Some Highlights

- What does the coming year hold for the housing market? Here’s what experts project for 2022.

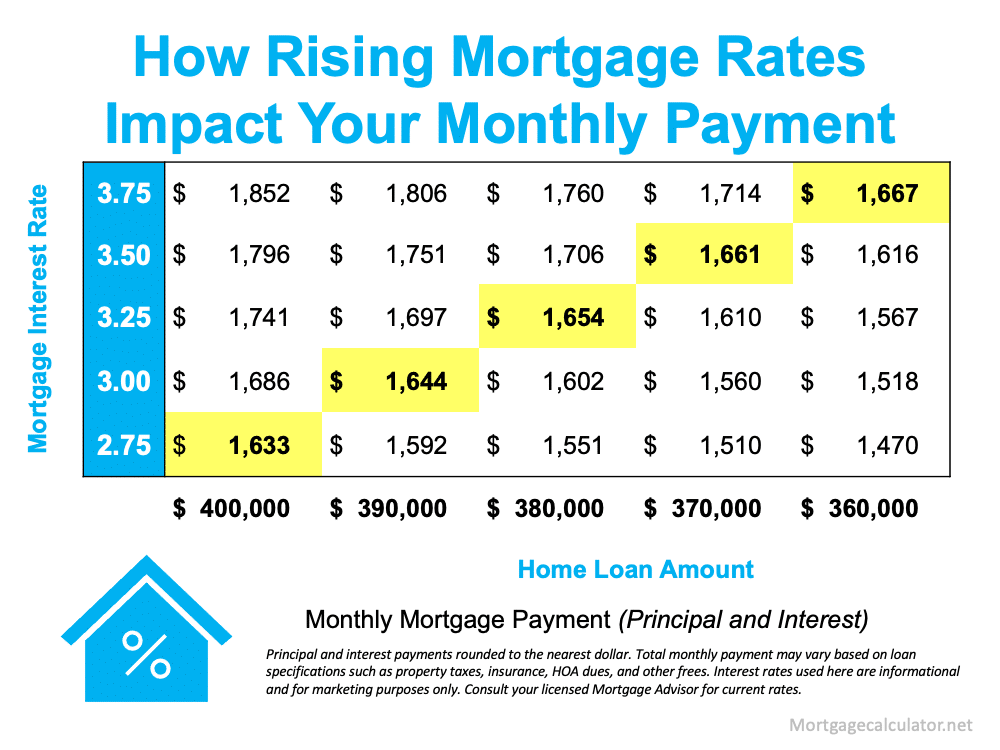

- Mortgage rates are projected to rise and so are home prices. Experts are forecasting buyer demand will remain strong as people try to capitalize on rates and prices before they climb, creating another strong year for home sales.

- Let’s connect so you can make your best move in the new year.

![2022 Housing Market Forecast [INFOGRAPHIC] | Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2021/12/20211217-MEM.png)

![Your Journey to Homeownership [INFOGRAPHIC] | Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2021/11/20211119-KCM-Share-549x300-1.png)

![Your Journey to Homeownership [INFOGRAPHIC] | Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2021/11/20211119-MEM.png)