![How Owning a Home Grows Your Wealth with Time [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/06/How-Owning-a-Home-Grows-Your-Wealth-with-Time-KCM-Share.png)

Some Highlights

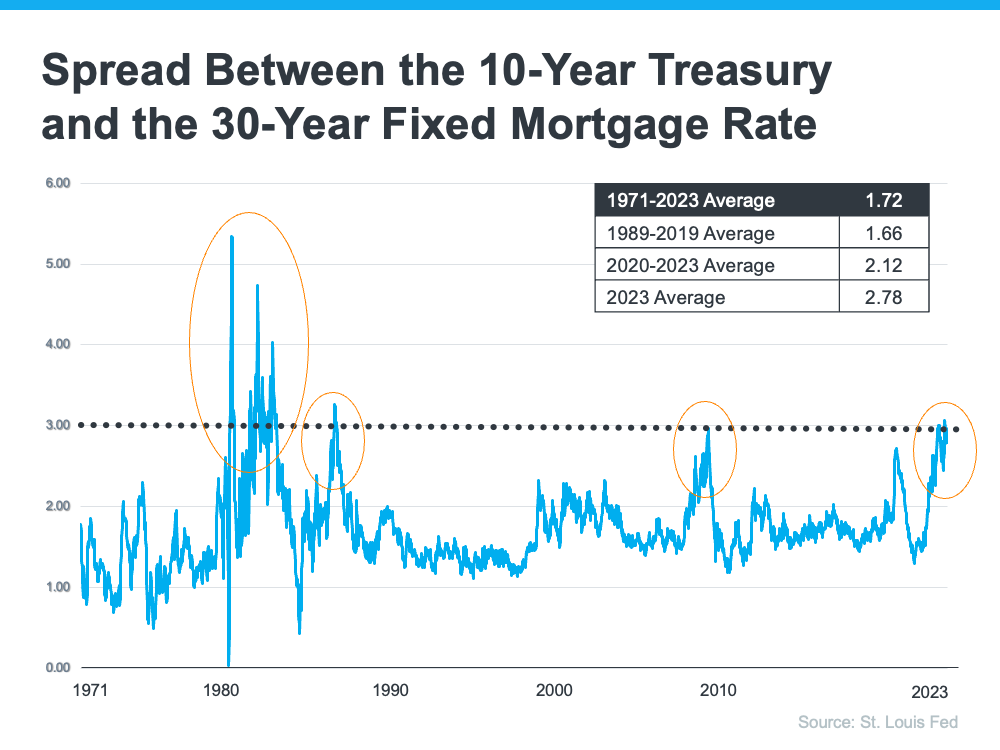

- In the event you’re pondering of buying a house this 12 months, make sure you factor within the long-term benefits of homeownership.

- Over time, homeownership lets you construct fairness. On common, nationwide home prices appreciated by 290.2% over the past 32 years.

- Meaning your internet price can grow considerably in the long run whenever you personal a house. Attain out to an actual property professional so you can begin your homebuying journey at the moment.

![Why You Can’t Compare Now to the ‘Unicorn’ Years of the Housing Market [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/06/Why-You-Cant-Compare-Now-to-the-Unicorn-Years-of-the-Housing-Market-KCM-Share.png)