The Nationwide Affiliation of Realtors (NAR) will launch its newest Existing Home Sales Report tomorrow. The knowledge it comprises on home prices could trigger some confusion and will even generate some troubling headlines. This all stems from the truth that NAR will report the median gross sales worth, whereas different residence worth indices report repeat sales prices. The overwhelming majority of the repeat gross sales indices present costs are starting to appreciate once more. However the median worth reported on Thursday could inform a distinct story.

Right here’s why utilizing the median residence worth as a gauge of what’s occurring with residence values isn’t supreme proper now. According to the Heart for Actual Property Research at Wichita State College:

“The median sale worth measures the ‘center’ worth of properties that offered, which means that half of the properties offered for the next worth and half offered for much less. Whereas it is a good measure of the standard sale worth, it isn’t very helpful for measuring residence worth appreciation as a result of it’s affected by the ‘composition’ of properties which have offered.

For instance, if extra lower-priced properties have offered not too long ago, the median sale worth would decline (as a result of the “center” house is now a lower-priced residence), even when the worth of every particular person house is rising.”

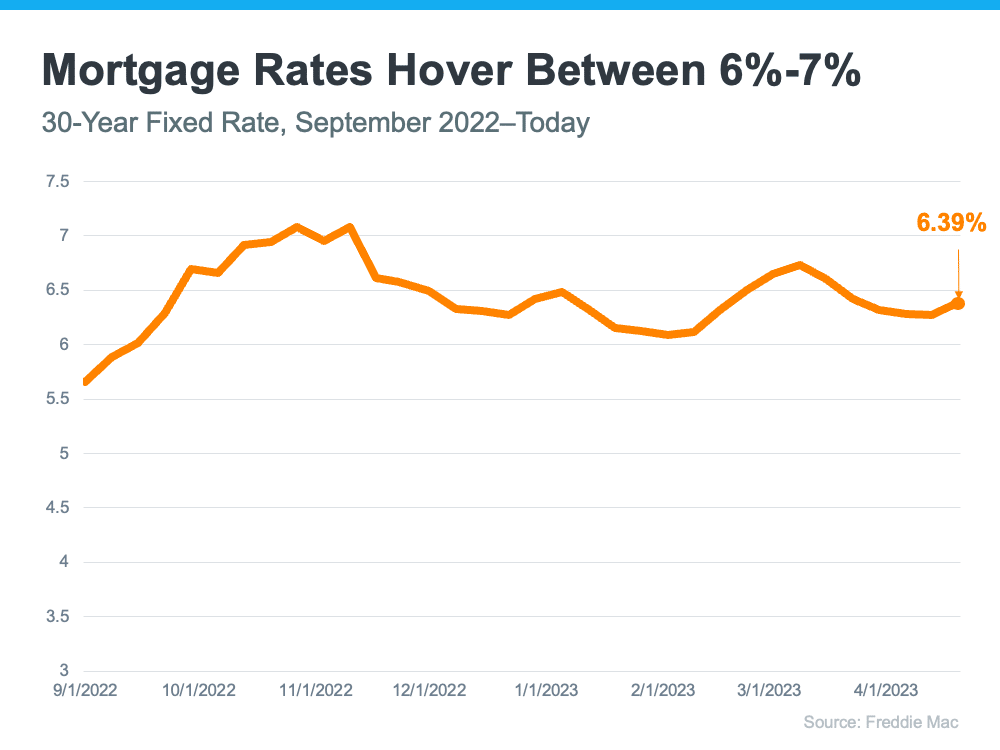

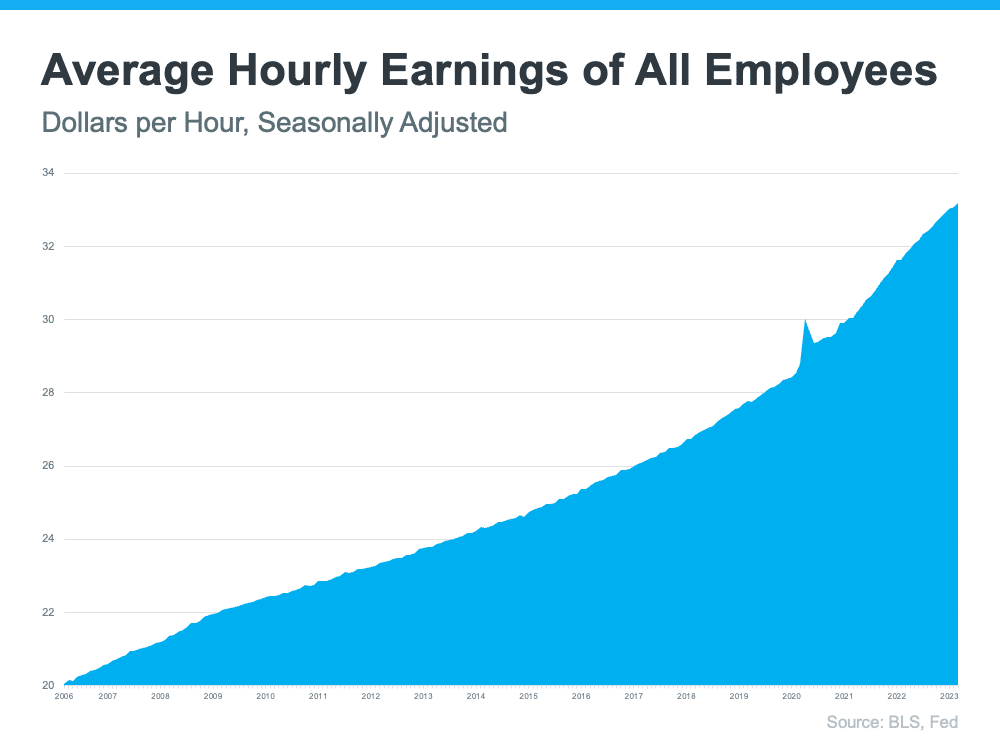

Folks buy homes primarily based on their month-to-month mortgage cost, not the value of the home. When mortgage charges go up, they’ve to purchase a cheaper residence to maintain the month-to-month expense affordable. Extra ‘less-expensive’ homes are promoting proper now, and that’s inflicting the median worth to say no. However that doesn’t imply any single home misplaced worth.

Even NAR, a company that stories on median costs, acknowledges there are limitations to what this sort of information can present you. NAR explains:

“Adjustments within the composition of gross sales can distort median worth information.”

For clarification, right here’s a easy clarification of median worth:

- You could have three cash in your pocket. Line them up in ascending worth (lowest to highest).

- You probably have one nickel and two dimes, the median worth of the cash (the center one) in your pocket is ten cents.

- You probably have two nickels and one dime, the median worth of the cash in your pocket is now 5 cents.

- In each instances, a nickel remains to be price 5 cents and a dime remains to be price ten cents. The worth of every coin didn’t change.

The identical factor applies to right now’s real estate market.

SBottom Line

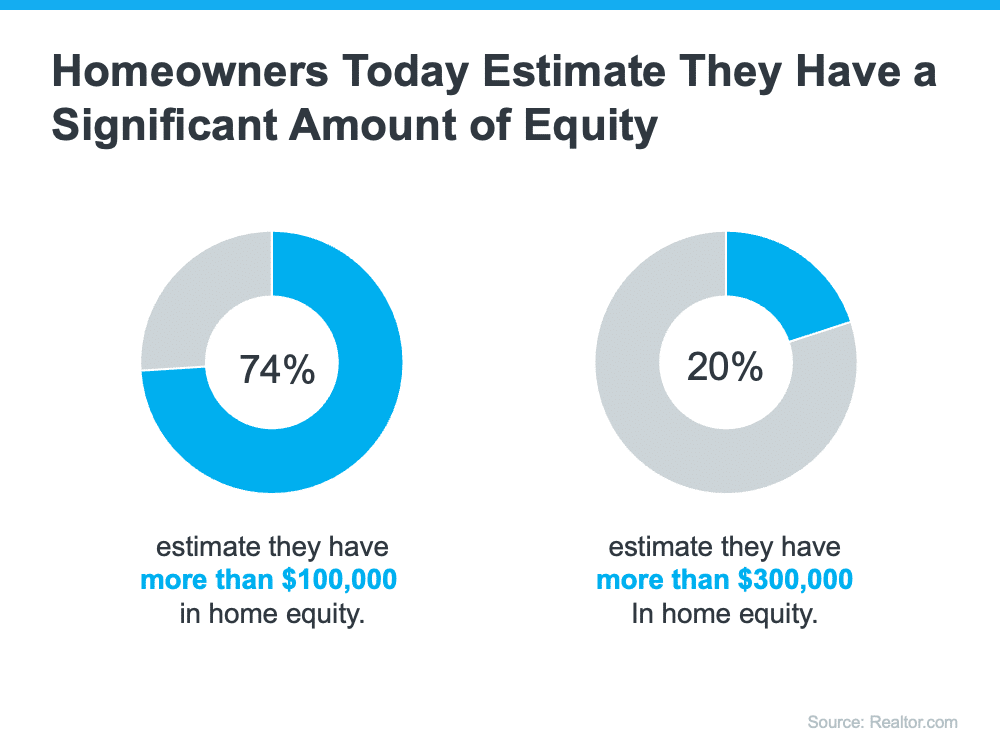

Precise residence values are going up in most markets. The median worth reported tomorrow may inform a distinct story. For a extra in-depth understanding of residence worth actions, attain out to an area actual property skilled.

![The Worst Home Price Declines Are Behind Us [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/05/The-Worst-of-Home-Price-Declines-Are-Behind-Us-KCM-Share.png)

![Ways To Overcome Affordability Challenges in Today’s Housing Market [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/04/Ways-To-Overcome-Affordability-Challenges-In-Todays-Market-KCM-Share.png)