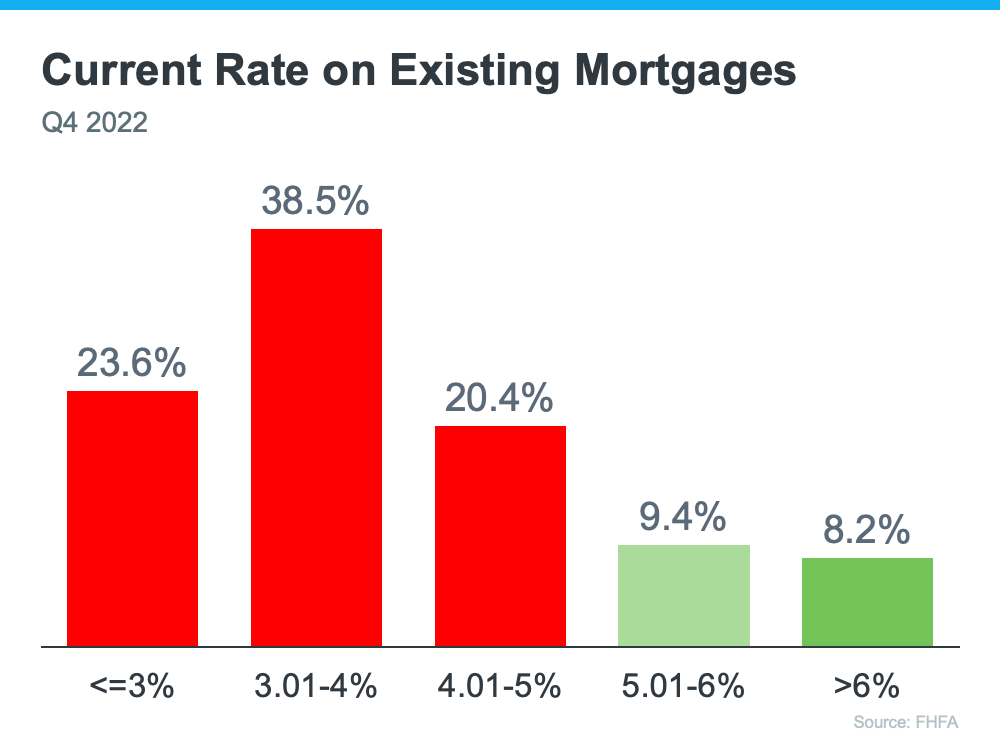

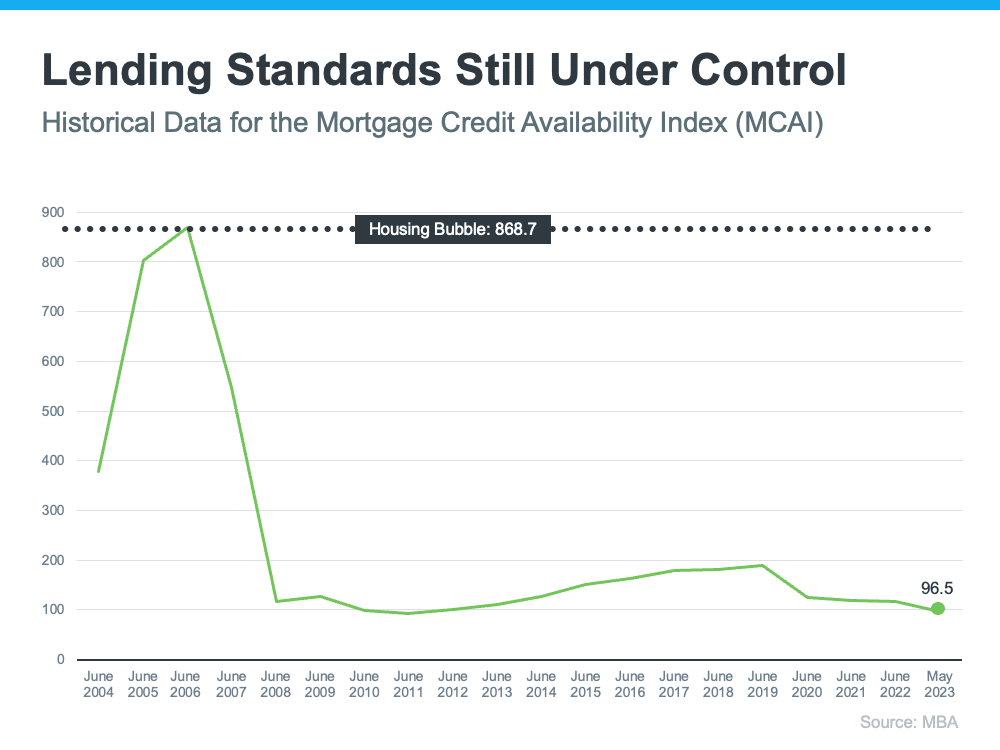

Mainly, the index determines how simple it’s to get a mortgage. Check out the graph under of the MCAI since they began preserving observe of this knowledge in 2004. It reveals how lending requirements have modified over time. It really works like this:

- When lending requirements are much less strict, it’s simpler to get a mortgage, and the index (the inexperienced line within the graph) is greater.

- When lending requirements are stricter, it’s more durable to get a mortgage, and the road representing the index is decrease.

In 2004, the index was round 400. However, by 2006, it had gone as much as over 850. As we speak, the story is sort of completely different. Because the crash, the index went down as a result of lending requirements acquired tighter, so in the present day it’s more durable to get a mortgage.

Unfastened Lending Requirements Contributed to the Housing Bubble

One of many primary elements that contributed to the housing bubble was that lending requirements had been lots much less strict again then. Realtor.com explains it like this:

“Within the early 2000s, it wasn’t precisely exhausting to snag a house mortgage. . . . loads of mortgages had been doled out to individuals who lied about their incomes and employment, and couldn’t really afford homeownership.”

The tall peak within the graph above signifies that main as much as the housing disaster, it was a lot simpler to get credit score, and the necessities for getting a mortgage had been removed from strict. Again then, credit score was extensively obtainable, and the edge for qualifying for a mortgage was low.

Lenders had been approving loans with out at all times going by way of a verification course of to verify if the borrower would seemingly be capable of repay the mortgage. Meaning collectors had been lending to extra debtors who had a better danger of defaulting on their loans.

As we speak’s Loans Are A lot More durable To Get than Earlier than

As talked about, lending requirements have modified lots since then. Bankrate describes the distinction:

“As we speak, lenders impose robust requirements on debtors – and those that are getting a mortgage overwhelmingly have glorious credit score.”

In case you look again on the graph, you’ll discover after the height across the time of the housing crash, the road representing the index went down dramatically and has stayed low since. In truth, the road is much under the place requirements had been even in 2004 – and it’s getting decrease. Joel Kan, VP and Deputy Chief Economist at MBA, provides the newest replace from Could:

“Mortgage credit score availability decreased for the third consecutive month . . . With the decline in availability, the MCAI is now at its lowest degree since January 2013.”

The reducing index suggests requirements are getting a lot more durable – which makes it clear we’re distant from the acute lending practices that contributed to the crash.

Backside Line

Main as much as the housing crash, lending requirements had been far more relaxed with little analysis accomplished to measure a borrower’s potential to repay their mortgage. As we speak, requirements are tighter, and the danger is lowered for each lenders and debtors. This goes to indicate, these are two very completely different housing markets, and this market isn’t just like the final time.

![Why You Can’t Compare Now to the ‘Unicorn’ Years of the Housing Market [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/06/Why-You-Cant-Compare-Now-to-the-Unicorn-Years-of-the-Housing-Market-KCM-Share.png)