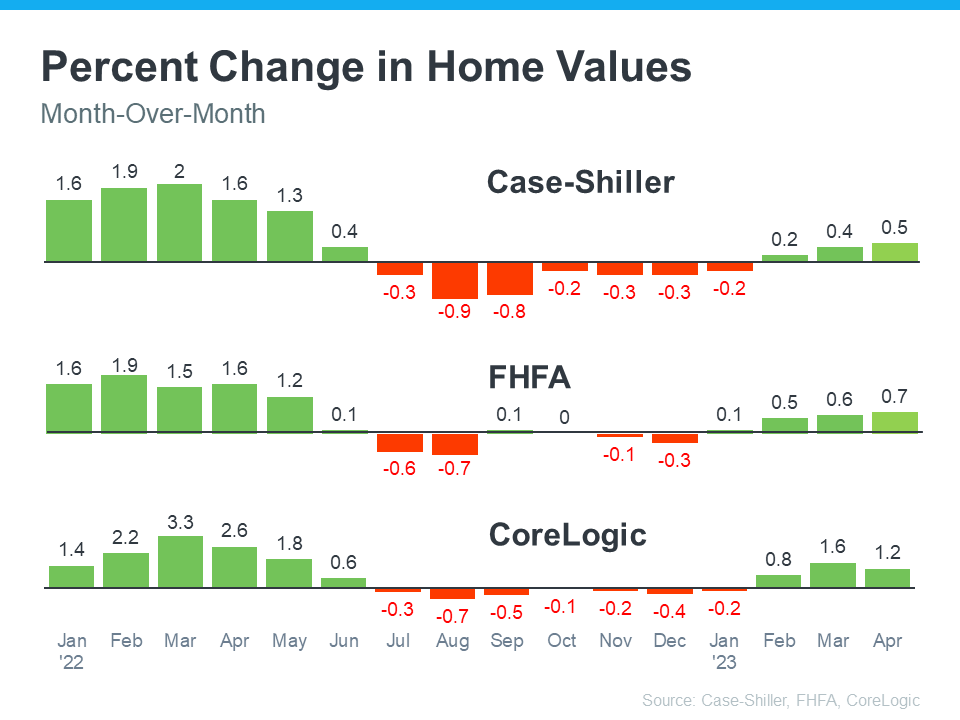

For those who’re considering of buying or selling a home, one of many largest questions you have got proper now might be: what’s occurring with residence costs? And it’s no shock you don’t have the readability you want on that subject. A part of the problem is how headlines are speaking about costs.

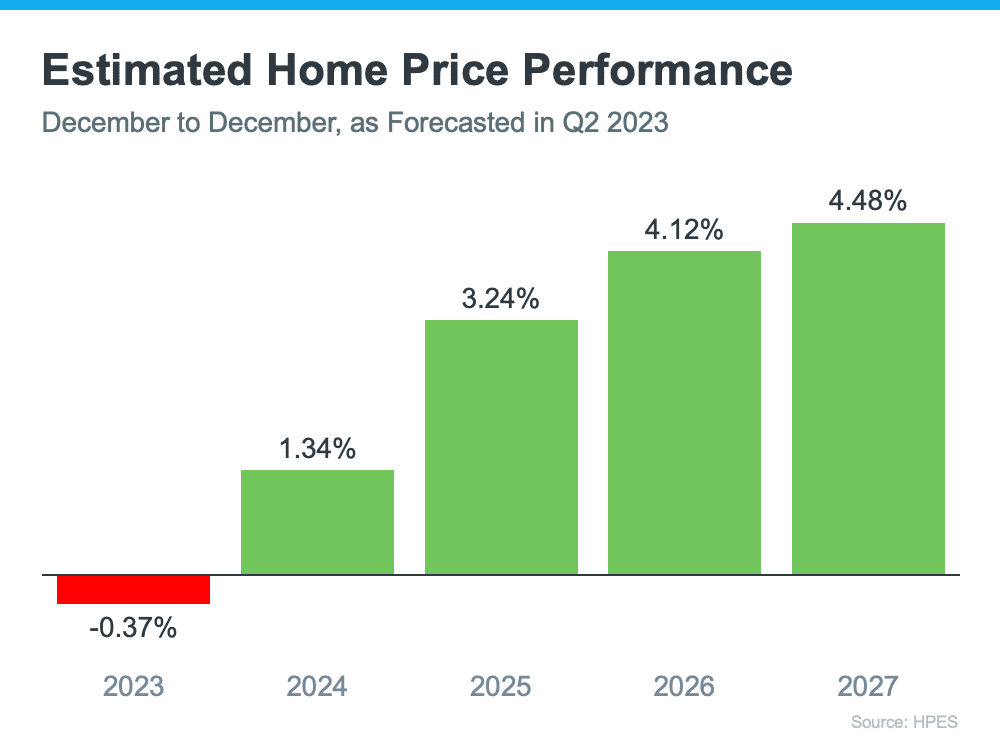

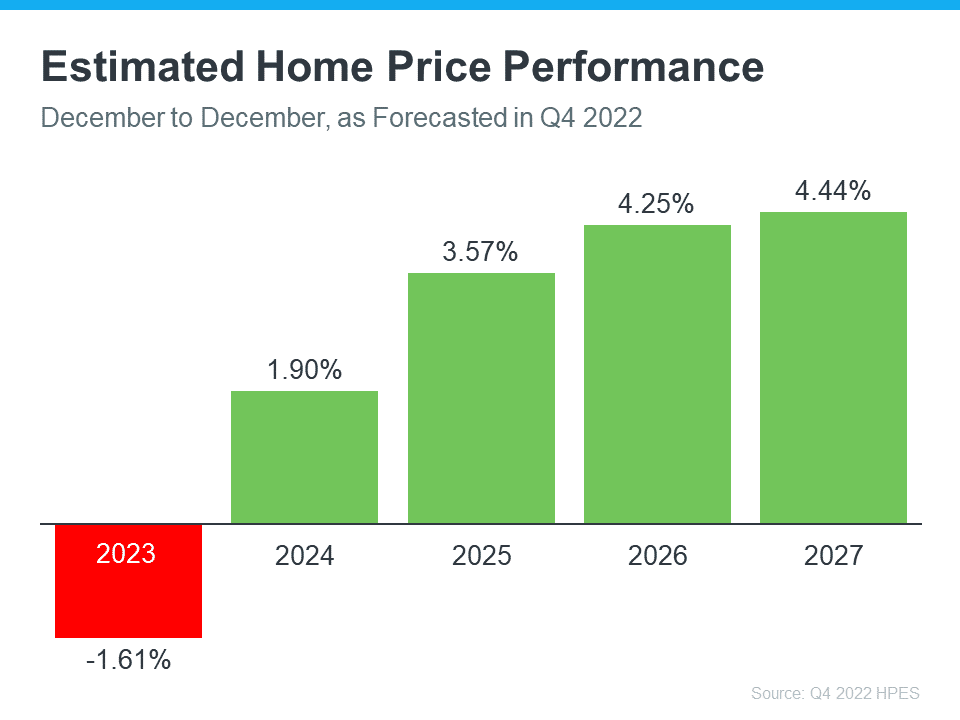

They’re basing their destructive information by comparing present stats to the previous few years. However you’ll be able to’t examine this 12 months to the ‘unicorn’ years (when residence costs reached file highs that have been unsustainable). And as costs start to normalize now, they’re speaking about it prefer it’s a foul factor and making folks concern what’s subsequent. However the worst home price declines are already behind us. What we’re beginning to see now could be the return to extra regular home price appreciation.

To assist make residence value tendencies simpler to know, let’s concentrate on what’s typical for the market and omit the previous few years since they have been anomalies.

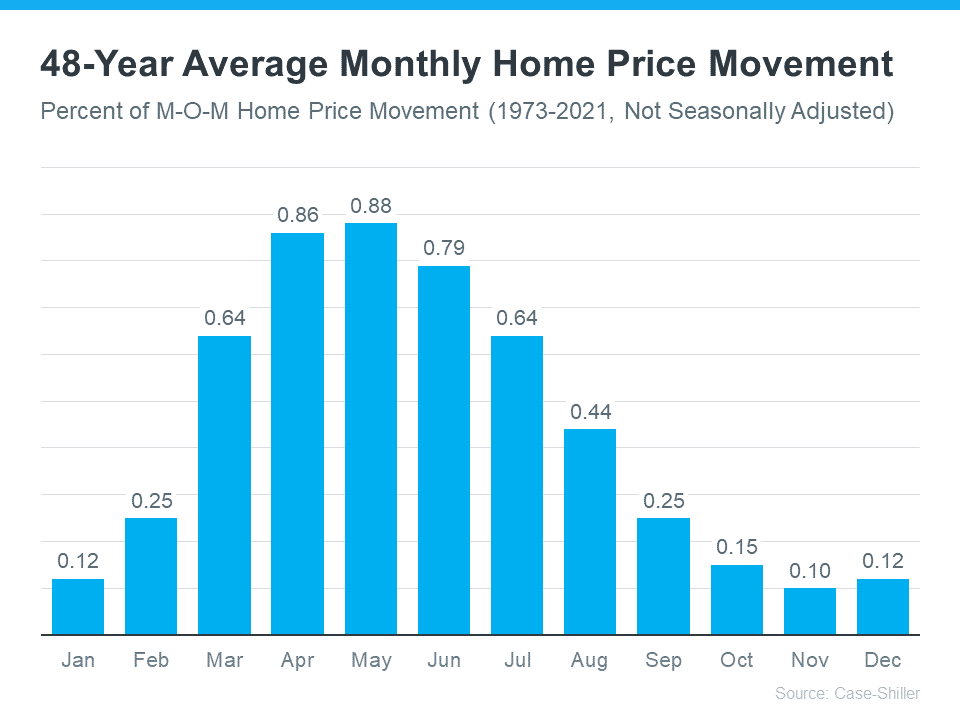

Let’s begin by speaking about seasonality in actual property. Within the housing market, there are predictable ebbs and flows that occur annually. Spring is the height homebuying season when the market is most lively. That exercise is usually nonetheless sturdy in the summertime however begins to wane because the cooler months method. Residence costs observe together with seasonality as a result of costs recognize most when one thing is in excessive demand.

That’s why, earlier than the irregular years we simply skilled, there was a dependable long-term residence value pattern. The graph beneath makes use of knowledge from Case-Shiller to point out typical month-to-month residence value motion from 1973 via 2021 (not adjusted, so you’ll be able to see the seasonality):

As the information from the final 48 years exhibits, firstly of the 12 months, residence costs develop, however not as a lot as they do coming into the spring and summer season markets. That’s as a result of the market is much less lively in January and February since fewer folks transfer within the cooler months. Because the market transitions into the height homebuying season within the spring, exercise ramps up, and residential costs go up much more in response. Then, as fall and winter method, exercise eases once more. Value development slows, however nonetheless sometimes appreciates.

Why This Is So Essential to Perceive

Within the coming months, because the housing market strikes additional right into a extra predictable seasonal rhythm, you’re going to see much more headlines that both get what’s occurring with residence costs improper or, on the very least, are deceptive. These headlines would possibly use a lot of value phrases, like:

- Appreciation: when costs improve.

- Deceleration of appreciation: when costs proceed to understand, however at a slower or extra average tempo.

- Depreciation: when costs lower.

They’re going to mistake the slowing residence value development (deceleration of appreciation) that’s typical of market seasonality within the fall and winter and suppose costs are falling (depreciation). Don’t let these headlines confuse you or spark concern. As a substitute, keep in mind it’s regular to see a deceleration of appreciation, slowing residence value development, because the months go by.

Backside Line

In case you have questions on what’s occurring with residence costs in your space, join with a trusted actual property skilled.

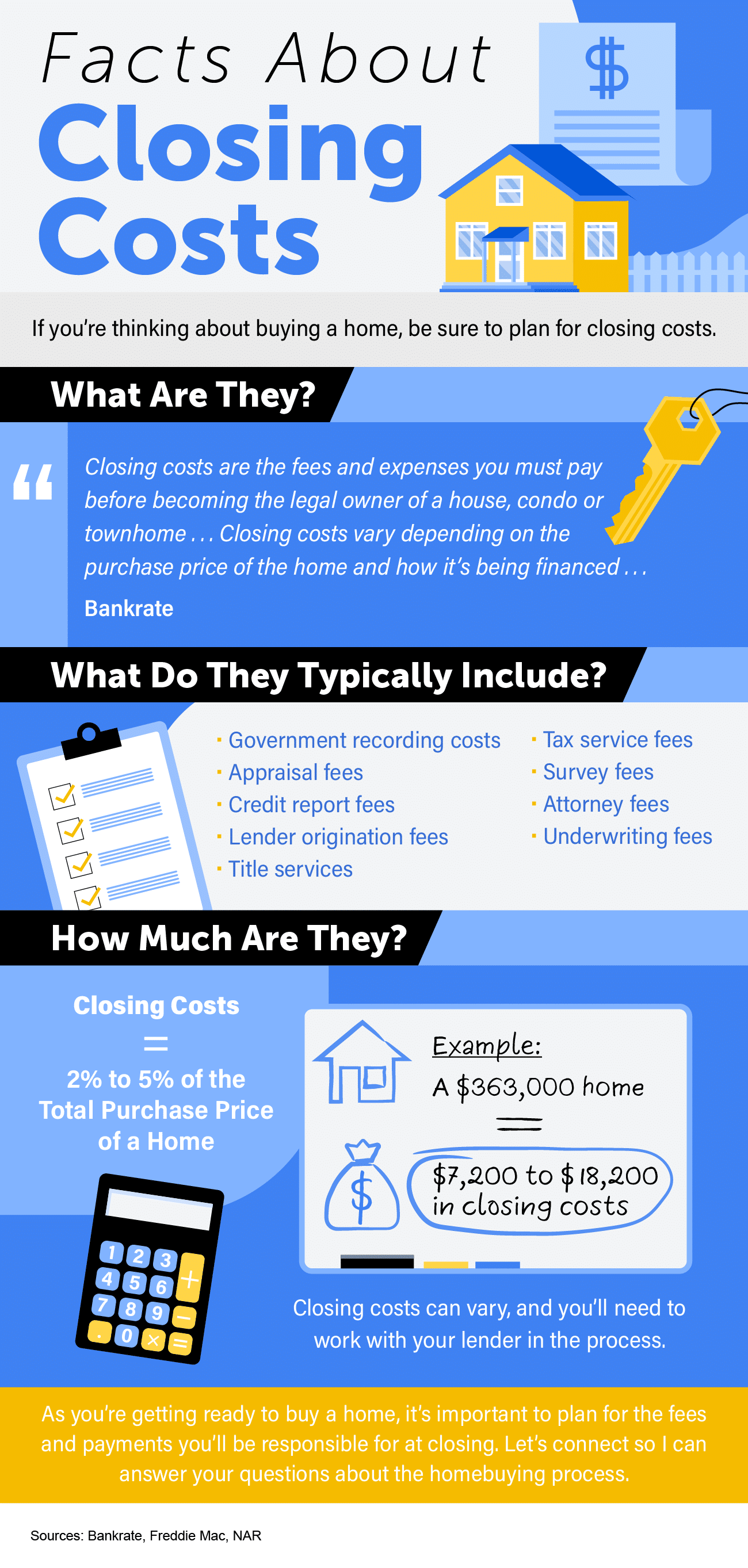

![Facts About Closing Costs [INFOGRAPHIC] Simplifying The Market](https://daytonabeachpropertysearch.com/wp-content/uploads/2023/04/Facts-About-Closing-Costs-KCM-Share.png)