![Mortgage Rates & Payments by Decade [INFOGRAPHIC] | Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2020/08/20200814-KCM-Share-549x300-1.jpg)

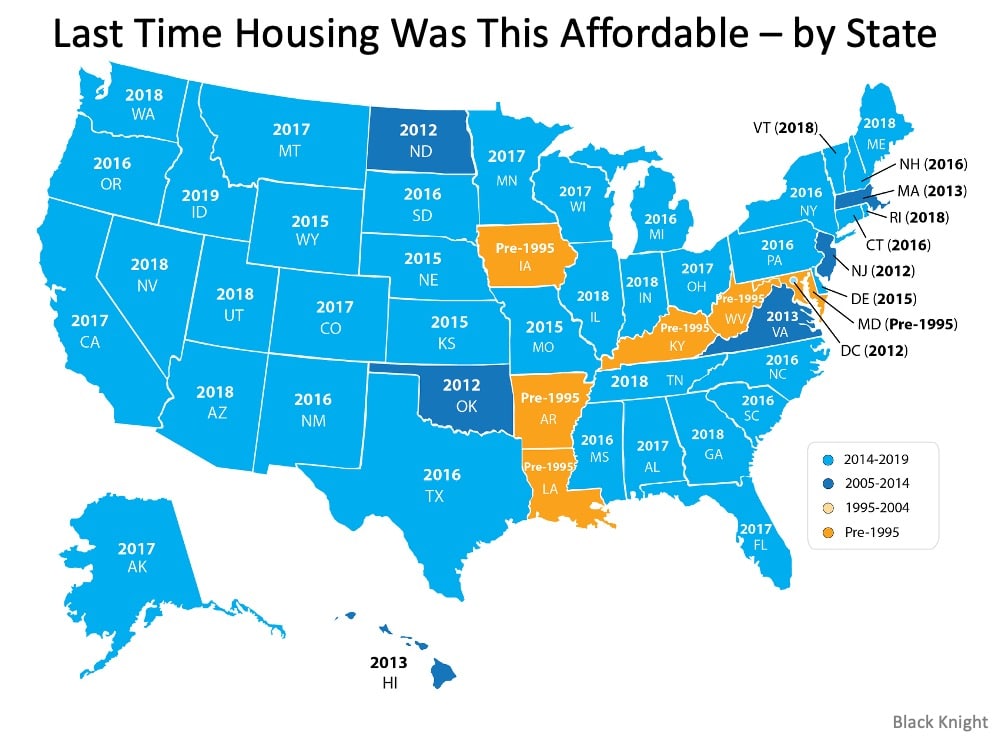

Some Highlights

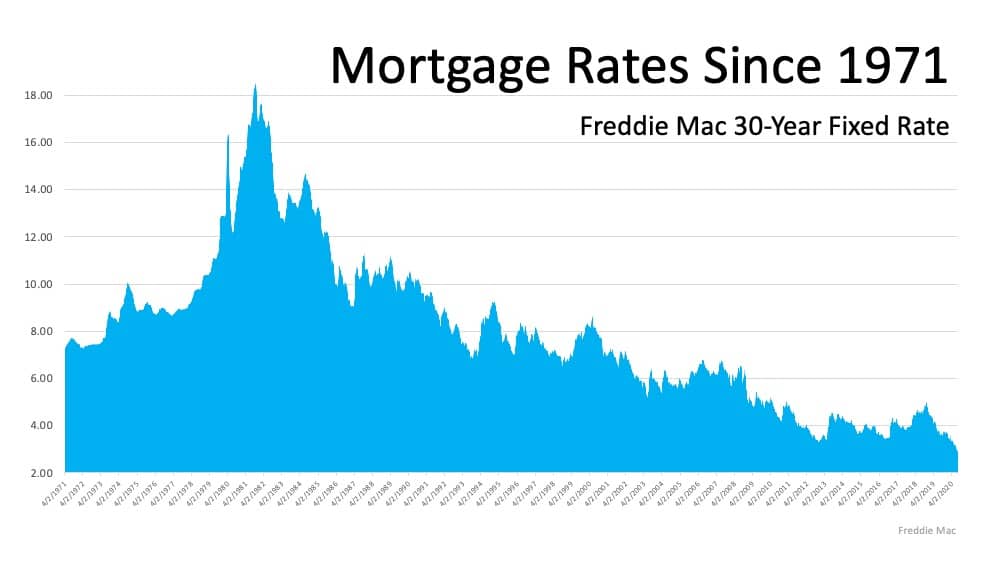

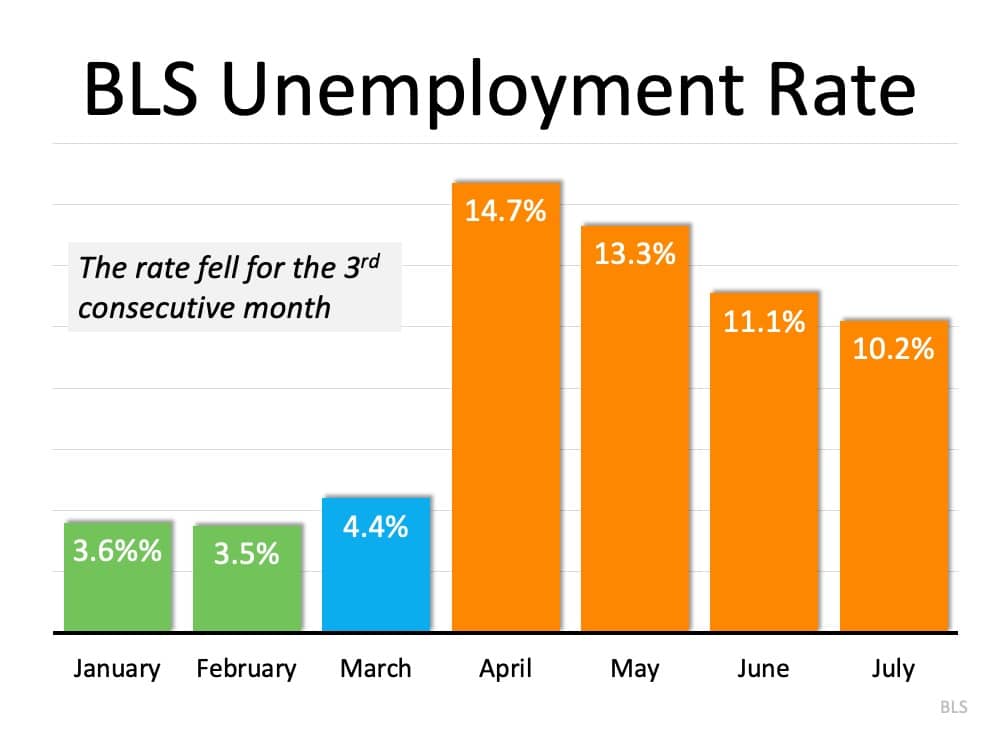

- Sometimes it helps to see the dollars and cents you’ll save when you purchase a home while mortgage rates are low.

- Today’s low rates mean it’s less expensive to borrow money, so the savings over the life of your loan is significant.

- Let’s connect to determine the best way to position your family for a financially-savvy move in today’s market.

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] | Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2020/08/20200814-MEM-1-scaled-1.jpg)

![2020 Homebuyer Preferences [INFOGRAPHIC] | Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2020/08/20200807-MEM.jpg)

![Where Is the Housing Market Headed in 2020? [INFOGRAPHIC] | Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2020/08/20200730-MEM-scaled-1.jpg)