Media protection about what’s occurring with dwelling costs will be complicated. A big a part of that’s as a result of kind of knowledge getting used and what they’re selecting to attract consideration to. For dwelling costs, there are two completely different strategies used to match dwelling costs over completely different time intervals: year-over-year (Y-O-Y) and month-over-month (M-O-M). Here is a proof of every.

12 months-over-12 months (Y-O-Y):

- This comparability measures the change in dwelling costs from the identical month or quarter within the earlier yr. For instance, should you’re evaluating Y-O-Y dwelling costs for April 2023, you’d examine them to the house costs for April 2022.

- Y-O-Y comparisons concentrate on adjustments over a one-year interval, offering a extra complete view of long-term tendencies. They’re often helpful for evaluating annual development charges and figuring out if the market is usually appreciating or depreciating.

Month-over-Month (M-O-M):

- This comparability measures the change in dwelling costs from one month to the subsequent. As an example, should you’re evaluating M-O-M dwelling costs for April 2023, you’d examine them to the house costs for March 2023.

- In the meantime, M-O-M comparisons analyze adjustments inside a single month, giving a extra instant snapshot of short-term actions and value fluctuations. They’re usually used to trace instant shifts in demand and provide, seasonal tendencies, or the affect of particular occasions on the housing market.

The important thing distinction between Y-O-Y and M-O-M comparisons lies in the timeframe being assessed. Each approaches have their very own deserves and serve completely different functions relying on the precise evaluation required.

Why Is This Distinction So Necessary Proper Now?

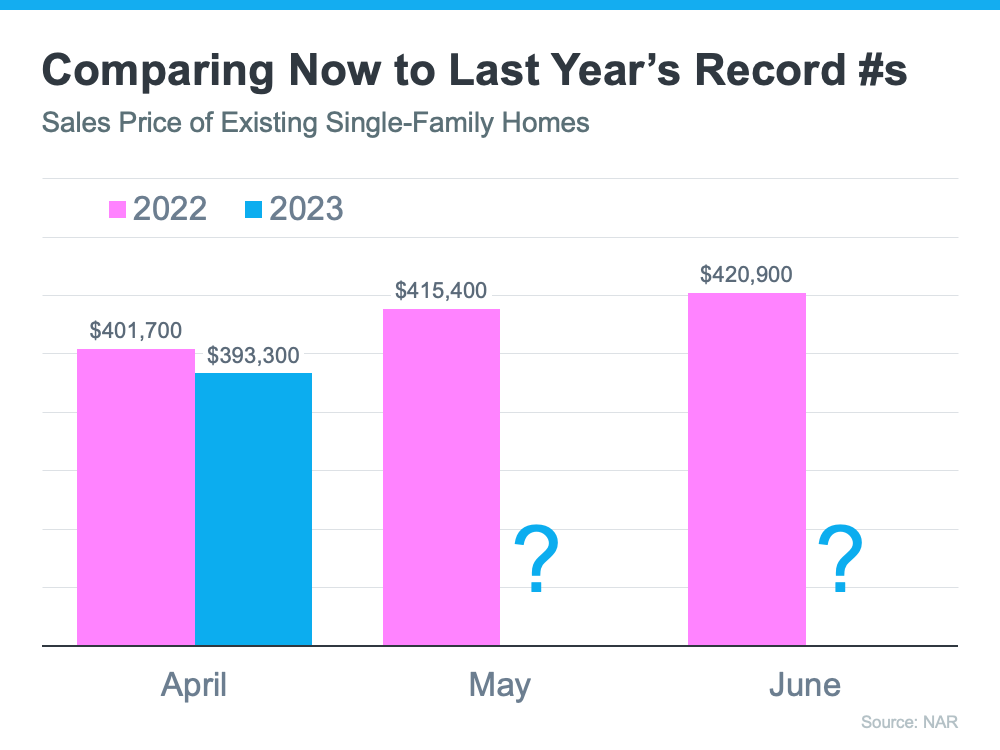

We’re about to enter a couple of months when home prices might probably be decrease than they had been the identical month final yr. April, Might, and June of 2022 had been three of one of the best months for dwelling costs within the historical past of the American housing market. Those self same months this yr may not measure up. Meaning, the Y-O-Y comparability will most likely present values are depreciating. The numbers for April appear to counsel that’s what we’ll see within the months forward (see graph beneath):

That’ll generate troubling headlines that say dwelling values are falling. That’ll be correct on a Y-O-Y foundation. And, these headlines will lead many shoppers to consider that dwelling values are presently cascading downward.

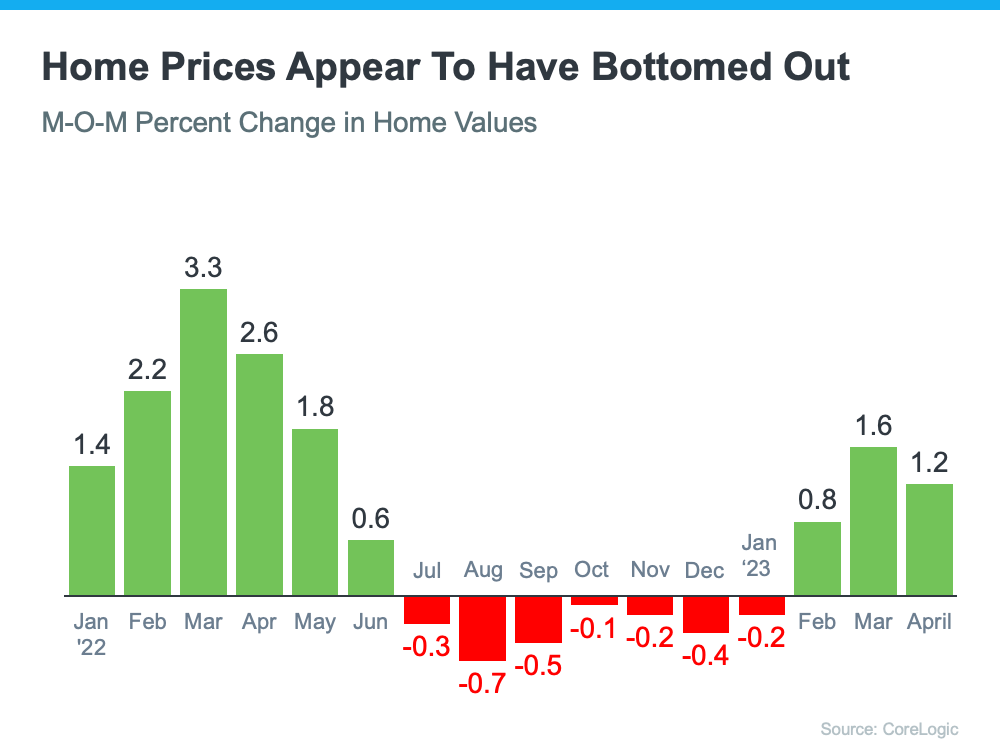

Nevertheless, on a better take a look at M-O-M dwelling costs, we are able to see costs have really been appreciating for the final a number of months. These M-O-M numbers extra precisely replicate what’s actually occurring with dwelling values: after a number of months of depreciation, it seems we’ve hit backside and are bouncing again.

Right here’s an instance of M-O-M dwelling value actions for the final 16 months from the CoreLogic Dwelling Value Insights report (see graph beneath):

Why Does This Matter to You?

So, should you’re listening to damaging headlines about dwelling costs, bear in mind they might not be portray the complete image. For the subsequent few months, we’ll be evaluating costs to final yr’s document peak, and which will make the Y-O-Y comparability really feel extra damaging. However, if we take a look at the extra instant, M-O-M tendencies, we are able to see dwelling costs are literally on the best way back up.

There’s a bonus to purchasing a house now. You’ll purchase at a reduction from final yr’s value and earlier than costs begin to decide up much more momentum. It’s known as “shopping for on the backside,” and that’s an excellent factor.

Backside Line

You probably have questions on what’s occurring with dwelling costs, or should you’re prepared to purchase earlier than costs climb greater, join with an area actual property agent.

![Reasons To Own Your Home [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/06/Reasons-To-Own-Your-Home-KCM-Share.jpg)

![Ways To Overcome Affordability Challenges in Today’s Housing Market [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/04/Ways-To-Overcome-Affordability-Challenges-In-Todays-Market-KCM-Share.png)