![Key Terms to Know in the Homebuying Process [INFOGRAPHIC] | Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2020/11/20201127-KCM-Share-549x300-1.png)

Some Highlights

- Buying a home can be intimidating if you’re not familiar with the terms used throughout the process.

- To point you in the right direction, here’s a list of some of the most common language you’ll hear along the way.

- The best way to ensure your homebuying process is a positive one is to find a real estate professional who will guide you through every aspect of the transaction with ‘the heart of a teacher’ by putting your needs first.

![Key Terms to Know in the Homebuying Process [INFOGRAPHIC] | Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2020/11/20201127-MEM.png)

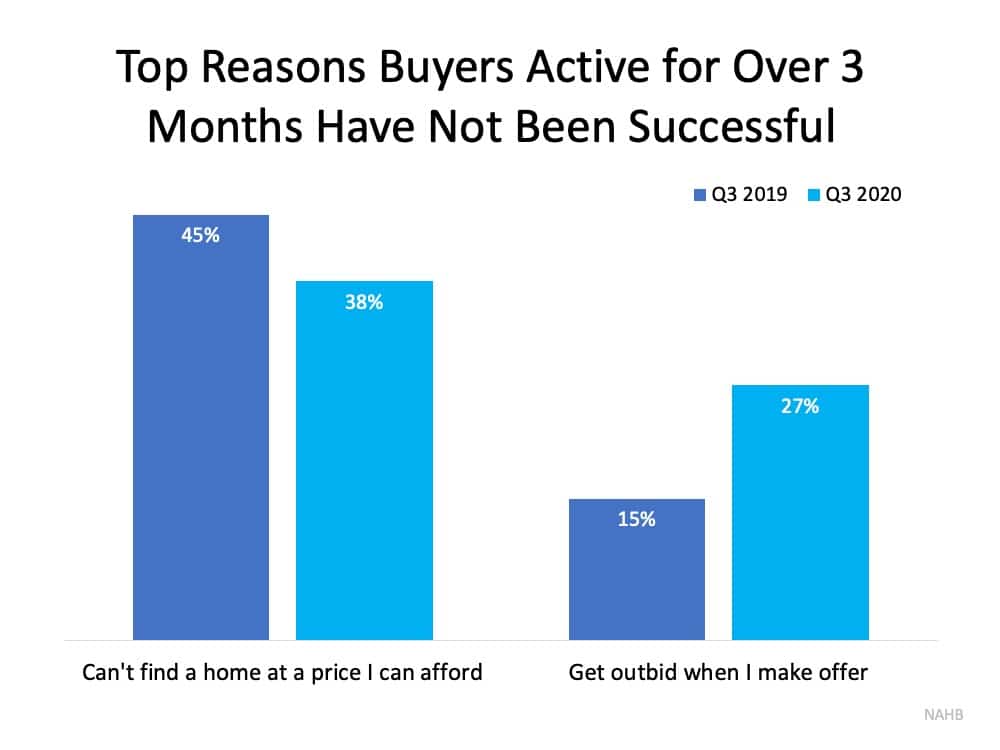

When you continually hear how rates are hitting record lows, you may be wondering: Are they going to keep falling? Should I wait until they get even lower?

When you continually hear how rates are hitting record lows, you may be wondering: Are they going to keep falling? Should I wait until they get even lower?

![Making a Home for the Brave Possible [INFOGRAPHIC] | Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2020/11/20201106-MEM.png)