If you happen to’ve been maintaining with the information currently, you have in all probability come throughout headlines speaking in regards to the improve in foreclosures in at the moment’s housing market. This will have left you with some uncertainty, particularly if you happen to’re contemplating buying a home. It’s vital to know the context of those studies to know the reality about what’s occurring at the moment.

In line with a recent report from ATTOM, a property information supplier, foreclosures filings are up 2% in comparison with the earlier quarter and eight% since one yr in the past. Whereas media headlines are drawing consideration to this improve, reporting on simply the quantity may truly generate fear for concern that costs may crash. The fact is, whereas rising, the info exhibits a foreclosures disaster isn’t the place the market is headed.

Let’s have a look at the newest info with context so we are able to see how this compares to earlier years.

It Isn’t the Dramatic Improve Headlines Would Have You Imagine

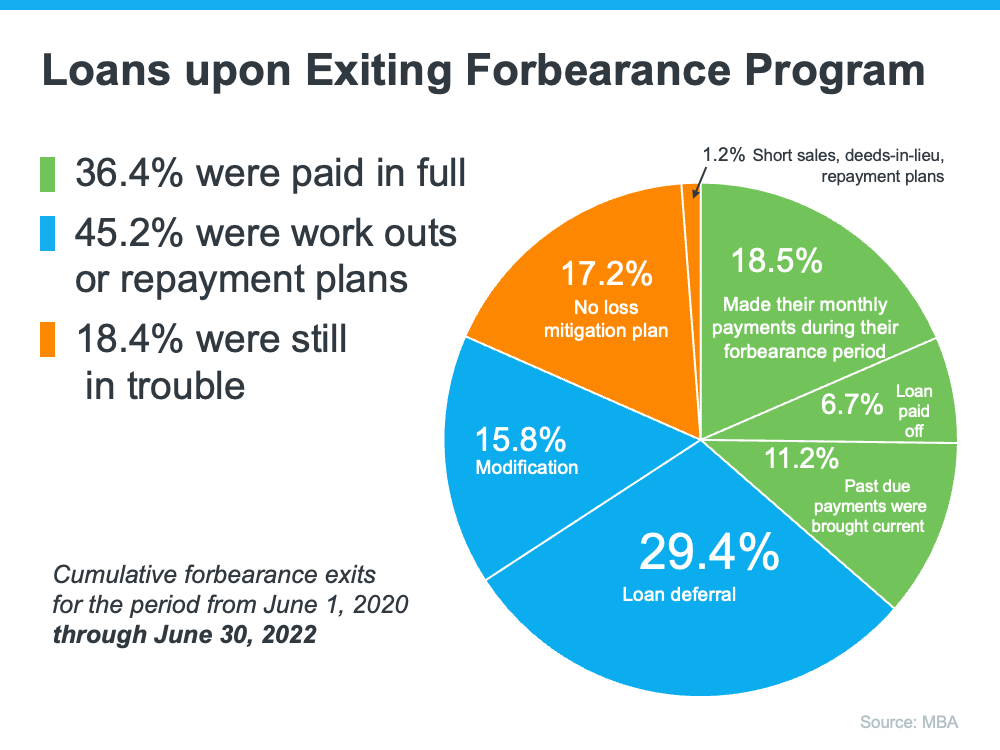

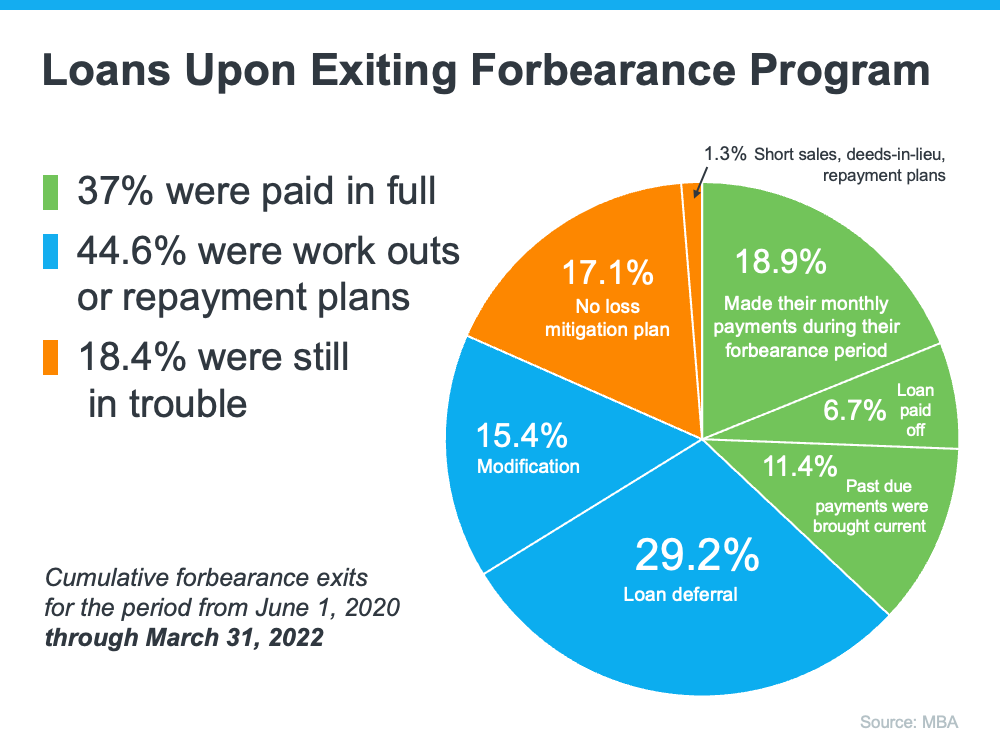

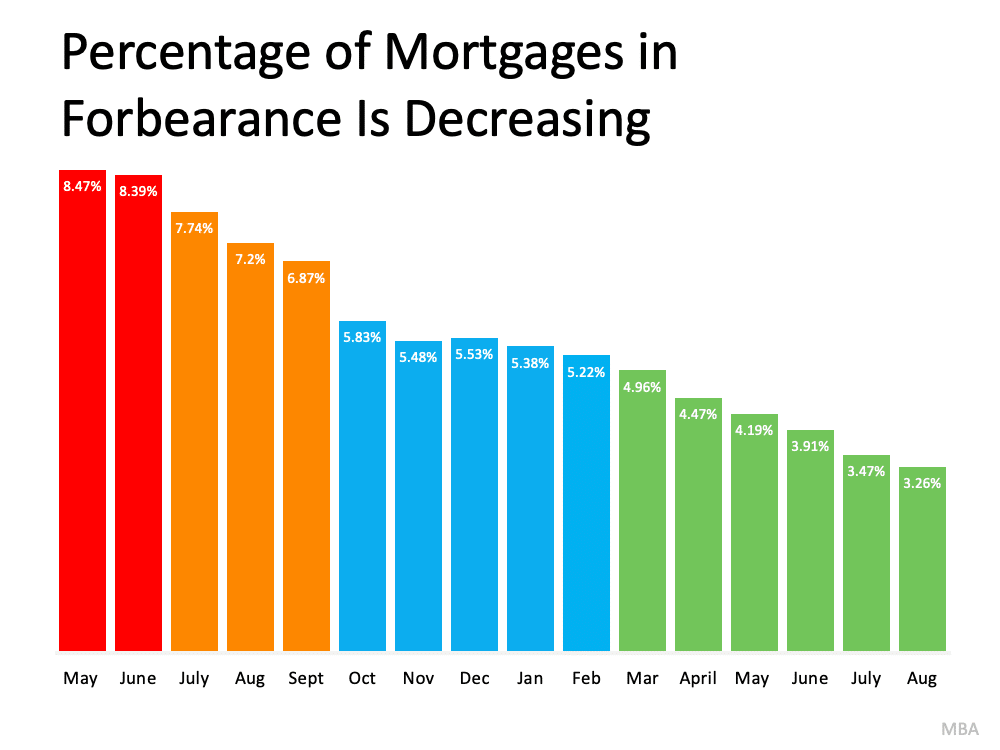

In recent times, the variety of foreclosures has been right down to document lows. That’s as a result of, in 2020 and 2021, the forbearance program and different reduction choices for householders helped hundreds of thousands of house owners keep of their properties, permitting them to get again on their ft throughout a really difficult interval. And with residence values rising on the identical time, many owners who might have discovered themselves dealing with foreclosures below different circumstances had been in a position to leverage their equity and promote their homes quite than face foreclosures. Shifting ahead, equity will proceed to be an element that may assist hold individuals from going into foreclosures.

As the federal government’s moratorium got here to an finish, there was an anticipated rise in foreclosures. However simply because foreclosures are up doesn’t imply the housing market is in hassle. As Clare Trapasso, Government Information Editor at Realtor.com, says:

“Many of those foreclosures would have occurred through the pandemic, however had been delay because of federal, state, and native foreclosures moratoriums designed to maintain individuals of their properties . . . Actual property specialists have pressured that this isn’t a repeat of the Nice Recession. It’s not that scores of house owners abruptly can’t afford their mortgage funds. Quite, many lenders are actually catching up. The foreclosures would have occurred through the pandemic if moratoriums hadn’t halted the proceedings.”

In a latest article, Bankrate additionally explains:

“Within the years after the housing crash, hundreds of thousands of foreclosures flooded the housing market, miserable costs. That’s not the case now. Most owners have a cushty fairness cushion of their properties. Lenders weren’t submitting default notices through the peak of the pandemic, pushing foreclosures to document lows in 2020. And whereas there was a slight uptick in foreclosures since then, it’s nothing prefer it was.”

Principally, there’s not a sudden flood of foreclosures coming. As an alternative, among the improve is because of the delayed exercise defined above whereas extra is from financial circumstances.

To additional paint the image of simply how totally different the scenario is now in comparison with the housing crash, check out the graph under. It makes use of information on foreclosures filings for the primary half of every yr since 2008 to indicate foreclosures exercise has been persistently decrease because the crash.

Whereas foreclosures are climbing, it’s clear foreclosures exercise now’s nothing prefer it was again then. Right this moment, foreclosures are far under the record-high quantity that was reported when the housing market crashed.

Along with all of the elements talked about above, that’s additionally largely as a result of patrons at the moment are extra certified and fewer prone to default on their loans.

Backside Line

Proper now, placing the info into context is extra vital than ever. Whereas the housing market is experiencing an anticipated rise in foreclosures, it’s nowhere close to the disaster ranges seen when the housing bubble burst, and that gained’t result in a crash in residence costs.