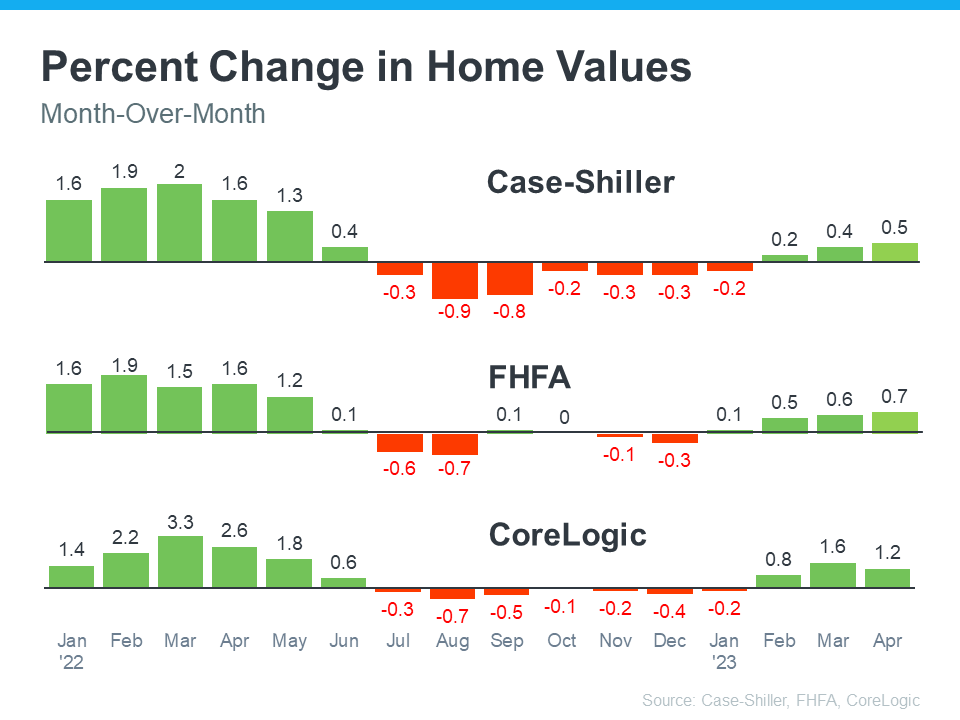

Whereas the wild experience that was the ‘unicorn’ years of housing is behind us, right now’s market remains to be aggressive in lots of areas as a result of the supply of homes on the market remains to be low. In the event you’re trying to buy a home this season, know that the height frenzy of bidding wars is within the rearview mirror, however you should still come up towards some multiple-offer situations.

Right here are some things to think about that can assist you put your greatest foot ahead when making a suggestion on a home.

1. Lean on a Actual Property Skilled

Depend on an agent who can assist your targets and make it easier to perceive what’s occurring in right now’s housing market. Agents are experts within the native market and on the nationwide tendencies too. They’ll use each of these areas of experience to be sure you have all the knowledge it’s worthwhile to transfer with confidence.

Plus, they know what’s labored for different patrons in your space and what sellers could also be on the lookout for in a suggestion. It could appear easy, however catering to what a vendor wants might help your provide stand out. As an article from Forbes says:

“Attending to know a neighborhood realtor the place you’re hoping to purchase may probably provide you with a vital edge in a decent housing market.”

2. Get Pre-Accredited for a Dwelling Mortgage

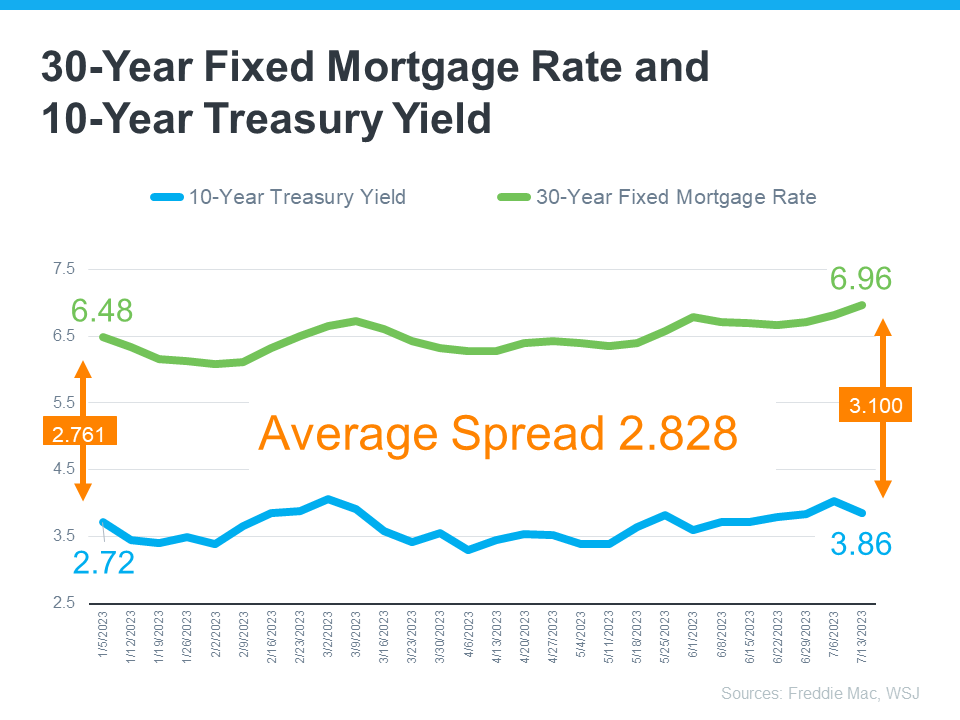

Having a clear budget in thoughts is very necessary proper now given the present affordability challenges. One of the simplest ways to get a transparent image of what you’ll be able to borrow is to work with a lender so you will get pre-approved for a house mortgage.

That’ll make it easier to be extra financially assured since you’ll have a greater understanding of your numbers. It reveals sellers you’re severe, too. And that may give you a aggressive edge when you do get right into a multiple-offer state of affairs.

3. Make a Truthful Provide

It’s solely pure to need the perfect deal you will get on a house. Nevertheless, submitting a suggestion that’s too low does have some dangers. You don’t wish to make a suggestion that can be tossed out as quickly because it’s obtained simply to see if it sticks. As Realtor.com explains:

“. . . a suggestion value that’s considerably decrease than the itemizing value, is usually rejected by sellers who really feel insulted . . . Most itemizing brokers attempt to get their sellers to at the very least enter negotiations with patrons, to counteroffer with a quantity a little bit nearer to the checklist value. Nevertheless, if a vendor is offended by a purchaser or isn’t taking the client severely, there’s not a lot you, or the actual property agent, can do.”

The experience your agent brings to this a part of the method will make it easier to keep aggressive and discover a value that’s honest to you and the vendor.

4. Belief Your Agent’s Experience All through Negotiations

Through the ‘unicorn’ years of housing, some patrons skipped dwelling inspections or didn’t ask for concessions from the vendor so as to submit the profitable bid on a house. An article from Bankrate explains this isn’t occurring as typically right now, and that’s excellent news:

“Whereas the market has largely calmed down since then, sellers are nonetheless very a lot within the driver’s seat on this period of scarce housing stock. It’s not as widespread for patrons to waive inspections anymore, but it surely does nonetheless occur. . . . It’s within the purchaser’s greatest curiosity to have a house inspected . . . Inspections provide you with a warning to present or potential issues with the house, providing you with not simply an early heads up but additionally a helpful negotiating tactic.”

Happily, today’s market is completely different, and you will have extra negotiating energy than earlier than. When placing collectively a suggestion, your trusted actual property advisor will make it easier to assume via what levers to drag and which of them chances are you’ll not wish to compromise on.

Backside Line

Once you purchase a house this summer time, you’ll want to work with an actual property advisor to make your greatest provide.

![Real Estate Continues To Be the Best Investment [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/07/Real-Estate-Continues-To-Be-the-Best-Investment-KCM-Share.png)

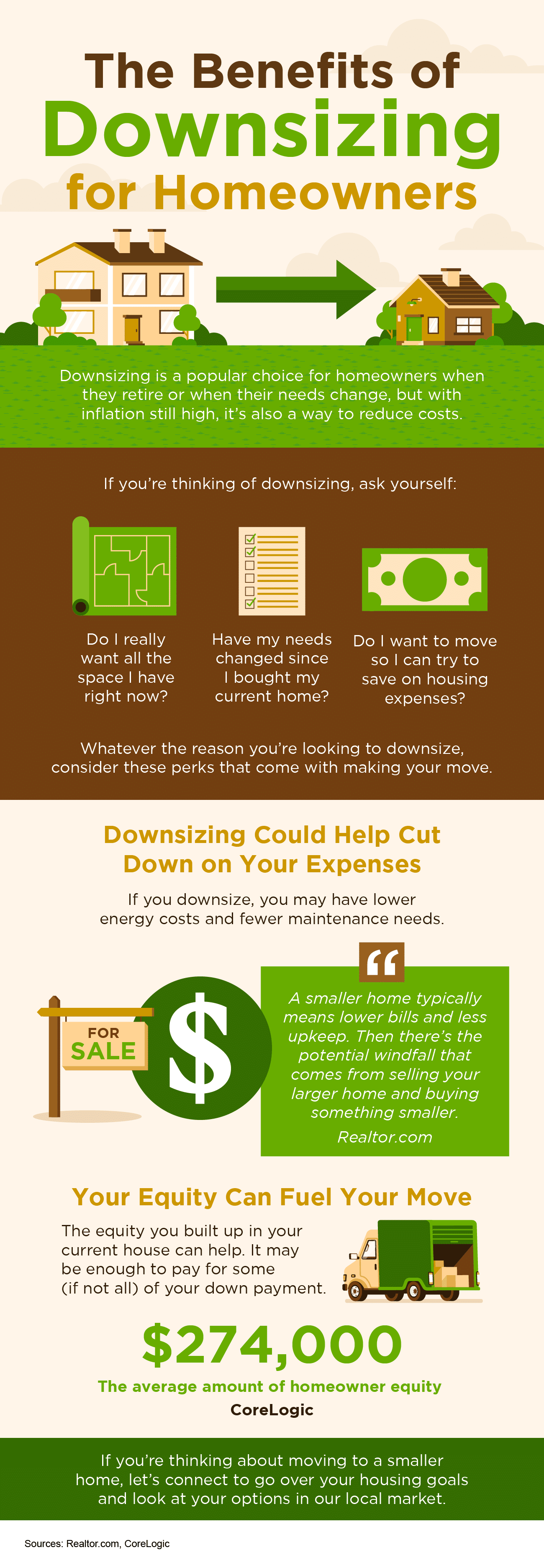

![The Benefits of Downsizing for Homeowners [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/07/The-Benefits-of-Downsizing-for-Homeowners-KCM-Share.png)